TLDR

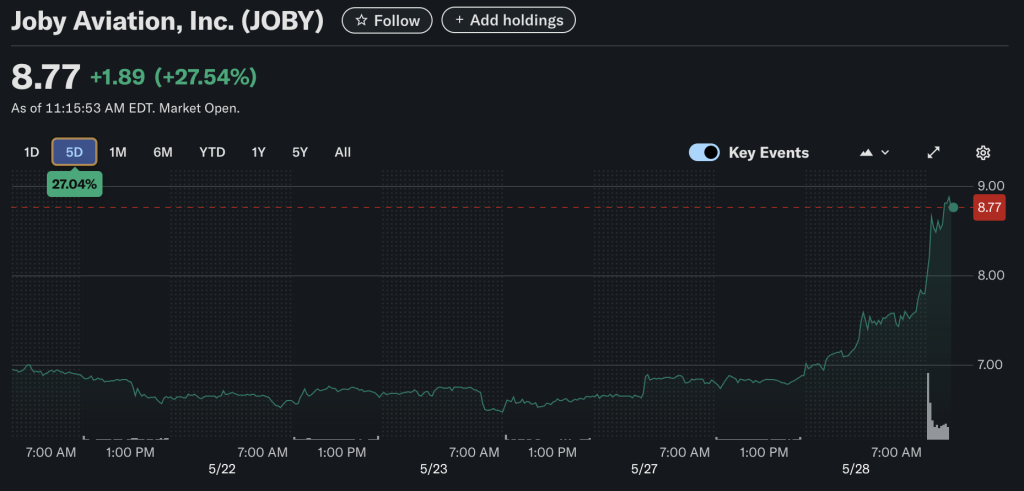

- JOBY stock jumped 27.54% to $8.77 on May 28 following Toyota’s $250 million investment.

- Toyota now becomes Joby’s largest outside shareholder.

- The deal supports eVTOL certification and future commercial production.

- Forward P/E stands at -11.05, and JOBY’s 1-year return hits 82.19%.

Shares of Joby Aviation, Inc. (NYSE: JOBY) surged 27.54% to close at $8.77 on May 28, 2025, after the company confirmed the closing of a $250 million investment from Toyota Motor Corporation. This represents the first tranche of a $500 million deal aimed at advancing Joby’s electric vertical takeoff and landing (eVTOL) aircraft toward certification and commercial deployment.

Toyota initially invested $394 million in Joby in 2020. With this additional funding, Toyota becomes Joby’s largest external investor, further aligning the two firms in a strategic manufacturing alliance for urban air mobility.

Analyst and Executive Insights

“We’re already seeing the benefit of working with Toyota in streamlining manufacturing processes and optimizing design,” said JoeBen Bevirt, founder and CEO of Joby. “This is an important next step in our alliance to scale the promise of electric flight.”

Toyota North America CEO Tetsuo Ogawa emphasized the companies’ shared vision for future mobility, stating, “Our investment in Joby reflects our shared dream of mobility for all.”

The funding will be used to support regulatory certification efforts and scale production capacity for Joby’s eVTOL aircraft, a critical milestone in making aerial ridesharing a commercial reality.

Financial Overview and Key Metrics

Joby Aviation carries a market capitalization of $7.01 billion and operates with high liquidity, holding over $812.5 million in cash. Despite strong backing and capital reserves, the firm remains in the development phase:

| Metric | Value |

|---|---|

| Market Capitalization | $7.01 billion |

| Total Cash (MRQ) | $812.5 million |

| Net Loss (TTM) | $595.85 million |

| Diluted EPS (TTM) | -0.84 |

| Operating Margin | -553,280% |

| Price-to-Book Ratio | 6.09 |

| Return on Assets | -34.14% |

| Debt-to-Equity | 4.73 |

While earnings remain negative, Toyota’s backing strengthens confidence in Joby’s transition to commercial viability.

Stock Performance and Volatility

Joby Aviation’s stock has shown notable volatility but strong performance relative to the broader market:

| Performance Metric | Value |

|---|---|

| 1-Year Return (JOBY) | +82.19% |

| 1-Year Return (S&P 500) | +11.34% |

| YTD Return | +8.91% |

| 52-Week Range | $4.66 – $10.72 |

| Beta | 2.34 |

| Maximum Drawdown | -76.27% |

| Sharpe Ratio | 0.47 |

Risk metrics indicate high volatility, with a maximum drawdown of -76.27%, and a Sharpe ratio of 0.47, signaling a moderate risk-adjusted return.

Outlook

With the August 2025 earnings window approaching and significant capital now secured, Joby Aviation stands at a pivotal point. The partnership with Toyota enhances its operational runway, technical expertise, and commercial prospects in the emerging eVTOL sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/340302-joby-stock-surges-nearly-30-after-toyotas-250m-air-taxi-investment/