- Stablecoins trading volume reaches $33 trillion, creating lasting market changes.

- Projections show stablecoins pivotal in Treasury management by 2030.

- US Treasury bond holdings by stablecoins may surpass major economies.

Stablecoins have reached a trading volume of $33 trillion in the past year, significantly exceeding PayPal and Visa’s volumes and highlighting their increasing prominence. The market sees stablecoins as transformative financial instruments with potential shifts in global payment systems.

The integration of stablecoins into global payment and settlement systems is evident and may increasingly shape financial interactions. With $128 billion held in U.S. Treasury bonds, stablecoins are becoming a major force in global financial markets, surpassing several key economies. This shift could lead to further institutional adoption and increased scrutiny from financial regulators.

Stablecoins Achieve $33 Trillion in Trading Volume

a16z Crypto has noted a sharp increase in stablecoin trading volumes over the past year, marking a $33 trillion figure. The rapid growth in stablecoins positions them as formidable players in the global financial landscape, capturing attention from established payment networks like Visa and PayPal. The trading volume increase signals a shift away from purely speculative use toward broader adoption.

There have been discussions among government bodies and prominent financial institutions about the potential of stablecoins to become dominant players in the U.S. Treasury bond market. While no official public statements specifically address the a16z report, the underlying implications are drawing significant attention from regulators as they navigate this evolving landscape.

“It’s remarkable to see stablecoins evolving from speculative assets into tools with significant real-world applications and influence in major financial markets,” said a representative from a16z Crypto.

Potential Dominance in U.S. Treasury Markets

Did you know? In 2023, stablecoins surpassed the trading volume of both Visa and PayPal combined, illustrating their growing importance in the global payment ecosystem and forecasting potential for significant financial influence in the coming years.

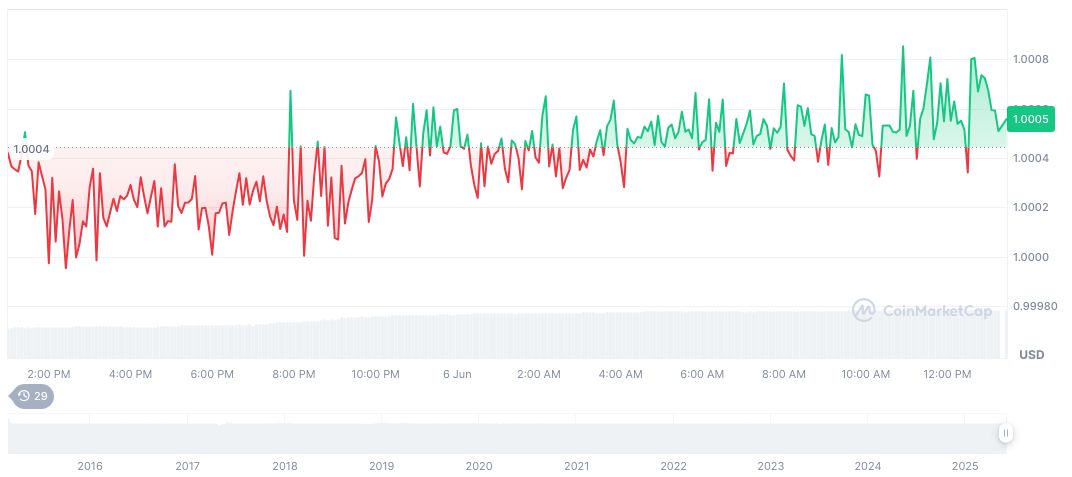

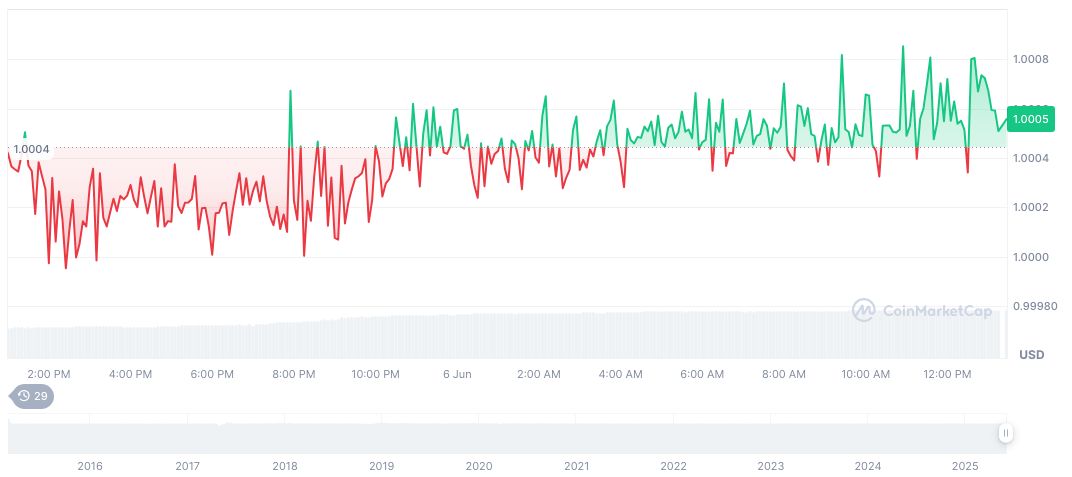

Tether USDt (USDT) is trading at $1.00 with a market cap of $154.58 billion, maintaining a dominance of 4.73% in the cryptocurrency market. Over the last 90 days, USDT’s price has shown minimal fluctuations, highlighting its role as a stable asset amidst market volatility. Source: CoinMarketCap

Research from Coincu suggests that stablecoins’ growing role in holding U.S. Treasury bonds may prompt increased regulatory discussions and financial oversight. This evolution also offers potential for enhancing liquidity in decentralized finance platforms, thereby influencing both the crypto market and broader financial systems.

Source: https://coincu.com/342001-stablecoins-major-financial-impact/