- The total AI crypto market cap declined 2.84% over the past 24 hours.

- All of the top 5 AI crypto projects printed 24-hour losses.

- Technicals suggest that AGIX, RNDR, ROSE, INJ, and GRT may rally in the coming weeks.

There has been a notable increase in enthusiasm regarding emerging digital currencies in the cryptocurrency market. AI-based crypto projects are the latest category of cryptos that has caught the eye of investors in the market. Due to this, projects in this category are currently battling it out with each other to become the top AI crypto project.

The launch of ChatGPT and other chatbots with advanced AI at the beginning of this year caused a surge in hype and excitement surrounding AI crypto coins. These AI crypto coins aim to leverage the capabilities of artificial intelligence to improve efficiency, accuracy, and automation within the cryptocurrency ecosystem.

Despite the hype surrounding AI cryptos, the AI crypto market cap dropped 2.84% over the past 24 hours according to CoinMarketCap. As a result, the total stood at $4,430,115,622 at press time. Furthermore, the 24-hour trading volume in this category of cryptos also decreased by 12.26% throughout the past day.

The top 5 crypto projects in this category are The Graph (GRT), Render Token (RNDR), Injective (INJ), SingularityNET (AGIX), and Oasis Network (ROSE). All of these projects printed 24-hour losses, but may soon enter into a rally.

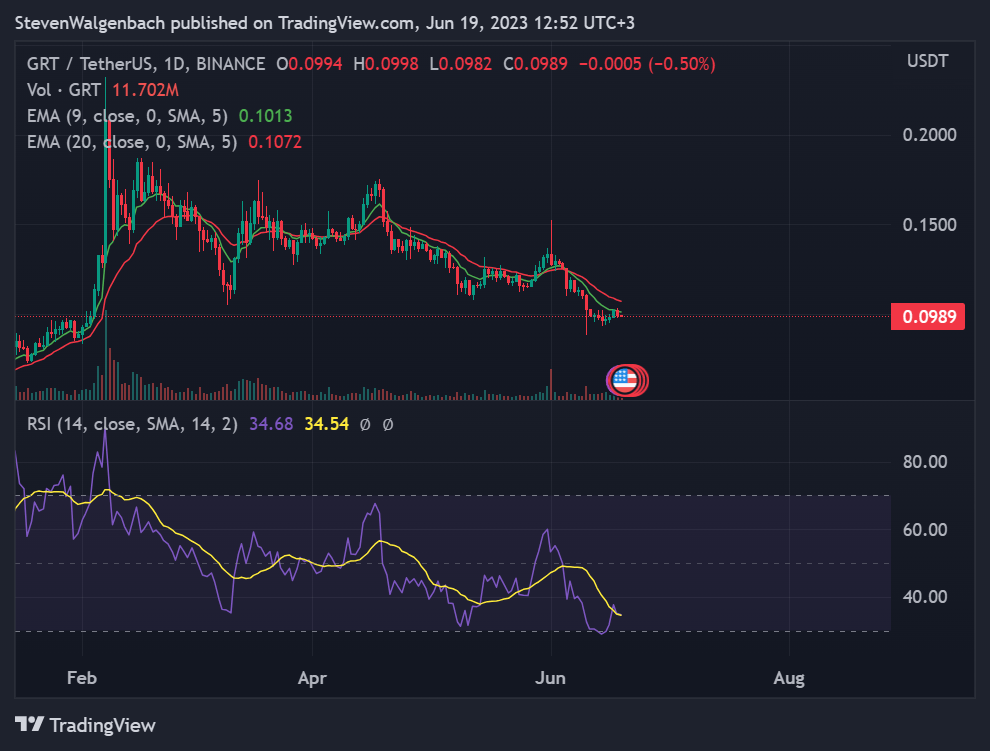

The Graph (GRT)

As with most crypto tokens in the market, GRT suffered a loss heading into the new week. The token was trading hands at $0.09884 at press time after it saw a more than 2% price drop over the past day. Consequently, GRT’s weekly performance was dragged into the red zone to -0.39%.

From a technical perspective, the altcoin’s price was looking to overcome the 9-day EMA line at press time. GRT’s price was able to break above this technical indicator during the past 48 hours but closed yesterday’s trading session back below the EMA line.

Should GRT’s price close today’s trading session above the 9–day EMA line, it will most likely look to climb to the next resistance level at around $0.1196 in the next few days. Conversely, a daily close below the technical indicator today may put the altcoin at risk of dropping to as low as $0.0774.

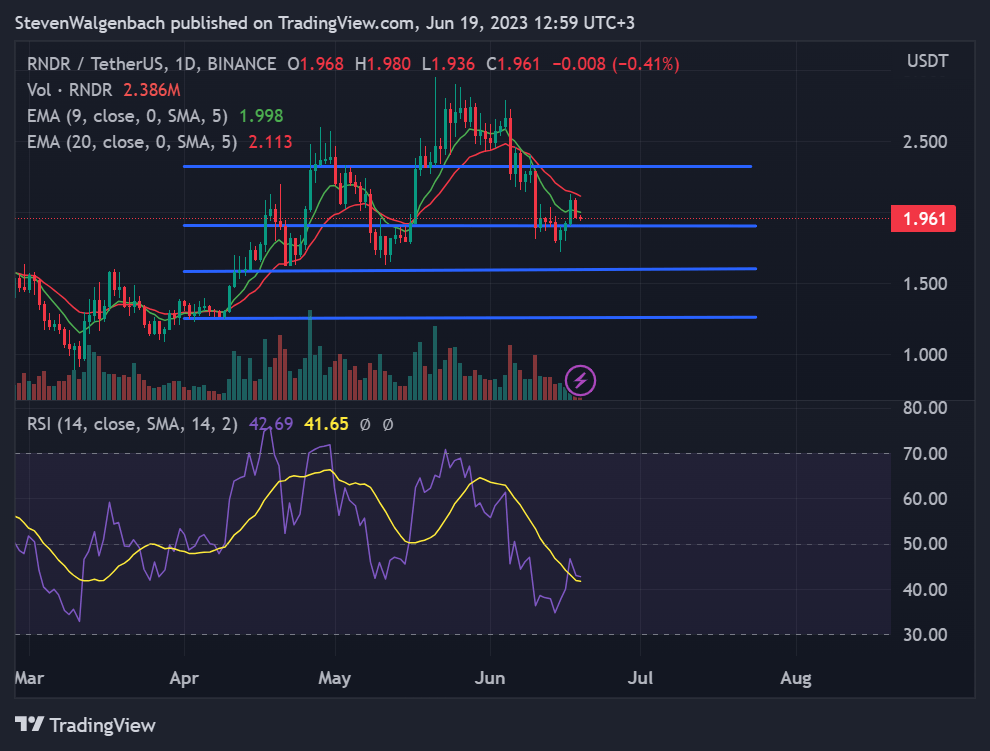

Render Token (RNDR)

RNDR was another AI token that saw its price decrease by more than 2% over the past day. As a result, the crypto was trading at $1.95 at press time. The AI token’s weekly performance was, however, still up by about 0.98%.

RNDR’s price was resting on the $1.906 support level at press time. It was able to break above the 9-day EMA line over the past 48 hours, which had forced the altcoin’s price to a low of $1.722 in the last week. Sell pressure from bears was too overwhelming for bulls yesterday, causing RNDR’s price to close yesterday back below the EMA line.

If RNDR’s price is able to close today and tomorrow above the aforementioned $1.722 support level, then it may look to flip the next resistance level at $2.317 into support in the coming week. However, a close below the $1.722 mark in the next 48 hours will see RNDR’s price drop to $1.590.

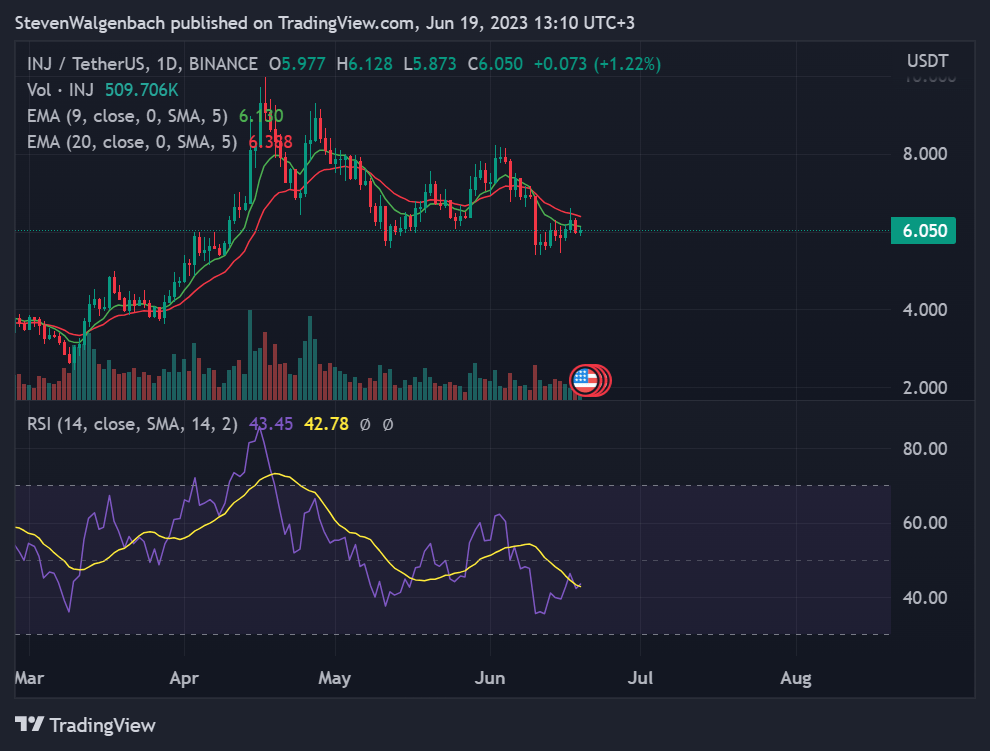

Injective (INJ)

INJ also suffered 24-hour losses greater than 2%, but the AI token’s weekly performance was still firmly set in the green zone at +3.69%. This left the crypto trading at $6.04 at press time and also meant that INJ was trading right between its 24-hour low of $5.89 and its daily high of $6.26.

A significant bearish flag was triggered on INJ’s daily chart recently, as the daily RSI line crossed below the daily RSI SMA line in the past 48 hours. If this bearish flag is validated, the altcoin’s price could drop to $5 in the coming week.

A daily candle close above the 9-day EMA line in the next 48 hours will invalidate the bearish thesis. Should this happen, INJ’s price will rise to $7.464 in the 48 hours thereafter.

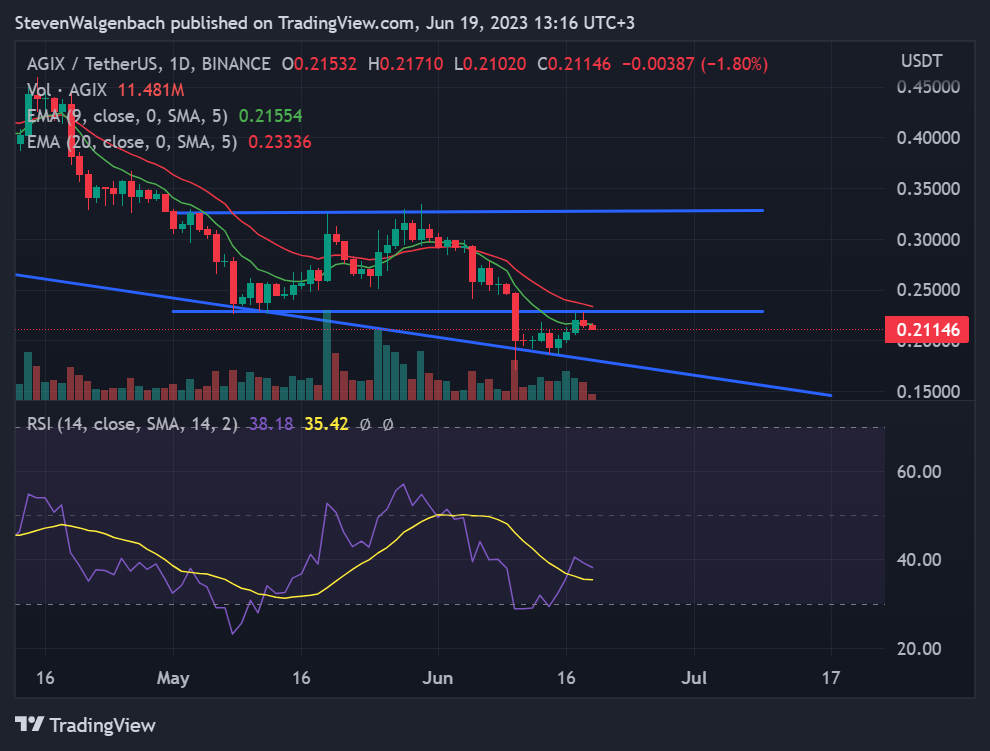

SingularityNET (AGIX)

AGIX was one of the AI tokens that struggled the least over the past day of trading as it only suffered a 1.35% loss. The crypto’s weekly performance was also still in the green by more than 4%. Meanwhile, AGIX’s 24-hour trading volume rose by more than 80% since yesterday, which left it standing at over $12 million.

AGIX’s price was attempting to flip the major resistance level at $0.23481 into support. Should it successfully overcome the strong obstacle in the next 2 days, then it will have a clear path to rise to $0.32788 in the next week. Failure to break above the level within the next 48 hours will result in AGIX’s price dropping to $0.17424.

Oasis Network (ROSE)

Similar to the rest of the AI crypto market, ROSE also printed a 24-hour loss. At press time, the altcoin was trading at $0.04565 after its price had dropped 3.37%. Nevertheless, the altcoin’s weekly performance remained in the green at +3.37%.

In addition, ROSE’s 24-hour trading volume dropped by more than 20%, which left standing at approximately $28 million. Since the token reached its ATH in January of 2018, its price has slipped by 88.61%.

ROSE’s daily RSI line crossed bullishly above the daily RSI SMA line over the past 3 days. However, the slope of the RSI line went from positive to negative after the altcoin’s price faced rejection from the 9-day EMA line.

Should the RSI line cross below the SMA line in the next 48 hours, ROSE’s price will drop to $0.03770 in the next few days. On the other hand, if ROSE’s price is able to close a daily candle above the 9-day and 20-day EMA lines within the coming 2 days, then the crypto’s price will have a clear path to rise to around $0.05.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Source: https://coinedition.com/technical-indicators-suggest-the-top-5-ai-cryptos-will-rally-soon/