- Tether surpasses $127 billion in US Treasuries by Q2 2025.

- Market confidence in USDT stability boosts.

- US government debt serves as collateral and liquidity.

Tether’s CEO Paolo Ardoino disclosed that the company held over $127 billion in US Treasury bonds by the second quarter of 2025.

This positions Tether as a dominant stablecoin issuer, enhancing market trust in USDT-backed reserves.

Tether’s Record-Breaking $127 Billion Treasury Investment

Tether has announced its US Treasury holdings have exceeded $127 billion. Previously, Tether’s Q1 2025 attestation had indicated a budding figure close to this value. This signals a strategic move underscoring transparency and robust reserve backing.

As an industry leader, Tether’s massive investment in low-risk, dollar-denominated securities changes the landscape, solidifying USDT’s reputation as a stable, reliable asset. Market participants are likely to show enhanced confidence in USDT as a primary trading pair with significantly bolstered backing.

Community and industry reactions point towards Tether’s decision as strengthening the ecosystem’s resilience. Officials and influential market figures like Arthur Hayes and CZ are yet to comment. However, their potential insights might further shape perceptions as the situation evolves.

Tether’s Market Position and Potential Regulatory Challenges

Did you know? Tether’s treasury investment places it among the largest holders of US government debt outside sovereign central banks, marking a notable alignment with traditional financial entities.

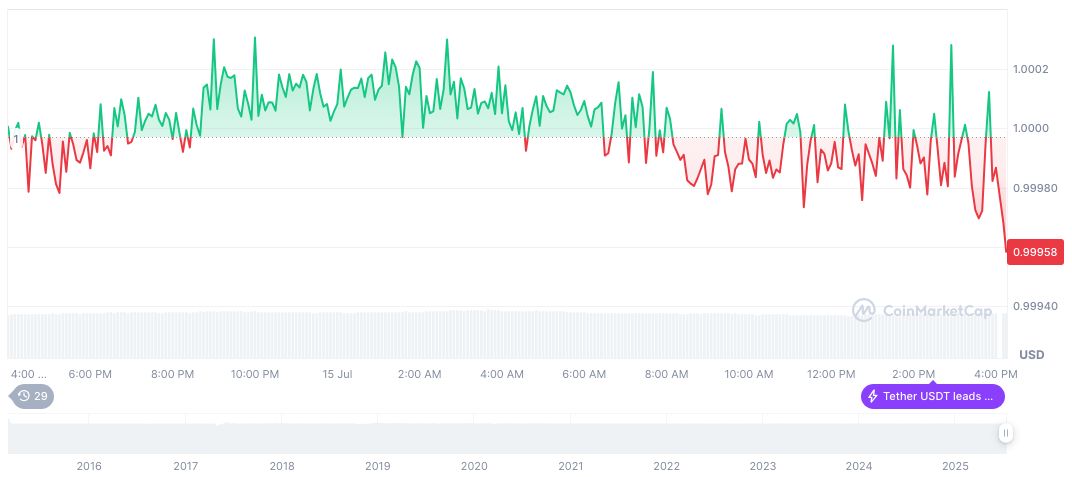

According to CoinMarketCap, Tether (USDT) remains steady at $1.00 with a market cap standing at 159.86 billion. The largest part of its capital dominance is seen in a 4.34% share of the market. Over the last 24 hours, 138.88 billion in trading volume was recorded, reflecting a modest 0.43% increase.

The Coincu research team suggests Tether’s strategic focus on US government debt may lead to increased regulatory scrutiny while reinforcing USDT’s role as a dollar proxy. Industry dynamics could see further stabilization if Tether continues its trajectory in backing strength.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348851-tether-127-billion-us-treasuries/