XLM, the native token of Stellar and an XRP rival, is poised for a massive price decline as it has formed a bearish price pattern on the four-hour timeframe. The asset is holding above a crucial level, but due to bearish market sentiment and continuous price drops, it has reached a critical make-or-break level.

XLM Technical Analysis and Upcoming Level

According to expert technical analysis, XLM has formed a bearish head and shoulders pattern and is on the verge of a breakout as it currently sits at the neckline. Based on recent price momentum and historical patterns, if the asset breaches this level and closes a four-hour candle below $0.265, there is a strong possibility it could drop by 30% to reach $0.19 in the coming days.

Amid the ongoing bearish market sentiment and continuous price decline, the asset has already traded below the 200 Exponential Moving Average (EMA) on both the daily and four-hour timeframes. This indicates a downtrend in both the short term and long term.

Currently Price Momentum

XLM is currently trading near $0.275 and has experienced a price drop of over 4.5% in the past 24 hours. During the same period, due to the market’s unexpected move, its trading volume dropped by 35%, indicating lower participation from traders and investors compared to previous days.

Traders Over-Leveraged Positions

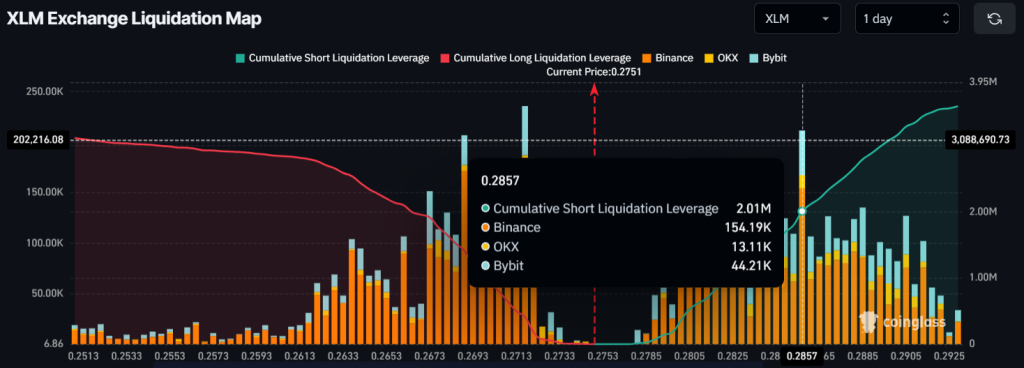

At press time, traders are over-leveraged at $0.27 on the lower level and $0.285 on the upper level, as reported by the on-chain analytics firm Coinglass.

Data further reveals that traders have built $500K worth of long positions at the lower level and $2 million worth of positions at the upper level, indicating that bears are currently dominating. This suggests a strong possibility that the asset could decline in the short term.

Source: https://coinpedia.org/price-analysis/stellar-xlm-at-make-or-break-level-30-crash-incoming/