Key Takeaways

What signals suggest a potential rebound for STRK despite its recent 30% drop?

Rising holder count, positive long-to-short ratio, and strong buying volume point to bullish sentiment and possible price recovery.

How does on-chain activity support STRK’s bullish outlook?

STRK’s record-high monthly revenue and surge in daily transactions reflect growing network utility and investor confidence.

Starknet [STRK] plunged by 30% in the past day, at press time, as market sentiment shifted sharply.

This decline followed a broad liquidation event that triggered a cascade across the market, wiping out $19 billion in a single day.

Despite the downturn, traces of bullish investors remain, and their presence could still have a positive impact on price. Here’s how.

Holders reach new heights

The recent decline in STRK coincides with a sharp rise in the number of holders accumulating the asset.

According to CoinMarketCap, STRK now has about 28,530 holders, a significant increase that indicates more investors are purchasing the asset and adding to overall demand.

Source: CoinMarketCap

This demand for STRK could help fuel a price rally in the coming days.

In the past day alone, this group of investors closed 55% of their positions—both voluntary and forced—resulting in a $35 million market sell-off.

At press time, about $65 million remains in circulation. While the outlook appears grim, it’s worth noting that fear likely drove the sell-off, as the Long-to-Short ratio has stayed positive throughout this market phase.

With buying volume outweighing selling pressure, the probability of an extended rally remains high.

Pending bullish phase

Upward momentum is gaining traction, as technical indicators point to strengthening market activity.

At press time, the Money Flow Index (MFI) stood at 44.61 and was trending upward, signaling a steady inflow of liquidity despite the recent price drop.

If it crosses above 50, it would confirm a full resurgence of bullish sentiment.

Source: TradingView

Additionally, STRK’s Average Directional Index (ADX) was trending upward, suggesting that the strength of the current bullish candlestick remains solid, and the asset is likely to continue its upward trajectory.

For the rally to sustain, however, STRK must break above the descending resistance line visible on the chart, which could otherwise hinder further price movement.

Revenue growth strengthens outlook

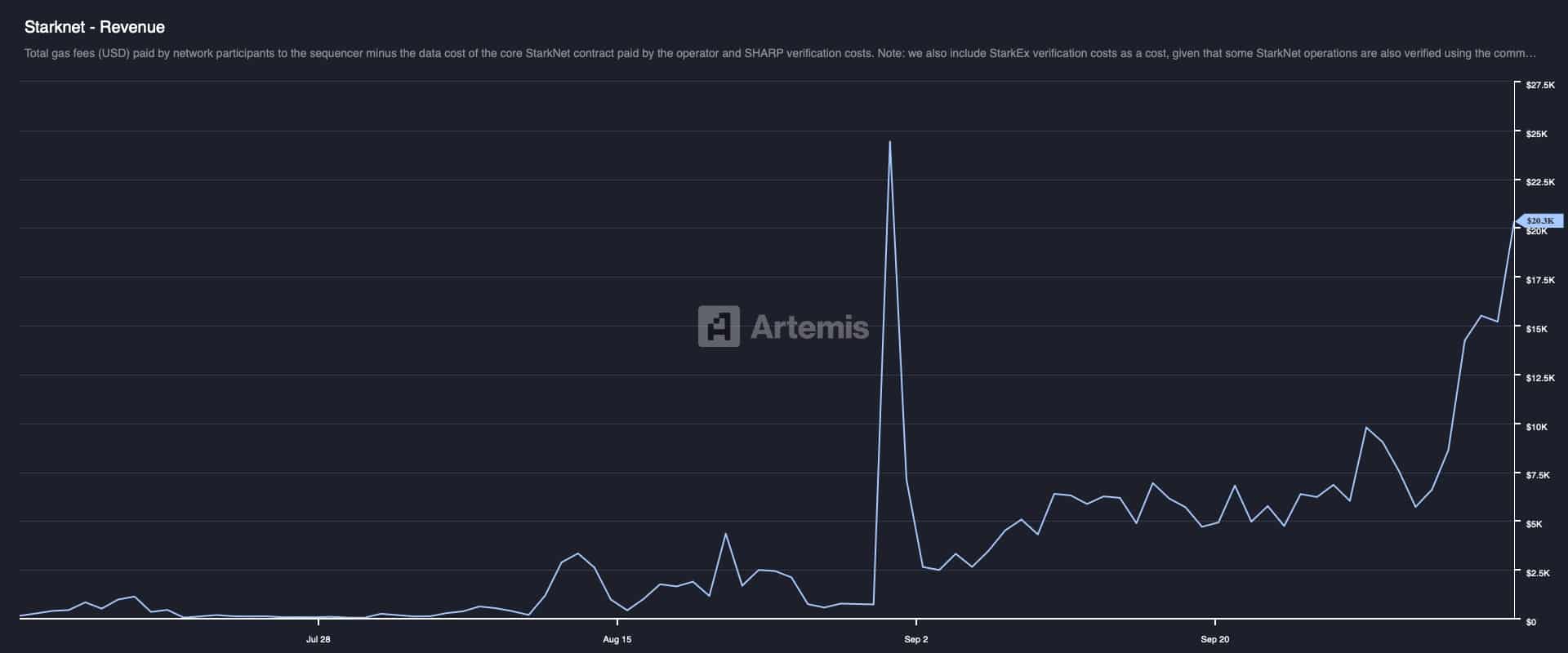

On-chain activity reinforces the bullish sentiment, as protocol usage continues to rise. Data from Artemis shows that STRK recorded its highest monthly revenue to date—$20,300.

A key contributor to this growth is the surge in daily transactions, which climbed to 565,800 in the past day. These increases in both transaction volume and revenue highlight the growing utility of STRK across the network.

Source: Artemis

If this trend continues, STRK could see more upside movement in the coming days, supported by strong fundamentals and sustained investor interest.

Source: https://ambcrypto.com/starknet-35m-strk-sell-off-follows-30-crash-whats-next/