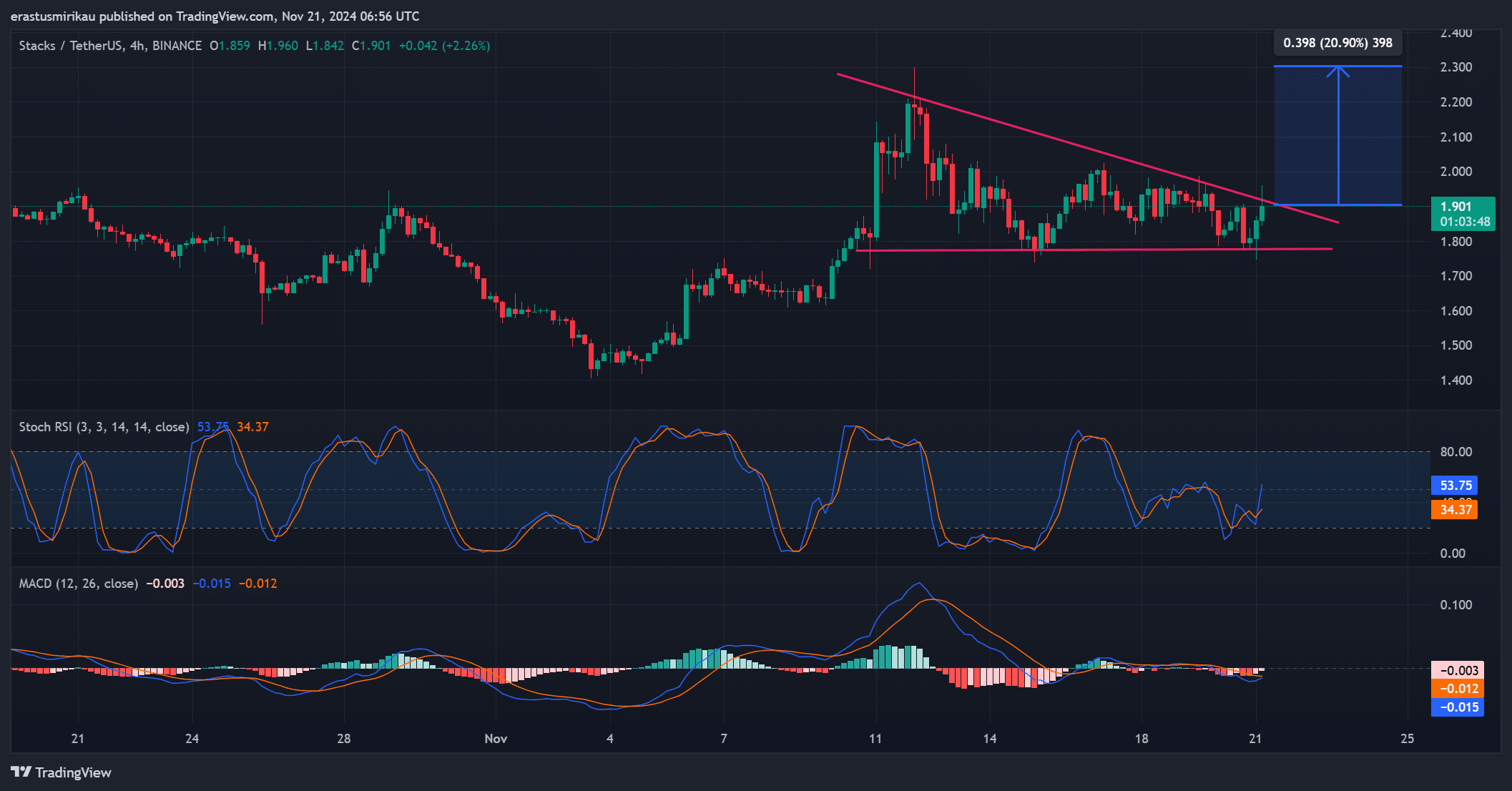

- STX forms a bullish pennant pattern, signaling a potential 20-25% price surge if it breaks $2.00 resistance.

- Technical indicators and moderate social volume support the likelihood of a bullish breakout above key levels.

Stacks [STX] has formed a bullish pennant pattern following a period of consolidation, signaling the potential for a breakout. After weeks of consolidation, the cryptocurrency is positioning itself for a potential rally.

As of this writing, STX was trading at $1.91, up by 4.08% at press time. However, the crucial question is: can STX break its key resistance level and trigger the next phase of upward momentum?

Bullish pennant breakout targets $2 resistance

Stacks has recently formed a classic pennant pattern, a technical formation that often precedes significant price movements. After a period of consolidation, STX appears to be preparing for a breakout.

This pennant structure hints at a possible surge in price as it reaches its apex. As a result, many market participants are keeping a close eye on STX to see if it can breach the resistance levels and start an upward trajectory.

The most significant resistance for STX lies around $2.00, a price point that has been a barrier for the coin in the past. Consequently, a break above this level would be a key indicator that the breakout is in motion.

Traders are anticipating a 20%-25% price increase following such a breakout. This could potentially push the cryptocurrency to levels near $2.40, based on the breakout’s target projections.

Therefore, the coming days will be critical for STX to break through this resistance and confirm its bullish movement.

The technical indicators, including the STOCH RSI and MACD, are signaling potential bullish momentum. The STOCH RSI is currently at 53.75, suggesting that STX is in a neutral-to-bullish state.

In addition, the MACD is showing a slight bullish crossover, which further strengthens the case for an impending price surge. Consequently, these indicators support the notion that STX could be on the verge of an upward move.

Source: TradingView

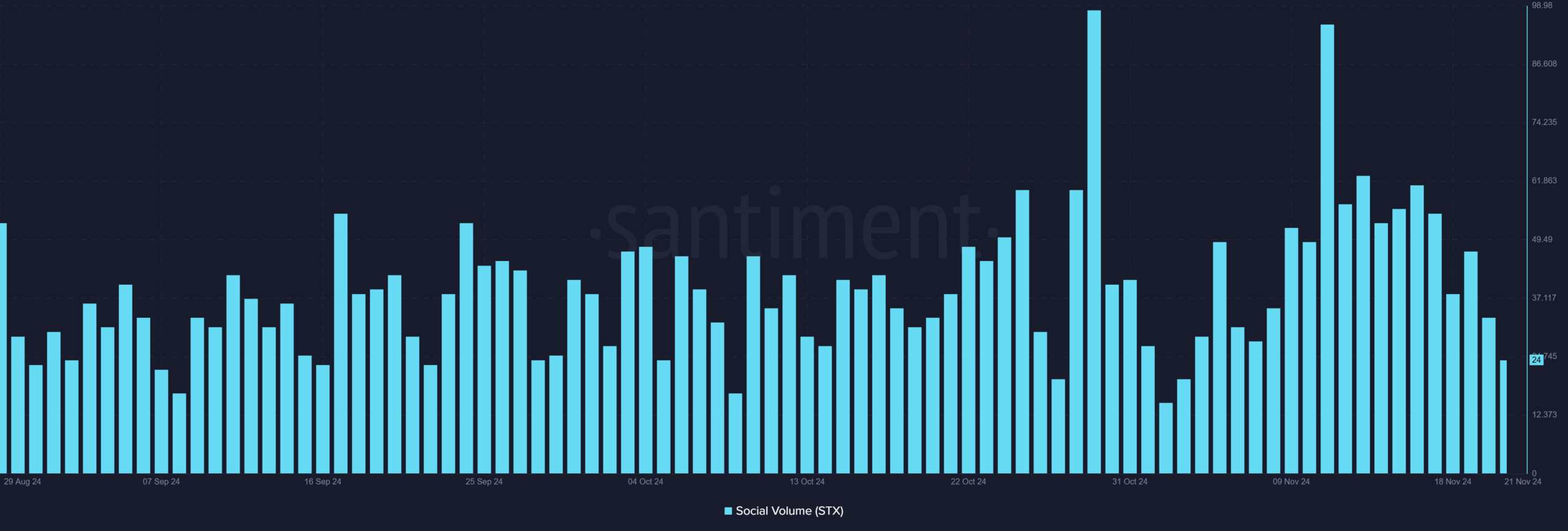

What role does social volume play in this breakout?

Social volume for STX has seen a moderate rise recently, with the metric standing at 24. This figure signals an uptick in interest surrounding the asset.

However, this level is still notably lower than the peaks observed in late October, where social volume surged above 70.

Despite the current moderate activity, if social volume continues to rise, it could act as a catalyst for the upcoming breakout, providing the momentum needed to drive the price higher.

Source: Santiment

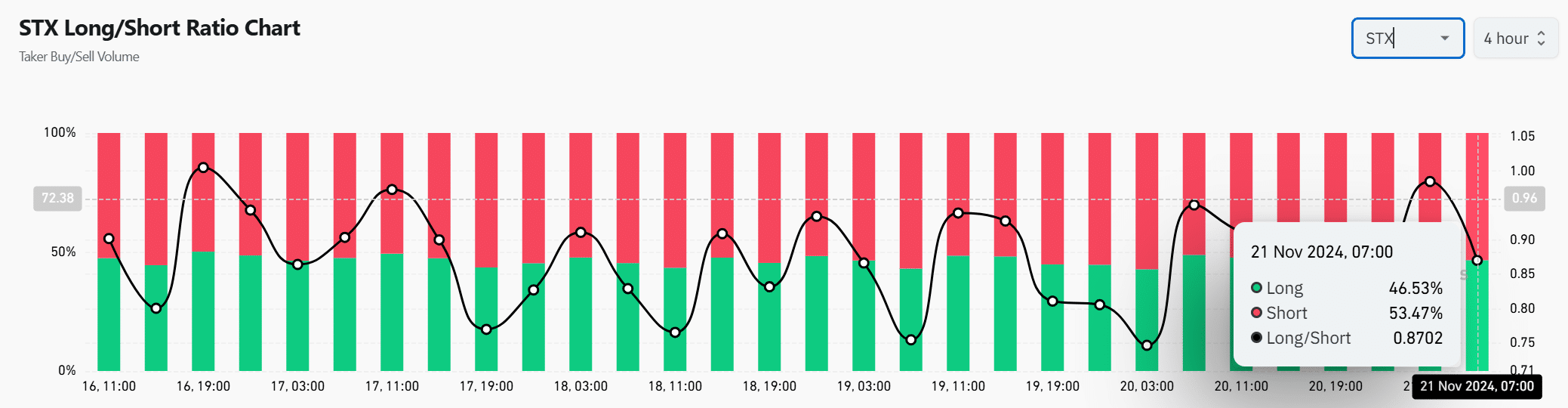

How does the long/short ratio impact the price outlook?

The long/short ratio for STX shows that 46.53% of market participants are currently long, while 53.47% are short. This slight bearish sentiment indicates some market hesitation.

However, a bullish breakout could shift this ratio significantly, leading to more long positions being opened, which would fuel upward momentum. Consequently, the long/short ratio could change quickly if the price begins to break resistance levels.

Source: Coinglass

Read Stacks [STX] Price Prediction 2024-25

Is STX set to break out?

STX appears to be on the brink of a bullish breakout, with a pennant pattern signaling the potential for a 20-25% surge. If it successfully breaks the $2.00 resistance level, the cryptocurrency could rise to approximately $2.40.

Technical indicators, social volume, and the long/short ratio all point to the possibility of significant price movement. Therefore, it seems likely that STX is poised for a bullish rally.

Source: https://ambcrypto.com/stx-all-set-for-a-25-breakout-watch-out-for-these-price-levels/