- Elon Musk shifts Tesla AI focus to single architecture, ending dual paths.

- AI6 aims to surpass performance records, costing $16.5 billion in partnership.

- Market reactions remain hardware-centric, with no immediate crypto impact.

Elon Musk announced on September 7th that Tesla has reviewed its AI5 chip design, which promises to be highly efficient and cost-effective, with AI6 aiming to surpass current standards.

The focus on a unified chip architecture emphasizes streamlined R&D resources and potentially enhances Tesla’s competitive edge in AI, with significant implications for its market positioning.

Tesla’s $16.5 Billion Partnership Boosts AI6 Chip Development

Tesla’s decision to focus solely on AI5 and AI6 is a departure from its prior strategy of developing multiple chip architectures. Elon Musk stated, “AI5 is a beast, and AI6 is capable of being the best AI chip to date.” This streamlined approach is designed to concentrate all of Tesla’s AI chip talent on producing a “kickass chip” capable of high-performance metrics at reduced silicon costs. Consequently, Tesla ended its previous dual-path development, notably the Dojo project, to focus resources on this new architecture.

AI6 chip development involves a significant $16.5 billion production agreement with Samsung foundries, further cementing Tesla’s commitment. This consolidation is expected to enhance performance efficiency and reduce production costs, aligning with Musk’s vision for increased chip utilization in their vehicles and broader applications.

The recent announcements have garnered reactions from various industry sectors, with observers noting Tesla’s bold strategy against competitors like Nvidia and Apple. Musk confirmed via his X post that, “Samsung is fully aware of the importance of this chip to Tesla,” underscoring the strategic partnership’s significance. No direct effects on crypto markets were observed, given the hardware-centric nature of the announcement. source

Ethereum and Industry Insights Post-Tesla Announcement

Did you know? Tesla’s focus shift to AI5/AI6 mirrors its 2019–2023 FSD chip rollout, which, although significant for autonomy, held no immediate crypto asset influence.

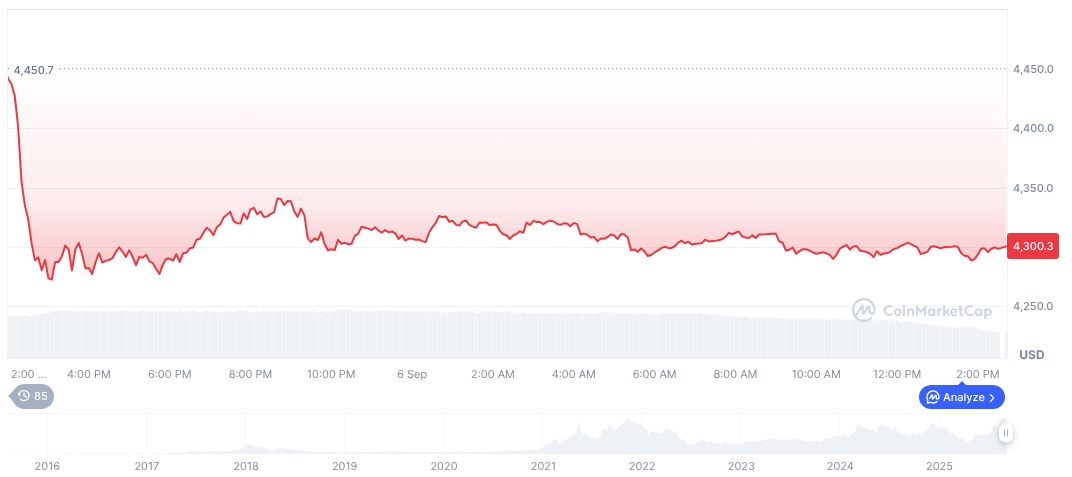

Ethereum (ETH) recently traded at $4,296.50 as of 01:38 UTC on September 7, 2025. Its market cap stands at $518.61 billion, with a 13.62% dominance. Ethereum has seen a 30-day rise of 10.44%, according to CoinMarketCap. Its trading volume was recorded at $17.98 billion, even while experiencing a 59.45% decrease.

Coincu experts suggest that Tesla’s chip strategy may drive technological advancements, indirectly influencing sectors such as automotive AI. Potential regulatory discussions might arise if AI implementations in vehicles increase, though direct crypto effects remain speculative.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/tesla-ai-chip-unification/