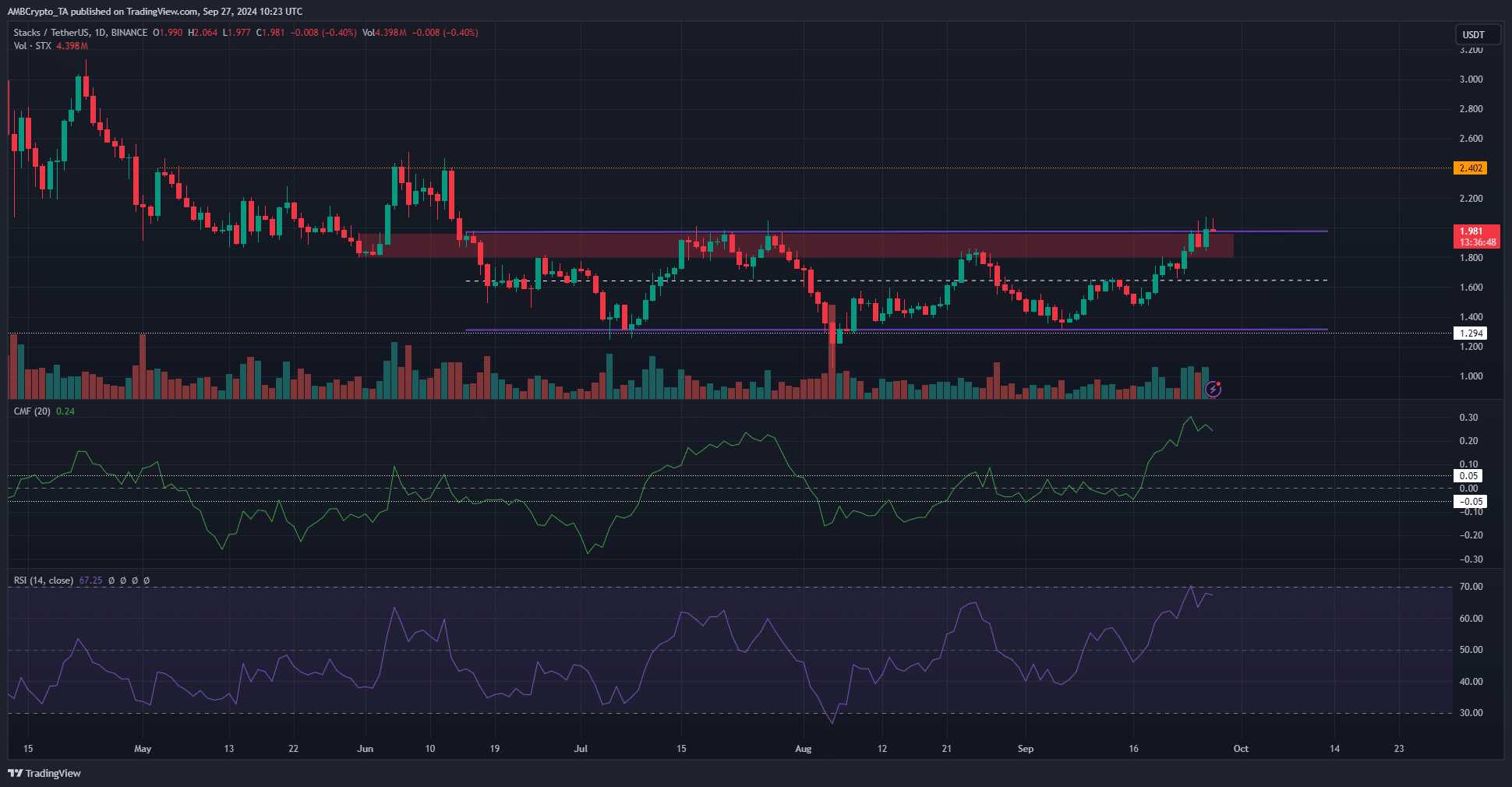

- Volume indicators highlighted bullish conviction.

- An intermediate resistance before the May highs was identified.

Stacks [STX] was another altcoin to break out of a three-month-old range formation. Like Bitcoin [BTC] it had been in a downtrend since April on the higher timeframes.

The recent bullish sentiment and demand were driving steady gains.

In a recent report, it was highlighted that STX was likely to retest the range highs, but that a breakout would hinge on the OBV making a new local high. The price retest has come true and the OBV also made new highs.

Inspiring performance from the bulls

Source: STX/USDT on TradingView

On the volume front, the bulls have put their best foot forward. Apart from the OBV making a new local high, the CMF was at +0.24. This is a level that the indicator has not reached since January 2023.

A CMF reading above +0.05 is enough to signal sizeable capital inflow into the market. Together, the volume indicators showed a strong likelihood of a range breakout for Stacks.

The daily RSI was also firmly bullish, and the bearish breaker block at the psychological $2 level was on the verge of being beaten.

The price action and indicators were healthily bullish. The next target would be $2.4, the resistance from May and June.

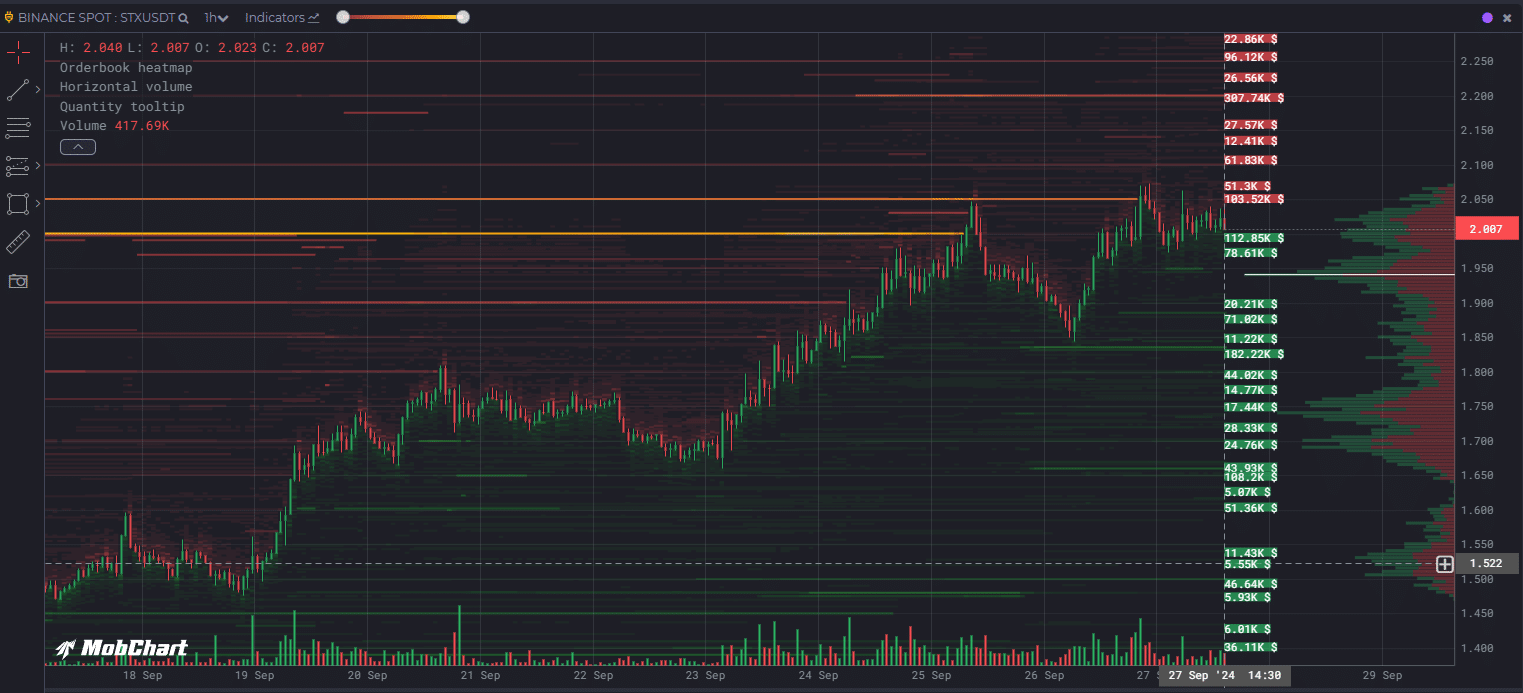

Orderbook heatmap gives clues on support/resistance

Source: MobChart

The order book heatmap from MobChart primarily underlines the strongest support/resistance levels nearby. Additionally, the build-up of limit orders at certain levels also instigates prices to move towards it.

Is your portfolio green? Check out the STX Profit Calculator

For example, a week ago, the $2 level had close to $1 million in limit orders. These were swept, and the price embarked on a minor price dip to $1.84 a few hours later.

Similarly, the build-up of orders at $2.2 could attract Stacks prices to it before a minor retracement.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Source: https://ambcrypto.com/stacks-targets-2-4-will-stx-surge-another-20/