Key Takeaways

What triggered Story Protocol’s latest rally?

The debut of its on-chain prediction market drove demand and boosted trading activity.

What levels must be reclaimed for further upside?

IP must break above EMA20 at $3.12 to target EMA50 near $4.4.

After defending $2.0 support, Story Protocol [IP] has staged a strong comeback, hitting a high of $3.2 before retracing.

At press time, IP was trading at $2.8, up 19.32% on the daily charts. Over the same period, its volume surged 197% to $181 million, reflecting growing on-chain activity.

But why is Story Protocol surging?

Story Protocol debuts on-chain prediction market

In 2025, prediction markets have become people’s favorite, with trading volume surpassing $3 billion according to Forbes.

Amid this growing demand, Story Protocol has stepped up to bring blockchain and the broader crypto into it.

According to Story Protocol, the blockchain unveiled its first prediction market with MusicbyVirtuals, enabling users to bet on financial and cultural events.

These markets will facilitate bets on various cultural topics such as K-pop chart positions and crypto prices.

The Story Blockchain will process settlements for various bets. This milestone highlights how trends and financial predictions can be tokenized and traded on-chain.

Even more significantly, it underscores Story Protocol’s aim to move beyond reliance on IP and capture real-world cases.

Demand follows suit

Significantly, after the prediction market debuted on Story Protocol, demand for the altcoin surged significantly.

According to Coinalyze data, buyers retook the market from sellers who had staged a comeback. Over the past 24 hours, the altcoin saw 2.1 million in Buy Volume compared to 1.7 million in Sell Volume, at press time.

Source: Coinalyze

As a result, the altcoin recorded a positive Buy-Sell Delta of 400k, a clear sign of aggressive spot accumulation.

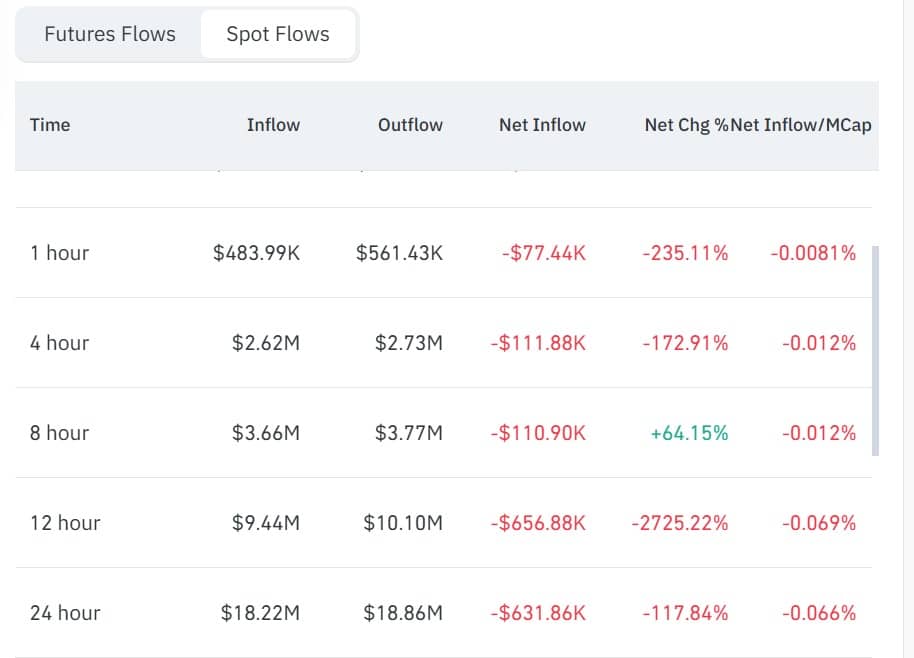

Exchange activity reinforced this trend, with $18.86 million in outflows compared to $18.22 million in inflows, according to CoinGlass.

Source: CoinGlass

As a result, the altcoin Spot Netflow dropped 177.84% to -$631.86k, indicating higher outflows.

Usually, increased exchange outflows reduce the supply available for immediate selling, causing upward pressure on an asset.

Can the wave propel IP to $4?

IP rallied as demand for the altcoin soared following the debut of an on-chain prediction market.

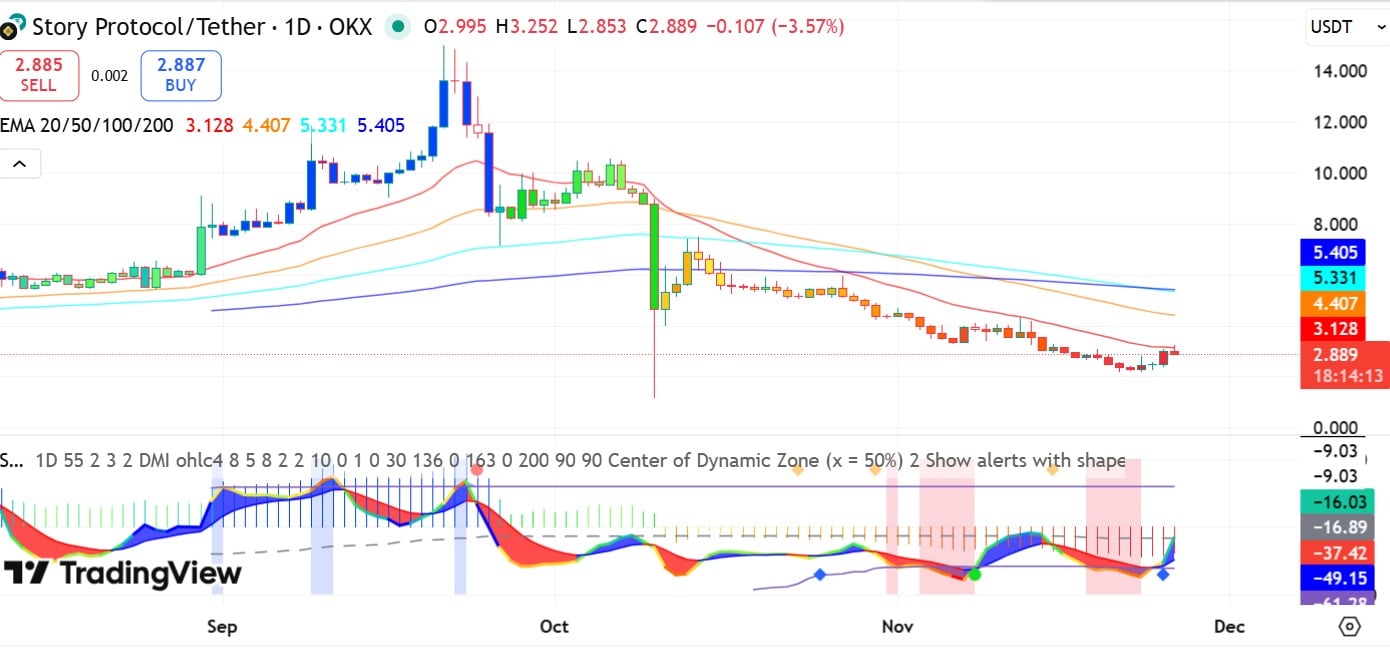

For that reason, the altcoin signaled a momentum shift to the upside, with the DMI Stochastic Momentum index turning green, at the time of writing.

This implies that buyers have recently stepped in for a relief move position IP for a short-term bullish bounce.

Source: TradingView

However, the indexes remain negative, confirming that the bearish structure is still in place. The altcoin also trades below all major moving averages.

For any sustained upside, IP must first reclaim the EMA20 at $3.12, which could pave the way for a move toward the EMA50 at $4.4.

If buyers fail to retake these levels, the rally will lose momentum, and the price may retrace back to the $2.4 support zone.

Source: https://ambcrypto.com/assessing-how-story-protocol-surged-19-can-ip-reclaim-4-next/