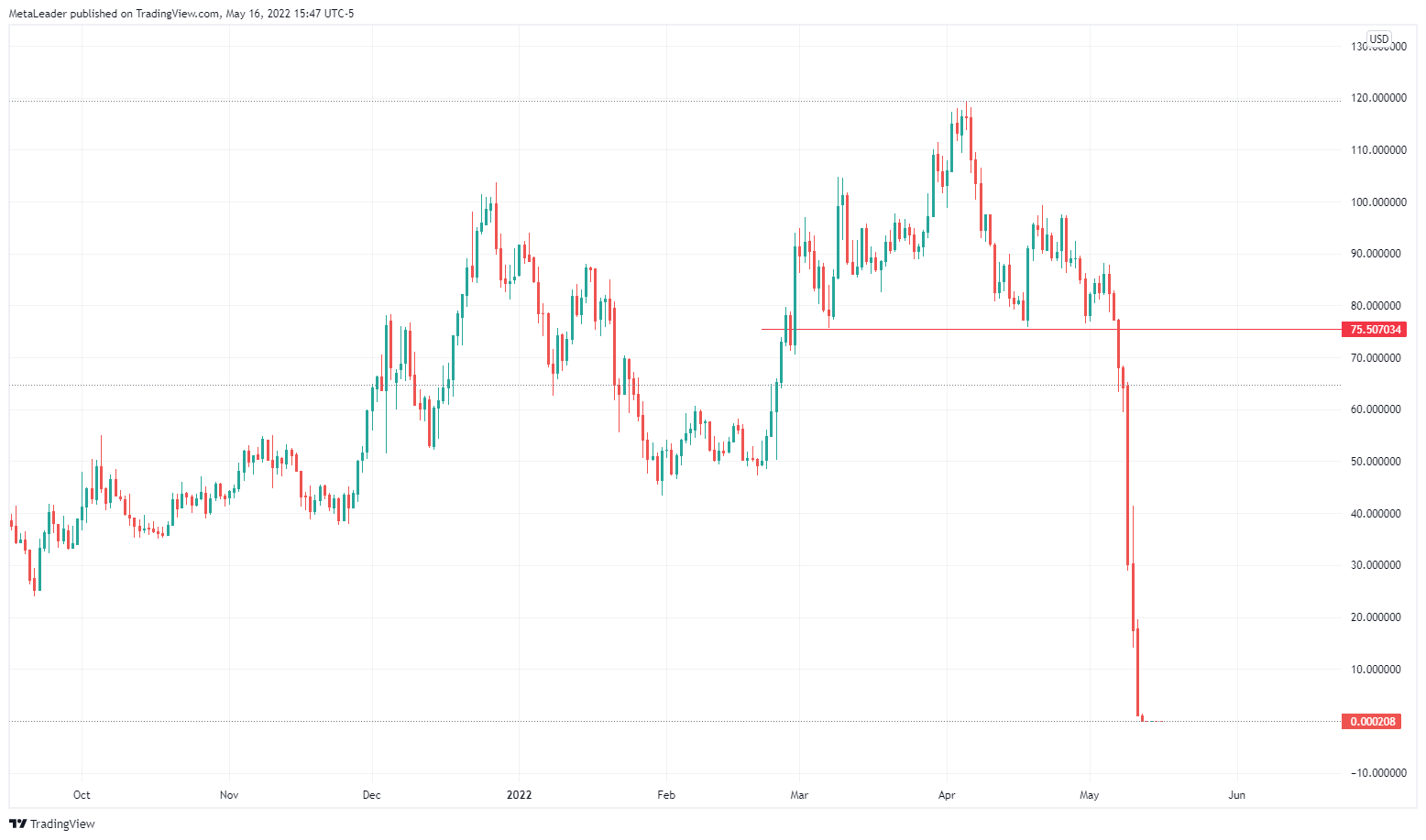

According to veteran cryptocurrency trader Peter Brandt, the devastating implosion of one of the largest cryptocurrency ventures was in the cards.

The creation of the traditional head and shoulders chart pattern, according to Brandt, was the catalyst for the red-hot token’s demise.

When a price peak (shoulder) is followed by a higher price peak (head), and then another lower peak, the easy-to-spot configuration appears. Despite the fact that traders generally underestimate the relevance of such traditional patterns, Brandt believes it was on display during the collapse of LUNA.

Last Monday, the token, which was worth a stunning $42 billion just two months ago, crashed to zero. The UST stablecoin, which is linked to LUNA, has lost its peg, leaving its users in the lurch.

Following a brief recovery after purportedly pumping billions of dollars in Bitcoin from its reserve to resuscitate the peg, UST continued to fall. It fell below the $0.01 level yesterday.

Recovery Plan?

Do Kwon, Terra’s contentious co-founder has proposed a fresh recovery plan that involves forking the chain and starting over. The UST stablecoin is no longer part of the strategy. Despite the fact that it was the project’s key selling feature, Loan believes that Terra is bigger than the failed stablecoin. Kwon is doubling back on his mistakes, despite mounting pressure to leave the business alone.

Meanwhile, following the Terra incident, financial regulators throughout the world are focusing their attention on stablecoins. Local regulators have urged exchanges to delist LUNA, according to a recent report by Yonhap, a South Korean news site.

LUNA is now trading at about $0.00019. At nearly half a cent or $0.006 per share, LUNA would reclaim its prior market cap of around $40 billion — a more reasonable mid-term price target, but still difficult given Terra’s declining reputation.

Many traders want to purchase LUNA, therefore it can still put in 100x moves and powerful pumps in the short run.

Was this writing helpful?

Source: https://coinpedia.org/altcoin/technicals-hinted-collapse-of-luna-price/