- Tether and U.S. authorities freeze $1.6 million USDT linked to Gaza.

- Impact on suspected terrorism financing financial networks.

- Tether collaboration with global law enforcement emphasized.

U.S. authorities, in cooperation with Tether, have frozen and reissued approximately $1.6 million in USDT linked to Gaza’s BuyCash, suspected of terrorist financing.

This freeze, part of a civil forfeiture case, emphasizes Tether’s role in compliance, aiding law enforcement globally, without impacting broader crypto markets.

$1.6M USDT Frozen Amidst Terrorism Financing Probe

Tether Holdings Ltd., led by CEO Paolo Ardoino, collaborated with U.S. authorities to freeze and reissue $1.6 million in USDT tied to BuyCash, a Gaza financial entity suspected of terrorist links. This action forms part of a broader civil forfeiture case. The U.S. Department of Justice leads the initiative, focusing on financial activities related to terrorism. Tether highlighted its stringent compliance practices and ongoing support for law enforcement across jurisdictions.

Immediate implications of this intervention involve disrupting potential financial channels utilized for terror activities. Tether’s cooperation signifies a significant commitment from centralized entities to combat financial crimes in the crypto space. The operations’ success reinforces Tether’s claim of overseeing transparent transactions and willingness to engage actively with regulatory frameworks.

Community reactions to this action include endorsements of Tether’s role in compliance, yet concerns over centralized control persist. CEO Paolo Ardoino emphasized transparency and USDT’s traceability in assisting global law enforcement efforts, setting the company apart from other stablecoin operators.

“USDT transactions are traceable and we are committed to aiding law enforcement globally, maintaining the integrity of the digital asset ecosystem.” – Paolo Ardoino, CEO, Tether

Tether Compliance Strengthens Amidst $2.9B in Global Freezes

Did you know? Tether’s freezing of $1.6 million USDT linked to Gaza marks part of a series of enforcement actions, with over $2.9 billion frozen to date, showcasing the critical role of centralized entities in financial compliance.

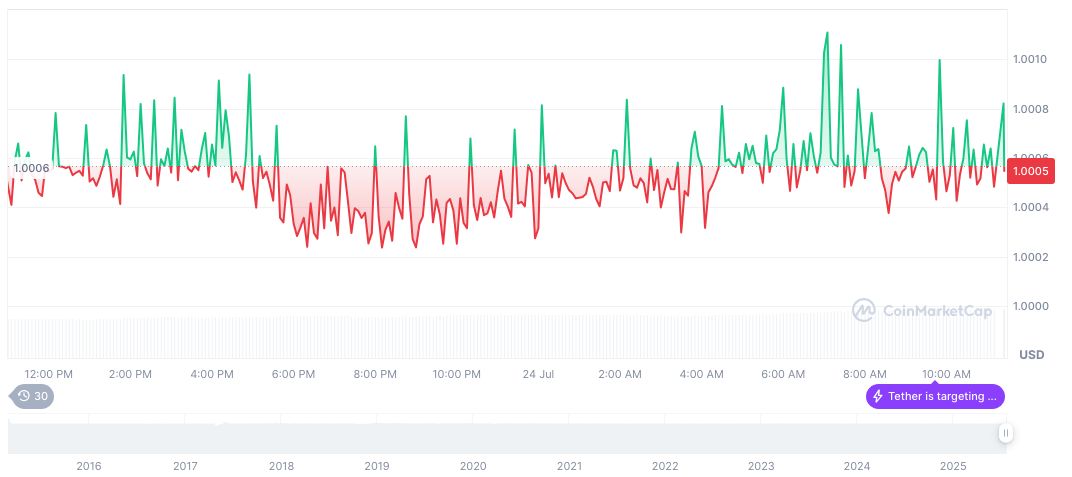

As per CoinMarketCap, USDT (Tether) maintains a price of $1.00 with a market cap of approximately $162.62 billion and a 24-hour trading volume of $149.03 billion. Price changes over various periods indicate a 0.03% increase over 24 hours and a slight 0.01% rise over 30 days. These metrics reflect minor fluctuations, continuing USDT’s position as a stable crypto asset.

Coincu research team’s insights suggest Tether’s actions illustrate the benefits of vast compliance capabilities and may encourage further regulatory scrutiny. Data shows the continuous engagement by Tether with global enforcement bodies may enhance trustworthiness in digital markets, despite underlying critiques regarding centralized control constraints.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tether-usdt-freeze-gaza-network/