- Bitcoin defends $123K after breakout, with $125.5K–$128.5K as next upside targets.

- Strategy reports $3.9B Q3 fair value gain, reinforcing corporate Bitcoin adoption.

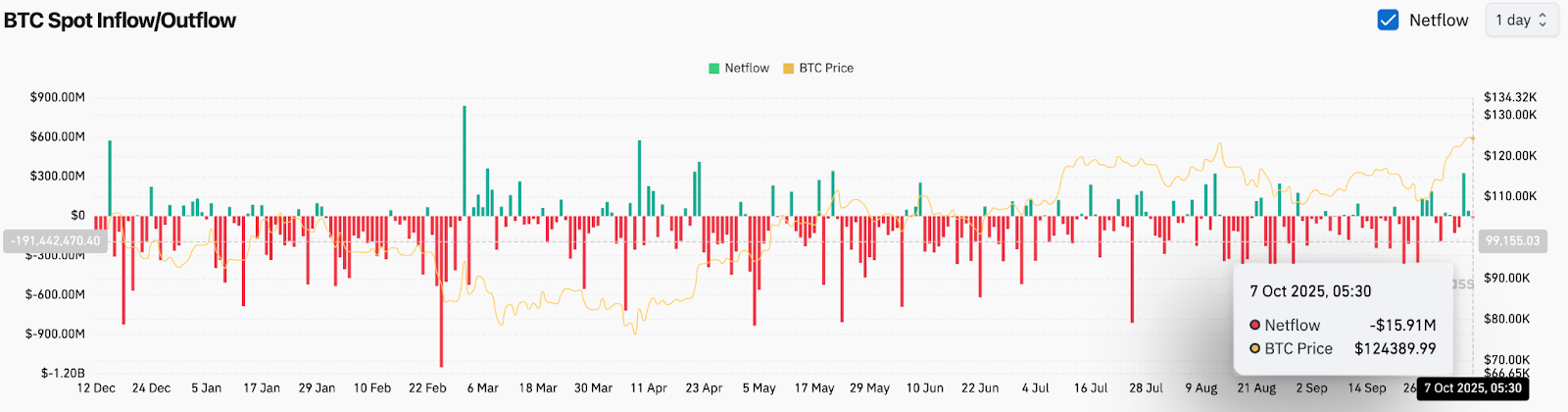

- On-chain flows show $15.9M outflow, signaling cautious accumulation amid consolidation.

Bitcoin price today is trading near $124,180, holding steady after a powerful breakout from its multi-month triangle structure. Buyers are defending the newly reclaimed $123,600 zone as the market digests news that corporate giant Strategy reported $3.9 billion in Bitcoin fair value appreciation for Q3 2025 — a signal of continued institutional confidence in BTC’s long-term valuation.

Bitcoin Price Extends Rally Within Rising Channel

The daily chart shows Bitcoin sustaining a strong advance inside a rising channel, with price now testing the midline near $124,800. The 20-day EMA at $117,800 and the 50-day EMA at $115,500 have formed a solid support cluster, confirming the bullish alignment of trend.

Momentum remains elevated, though the RSI near 71.6 suggests mild overbought conditions after last week’s sharp recovery from $111,000. As long as BTC stays above $123,000, short-term structure remains constructive. A break above $125,500–$126,000 could open the path toward $128,500, marking the upper boundary of the ascending channel.

Strategy’s $3.9 Billion Report Strengthens Institutional Narrative

Investor sentiment received a major boost after Michael Saylor confirmed that Strategy recorded $3.9 billion in total Bitcoin fair value appreciation during Q3 2025. The announcement underscored the expanding role of corporate treasuries in reinforcing BTC’s macro thesis as a digital reserve asset.

The update also reignited discussion about Bitcoin’s institutional momentum heading into Q4, as listed entities and ETFs continue to accumulate positions amid stronger fair value accounting standards. Analysts note that consistent corporate profitability tied to BTC holdings strengthens confidence in long-term demand and price stability.

Exchange Flows Show Controlled Outflows Amid Consolidation

As per Coinglass, spot exchange data shows a net outflow of $15.9 million on October 7, reflecting cautious accumulation rather than aggressive distribution. Over the past two weeks, netflows have alternated between small inflows and outflows, suggesting that traders are taking profits but not exiting positions.

Historically, persistent net outflows have aligned with medium-term rallies, as supply leaves exchanges for self-custody. Analysts view the current pattern as healthy consolidation following BTC’s 12% run-up since late September. Sustained outflows above $100 million would confirm deeper accumulation ahead of potential Q4 breakouts.

Technical Outlook For Bitcoin Price

Bitcoin price prediction for the short term remains anchored on maintaining the breakout channel:

- Upside levels: $125,500, $128,500, and $132,000 if momentum persists

- Downside levels: $123,000, $117,800, and $115,500 as key support

- Trend support: $107,500 (200-day EMA) as the long-term defense line

Outlook: Will Bitcoin Go Up?

Bitcoin remains well-positioned within its bullish channel, supported by positive corporate catalysts and stable on-chain flow behavior. The Strategy earnings highlight reinforces the broader institutional narrative, while steady outflows suggest limited selling pressure.

Analysts believe that if BTC can secure a daily close above $125,500, the next target zone sits near $128,500–$132,000. However, failure to hold above $123,000 could trigger a minor correction toward the EMA cluster before the next leg higher.

For now, Bitcoin’s broader structure continues to point upward, with buyers in control as the market eyes higher resistance levels into mid-October.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/bitcoin-price-prediction-strategys-3-9b-gain-boosts-sentiment/