- SUI has witnessed an increase in outflows this week after its uptrend faced resistance.

- Lack of buyer support could see SUI drop to test support before making another upswing.

Sui [SUI] has been one of the top performers across the cryptocurrency market in recent months. In the last 30 days, SUI has doubled its market capitalization to more than $5 billion after the price surged by more than 98%.

SUI’s gains have seen it stand out from the choppy trends witnessed with other altcoins.

However, after more than a month of a steady rise, the rally is now showing signs of exhaustion, and it could reverse to find support before resuming the uptrend.

SUI price analysis

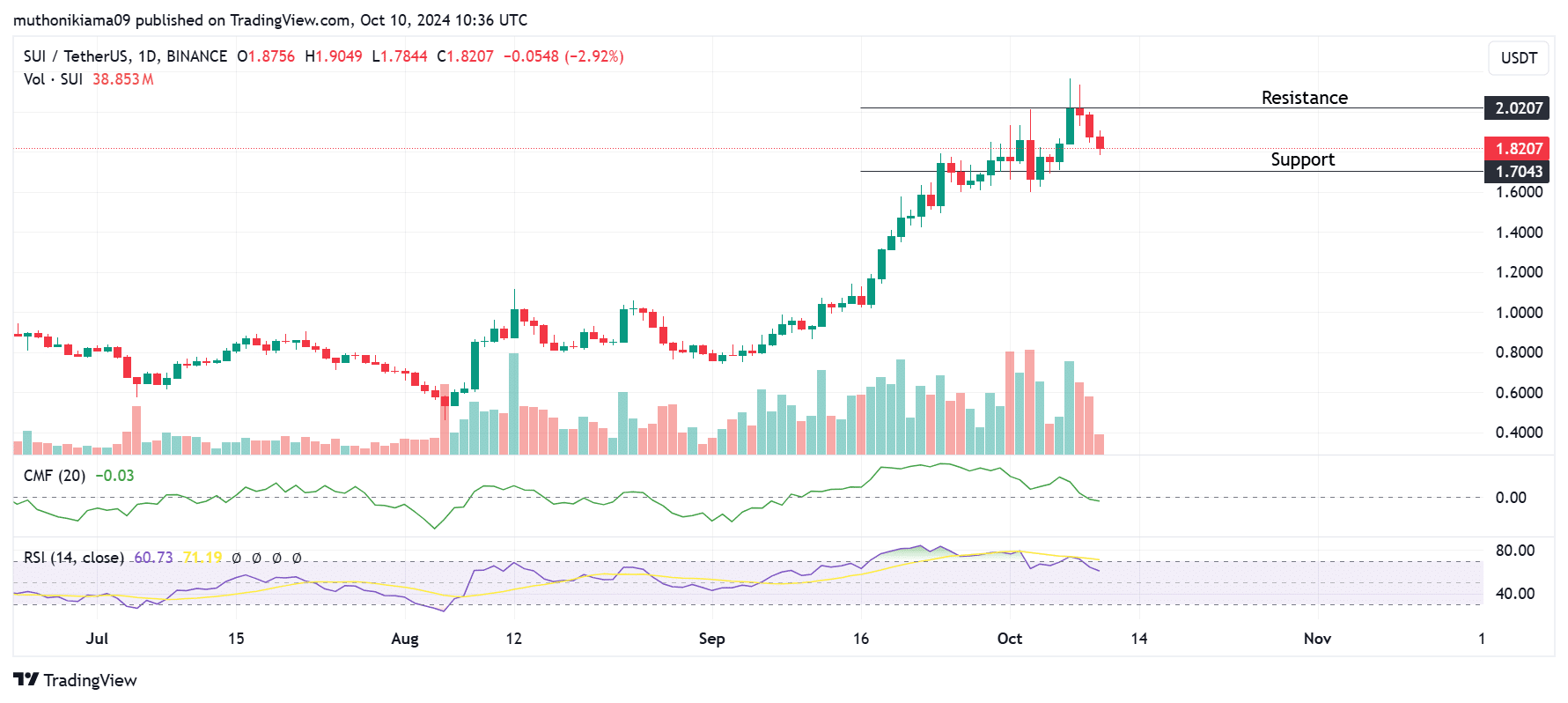

SUI traded at $1.82 at press time after a 4.4% drop in 24 hours. Trading volumes had also dropped by 6% according to CoinMarketCap, showing that interest in this token is dropping.

Furthermore, the volume histogram bars have been red in the last three consecutive days, suggesting that sell-side pressure is high.

Buying activity around SUI is also waning. The Chaikin Money Flow (CMF) has been on a downtrend this week, an indication that money is flowing out of the token.

The CMF had also flipped negative on the one-day chart as selling pressure overwhelmed buying pressure. This could be caused by traders taking profits after the uptrend showed signs of weakening.

Source: TradingView

The selling activity started after the Relative Strength Index (RSI) crossed below the signal line and formed a sell signal. Buyers will likely get back in the market if this metric crosses back into bullish territory.

If buying activity remains scanty and sellers continue to dominate, the price will likely drop to test support at $1.70. Buyers might use this drop to find a new entry point.

However, for a sustained uptrend, SUI needs to break resistance above $2.

Analyzing derivatives data

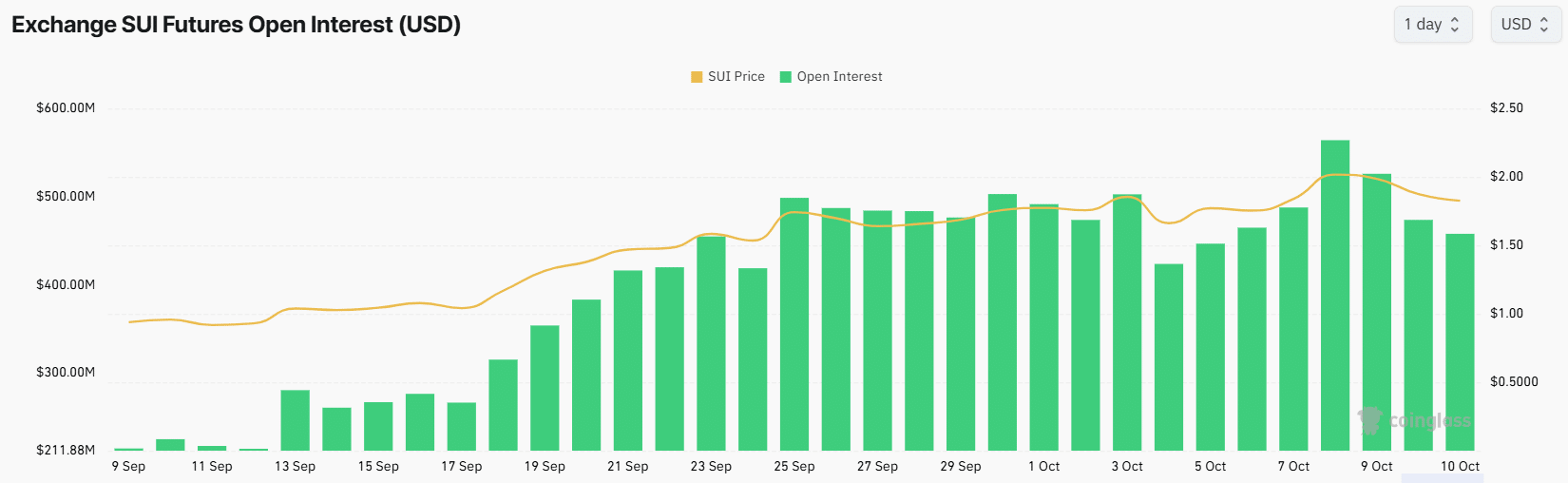

Derivatives market data shows that SUI is cooling down after being overheated. Open interest has dropped by 11% in the last 24 hours to $457 million at press time per Coinglass.

SUI’s Open Interest reached an all-time high above $563M earlier this week, but it has since dropped by more than $100M. This shows that traders are closing their positions on the token as interest wanes.

Source: Coinglass

Read Sui’s [SUI] Price Prediction 2024–2025

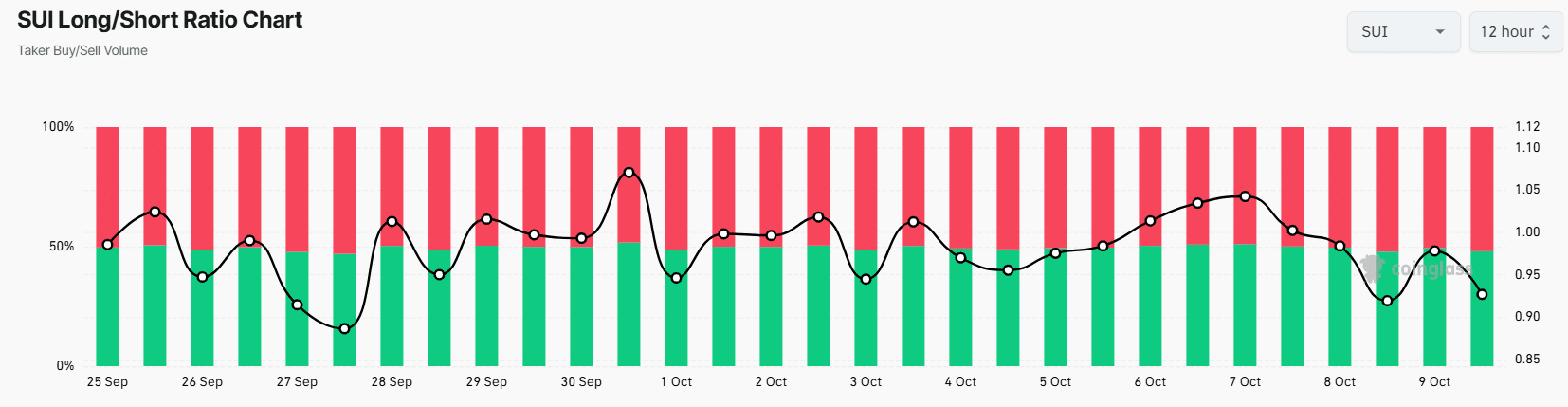

Additionally, SUI had the fourth-highest liquidations in the last 24 hours at $6 million. Most of the liquidated traders were those with long positions, which creates a bearish sentiment.

The long liquidations have also had an impact on the Long/Short Ratio, which has dropped to 0.92. Though this is near the neutral zone, it shows that there are slightly more short traders than long.

Source: Coinglass

Source: https://ambcrypto.com/sui-shows-signs-of-exhaustion-after-98-gain-fall-ahead/