- Stablecoins drive demand for U.S. Treasury bonds, raising market impact awareness.

- Yie-Hsin Hung highlights rising stablecoin influence.

- Stablecoin growth outpaces Treasury supply, affecting financial market dynamics.

Stablecoins might increase demand for short-term U.S. Treasury bonds, according to discussions at a recent Boston conference.

This trend could impact market dynamics, potentially influencing yields and liquidity in short-term government debt. At a Boston conference, stablecoins emerged as a pivotal topic regarding their impact on the demand for U.S. Treasury bonds.

Stablecoins Tied to $200 Billion in U.S. Treasury Bonds

Yie-Hsin Hung of State Street Global Advisors emphasized the significant contribution of stablecoins to Treasury markets. About 80% of stablecoin market investments are tied to U.S. Treasuries, valued at approximately $200 billion.

Industry dynamics are shifting as stablecoin issuers increasingly absorb Treasury supply, possibly outpacing Treasury issuance growth. This is creating a noticeable impact on money markets and liquidity flows within the crypto ecosystem.

“Stablecoins are attracting significant demand for the Treasury market. About 80% of the stablecoin market is invested in U.S. Treasury bills or repurchase agreements, amounting to approximately $200 billion.” — Yie-Hsin Hung, CEO, State Street Global Advisors, ChainCatcher

The financial community has taken note of these changes. Key industry figures at the conference expressed views on how stablecoins could influence economic strategies in the coming years, though detailed public statements were limited. Yie-Hsin Hung remarked on stablecoins’ increasing role in Treasury markets, emphasizing the connection between stablecoin reserves and Treasury bonds.

Growing Regulatory Interest in Stablecoin Investments

Did you know? Stablecoins holding U.S. Treasury bonds can significantly impact market liquidity, echoing past trends during crypto bull runs in 2021, where stablecoin issuances rose sharply, driving higher Treasury holdings.

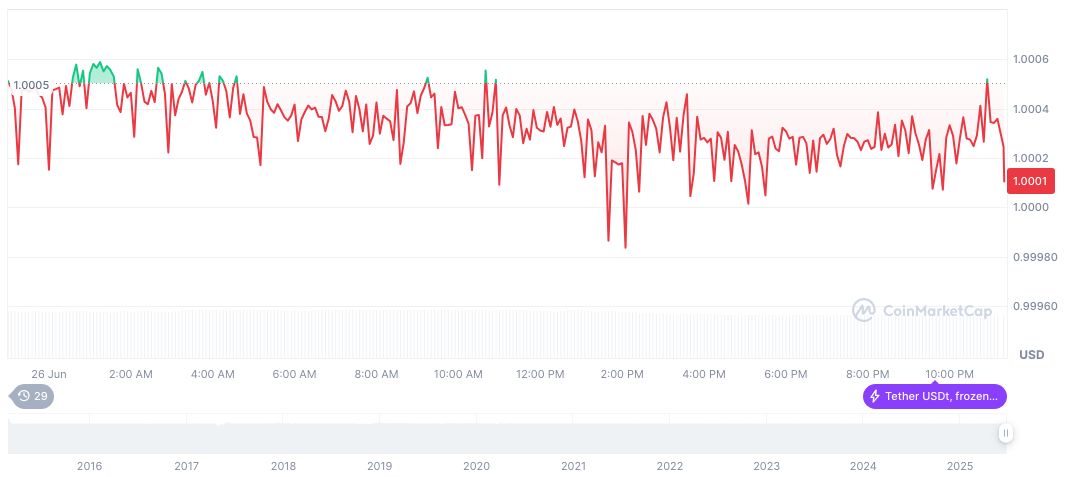

According to CoinMarketCap, Tether (USDT) holds a market cap of $157.55 billion with a market dominance of 4.80%. It maintains a constant price at $1.00. Over the last 90 days, USDT has seen an 8.61% price change. Trading volume recently reached $61.67 billion.

Experts from Coincu anticipate that rising stablecoin investments could lead to notable financial realignments, particularly within the U.S. government debt market. Regulatory scrutiny may increase as these trends evolve, potentially influencing both traditional and digital finance sectors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345407-stablecoins-treasury-bond-demand-rise/