The crypto space witnessed yet another brutal attack as the star crypto fell beneath $30,000 for the first time after the July 2021 crash. The price marked its 2022 lows at around $29,730 and quickly rebounded back above. No doubt, many speculated the BTC price to slash to $27K or $28K, but what actually went wrong is a much more interesting part of the story.

On the other hand, the much popular decentralized, algorithmic stablecoin UST, got de-pegged and slashed below 70 cents. Moreover, LUNA’s price also fell more than 50% to hit the rock-bottom levels around $24. But what went wrong? The asset which stood strong, making new ATH each day, amidst the bloodbath in the crypto space just collapsed within minutes!

It is very hard to believe and analyse but yes, Terra Foundation and LUNA Foundation Gaurd underwent an acute stress test. Let’s dig in more to know what actually happened!

Where Things Got Messed Up?

The Stablecoins usually are the assets which are backed by a reserve asset. Similar to Tether(USDT), and USD Coin(USDC) which are pegged to the USD, Terra’s UST is backed by LUNA. 1 LUNA and 1 UST were pretty identical and could be swapped against each other.

However, UST being decentralized and backed by LUNA was criticized and questioned by many. And this was when, the man behind UST, Do Kwon, decided to back the UST’s peg with other assets like Bitcoin. And hence the Terra Foundation left no stones unturned in accumulating BTC at every dip to accomplish their target of holding $10 billion worth of BTC reserves.

This was beyond the imagination of some maximalists who constantly questioned the stability of the stablecoin. In the world of decentralization, DeFi or NFT is not largely dominated by Bitcoin, a decentralized Stablecoin being back by BTC was the main concern. And hence the ‘Peg-Mechanism’ was put up under assessment.

The UST Stress Attack

Prior to diving into the details of the attack, it’s important to know Terra’s Peg Mechanism is designed to maintain the UST value at $1. The Terra Protocol uses the basic market forces of demand and supply. In simpler words, Terra economy has 2 pools, one for UST and other for LUNA. To maintain the price of UST, the LUNA gets burnt each time, the UST gets de-pegged.

Whenever the UST price rises above its peg of $1, LUNA is burnt to mint new UST to combat the supply squeeze and increasing demand. Conversely, if the price is too low, then UST is burnt to mint LUNA to decrease the supply and create scarcity to raise the demand. Moreover, the users can swap UST & LUNA in case of a price slash with any of these assets.

Coming to the attack, as per some reports, a deliberated dump was carried out on Binance and Curve by a single player who liquidated $285 million UST. This was followed by massive shorts on LUNA and numerous Twitter posts margining LUNA.

This created a huge FUD which compelled millions of LUNA to be dumped hard. And hence as the LUNA price fell, the UST got de-stabilized and began to de-peg. And as the crypto space was already in the bear market, the LUNA’s circulation had to be increased to maintain the UST peg.

Terra Founders Jump into Rescue

Much before the brutal UST crash of nearly 25%, UST had experienced a 2% drop and de-pegged to $0.98. Sensing the upcoming complications, the founder of UST, Do Kwon announced to deploy $1.5 billion ( $0.75 billion in BTC and $0.75 billion in UST) in capital to stabalize UST but had no intentions of liquidating BTC.

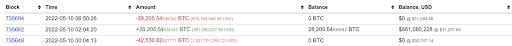

But, when the BTC price began to slash hard piercing through the $36,000 support levels, the LFG, emptied its BTC wallet. Currently, according to btcinfocharts.com, the LUNA-LFG Bitcoin wallet has 0 (ZER0) BTC.

As per the above data, the LFG withdrew the entire BTC reserve of 42,530.82 BTC worth nearly $1.3 billion at loss. The LFG accumulated at the higher price at an average price above $40,000, the highest when Bitcoin was valued at around $47,354. And liquidated all of its reserves at $30,237. And this explains the huge red candle in the BTC chart as LFG sold all of its reserves to stabalize UST.

Now when a billion-dollar has just whipped out from the global market cap (relatable), Do-Kwon informed the crypto space with a tweet saying

“ Deploying More capital – steady lads”

Soon after this episode, the UST regain its position above $0.9 and LUNA recovered above $30 but was still under-water by nearly 50% at the press time.

The Impact on BTC

Bitcoin price is not having a pretty good time ever since the beginning of May’s trade. Initially, BTC’s price lost the valuable positions around $40,000 and was consolidating hard around $36,000 for a couple of days. However, the recent terra’s incident dragged the price beneath $30,000 for the first time since the July 2021 crash and more than $1 billion worth of longs got rekt.

Adding to the substance, more than $700 million BTC long are liquidated since the beginning of the monthly trade. Therefore, it is pretty clear that Terra’s moves have deeply triggered the massive crypto crash which began with the BTC price plunge.

However, analysing the whole event is sure cannot be said the failure of Terra’s peg mechanism, but yes the platform needs to flood in some extra efforts to overcome these types of situations in the future.

Source: https://coinpedia.org/research-report/stress-test-for-luna-ust-is-it-a-maximalists-co-ordinated-attack-or-terras-peg-mechanism-failure/