- Michael Saylor comments on Strategy’s exclusion from the S&P 500.

- Strategic shift sparks market and community reactions.

- Robinhood sees stock surge from S&P addition.

Michael Saylor expressed concern over Strategy’s exclusion from the S&P 500 index after meeting all criteria, as Robinhood was included instead.

This decision influences both equity valuations and crypto-market sentiment, given Strategy’s substantial Bitcoin holdings.

Robinhood Joins S&P 500; Shares Surge 7.5%

In a notable occurrence, Strategy met all criteria for becoming part of the S&P 500, yet it was not included. Michael Saylor commented, suggesting potential inconsistencies in selection. Robinhood’s unexpected entry added further complexity to the announcement.

The exclusion limits Strategy’s opportunity for index-driven demand, especially for funds tracking the S&P 500. Robinhood’s inclusion sparked a positive response with its shares increasing by 7.5%, reflecting the immediate index effect.

Thinking about the S&P right now… with a chart showing Strategy’s 92% annualized returns since adopting the Bitcoin Standard, far exceeding both the S&P 500 and Bitcoin over the period. — Michael Saylor

Crypto Equities and Regulatory Trends: Expert Analysis

Did you know? Robinhood’s inclusion in the S&P 500 reflects an increasing intersection of traditional finance and cryptocurrency sectors, a trend noted since Coinbase’s addition in early 2025.

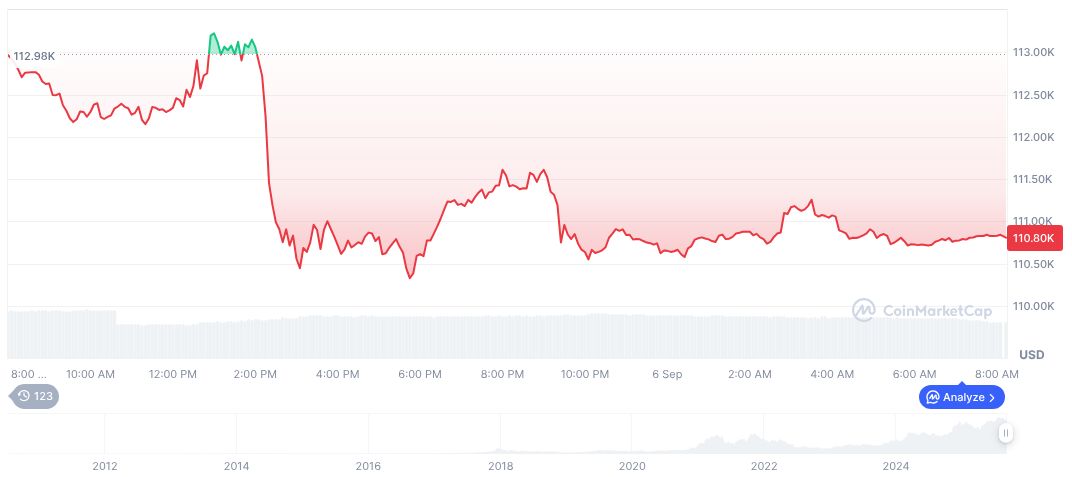

Bitcoin (BTC) currently trades at $110,314.73, with a market cap of $2.20 trillion according to CoinMarketCap data. Despite a slight 0.46% drop within the last 24 hours, its market dominance remains at 57.92%. Trading volume fell by 52.27% over the past day.

Coincu analysts highlight potential for continuous regulatory adjustments impacting firms like Strategy. Analysis suggests that such exclusions can temporarily disrupt equities, but often include future opportunities for rebalanced inclusion.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/strategy-sp500-exclusion-crypto-shift/