- Strategy issues 2.5 million preferred shares, affecting Bitcoin holdings.

- Insider participation boosts organizational confidence.

- No impact observed on Ethereum or other altcoins.

ChainCatcher news reports that Strategy announced the issuance of 2.5 million shares of 10.00% Series A perpetual preferred stock for Bitcoin purchases and working capital.

This development highlights Strategy’s continued focus on Bitcoin acquisition, reflecting a broader trend in crypto investment strategies among corporations.

Strategy’s $2.5M Stock Sale to Fund Bitcoin Acquisitions

Strategy’s recent announcement of a 2.5 million preferred stock offering under the ticker STRD comes with a 10% cumulative dividend. Proceeds will fund further Bitcoin acquisitions, enhancing the company’s crypto portfolio. CEO Phong Le and other insiders actively purchased shares, indicating robust internal support.

The move bolsters Strategy’s position in the crypto market, using traditional financial mechanisms to acquire more Bitcoin. The initiative is expected to increase the company’s BTC holdings substantially while not affecting other cryptocurrencies like Ethereum.

Michael Saylor, Founder, Strategy, “Preferred Stock STRF will be listed and traded on Nasdaq today.”

Reactions among market watchers remain mixed, with some analysts citing potential advantages for Bitcoin’s perception as a treasury asset. However, tangible effects on the overall crypto market remain limited, with no notable responses from key regulatory or industry figures as of now.

Bitcoin Price Trends and Institutional Interest

Did you know? In previous initiatives, Strategy’s preferred stock offerings have historically elevated Bitcoin’s status as a reserve asset, particularly enhancing corporate Bitcoin holdings.

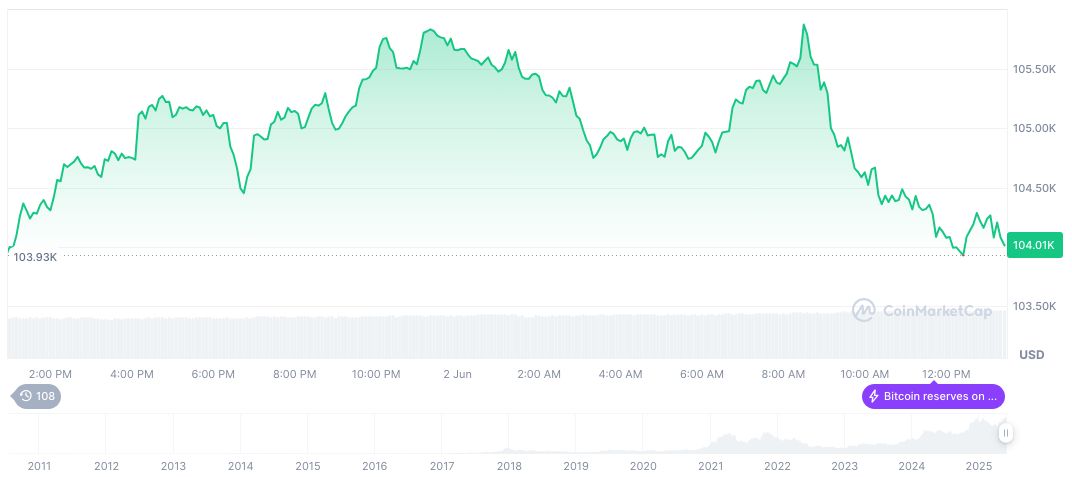

Bitcoin (BTC), currently valued at $105,000.15 with a market cap of $2.09 trillion and a 63.20% dominance rate, shows volatility in recent months according to CoinMarketCap. The 24-hour trading volume stands at approximately $46.98 billion, with a marked decrease in the last seven days by 4.27%.

According to Coincu research, Strategy’s stock offering represents a broader adoption trend, attracting institutional interest towards crypto. Experts predict regulatory barriers may arise, though they’ve yet to manifest significantly, potentially influencing future corporate cryptocurrency strategies.

Source: https://coincu.com/341345-strategy-strd-preferred-stock-offering/