- Tempo, backed by Stripe, raises $500M in Series A.

- Valuation hits $5B in a significant funding round.

- Stripe and Paradigm not involved in the round.

Tempo, a blockchain project by Stripe and Paradigm, raised $500 million led by Greenoaks and Thrive Capital, achieving a $5 billion valuation, according to sources on October 18.

Tempo’s funding positions it among top-valued blockchain ventures, highlighting stablecoins’ growing role in global payments and potentially influencing the blockchain ecosystem.

Tempo’s $5B Valuation Amidst Greenoaks and Thrive Led Funding

Tempo, a Layer 1 blockchain project, received $500 million in Series A funding from prominent venture capitalists Greenoaks and Thrive Capital. With a post-money valuation of $5 billion, Tempo marks one of the largest blockchain ventures lately. Stripe and Paradigm, prominent in its creation, did not participate in the funding round. Sequoia Capital, Ribbit Capital, and SV Angel also joined the funding effort, highlighting strong institutional interest.

Matt Huang, CEO of Tempo, stated, “Tempo is purpose-built for stablecoins and real-world payments, born from Stripe’s experience in global payments and Paradigm’s expertise in crypto tech.”

Market observers and crypto communities have shown keen interest in Tempo’s potential to reshape payment infrastructures. Despite its high valuation, regulators, including the SEC and ESMA, have remained silent on its debut. Discussions within the industry expect Tempo to contribute significantly to stablecoin adoption and remittance innovations.

Stablecoins and Regulatory Silence: Tempo’s Impact on Payments

Did you know? Tempo’s valuation rivals early stages of blockchain giants like Circle’s Arc, reflecting shifting trust toward stablecoin-focused payments solutions in financial markets.

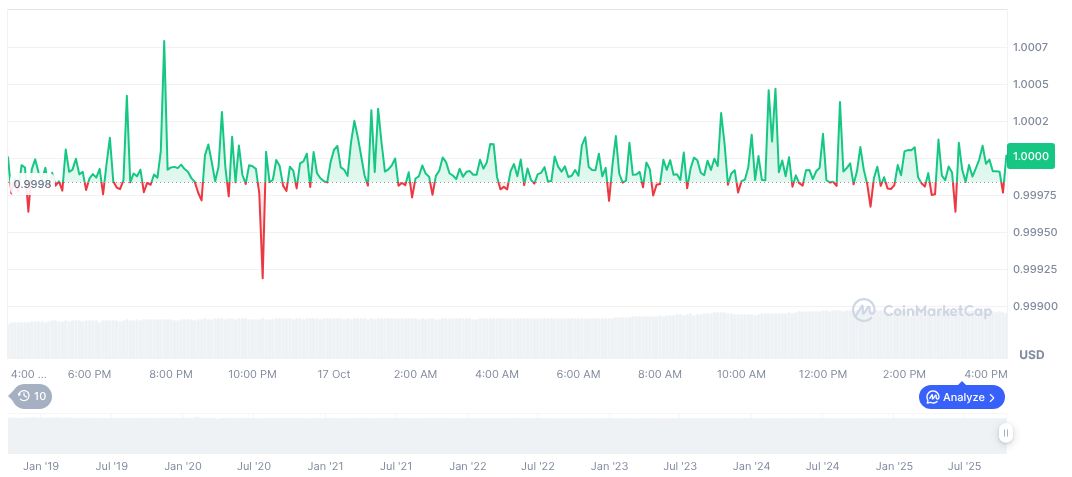

USDC, as reported by CoinMarketCap, remains stable at $1.00 with a market cap of $76.05 billion. Market dominance stands at 2.11%, supported by a 24-hour trading volume of $23.52 billion. Its price reflects minimal fluctuation, consistent with its stablecoin nature.

Experts at Coincu suggest that Tempo’s venture into the market foresees enhanced stablecoin utility, influencing both traditional and crypto-based financial services. As stablecoins embed further in remittances, industry adaptations in regulatory frameworks are anticipated, shaping future transaction landscapes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/stripe-tempo-raises-500-million/