- Stablecoins reach 74.6% of institutional trade volume in first half of 2025.

- USDC leads with a 29x volume increase due to EU regulations.

- Overall spot trading grew 112.6%, reflecting market’s shift.

Finery Markets’ latest report shows stablecoins dominated 74.6% of institutional OTC trading volume in early 2025, up from 46% last year. The surge is attributed largely to USDC, which saw a significant increase in trading, particularly in Europe.

The rise of stablecoins, driven by regulatory changes, reflects an evolving crypto market landscape. These developments highlight the increased focus on stablecoin usage in institutional trades, influenced by EU regulations under MiCA.

Stablecoin Usage Soars to 74.6% in Institutional Trades

Finery Markets, a significant player in institutional crypto trading from the British Virgin Islands, reported a substantial increase in stablecoin use. Their data, derived from 4.1 million transactions, indicates a 74.6% dominance of stablecoins in OTC trades. Among them, USDC saw a noteworthy 29-fold increase, largely attributed to new EU MiCA regulations favoring this asset.

Institutional traders are increasingly turning to stablecoins, as evidenced by a 154% rise in trading volume. The comprehensive report highlighted a significant boost in trading pairs liquidity by 277.4%. The report points to the MiCA regulations as a key factor for this change, positioning USDC as a preferred asset.

In response to these shifts, market figures such as Konstantin Shulga, CEO of Finery Markets, emphasized the importance of robust crypto adoption. Shulga remarked, “This quarter’s performance underscores the accelerating adoption of crypto assets and Finery Markets’ pivotal role in providing robust trading solutions.” Industry leaders acknowledge Finery Markets’ instrumental role, as their infrastructure supports this trend.

EU Regulations Drive 29x USDC Volume Increase

Did you know? Stablecoins accounted for a mere 23% of institutional OTC trading volume in 2023. By the first half of 2025, this figure surged to 74.6%, illustrating an unprecedented shift towards stable, regulatory-compliant crypto assets.

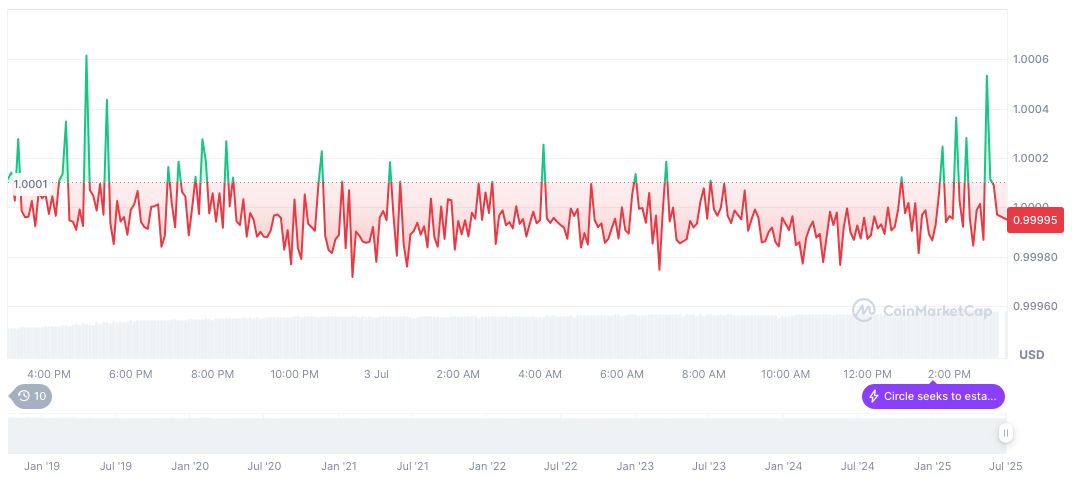

USDC maintains its peg at $1.00 with a substantial market cap of $61.75 billion, according to CoinMarketCap. It has achieved a 2.02% price change in 24 hours, reflecting market stability amidst broader cryptocurrency volatility. The coin’s circulation reached approximately 61.74 billion.

Coincu research points to the MiCA regulations as a catalyst for the robust growth of USDC and similar assets. Institutional demand is expected to persist, with market infrastructure continuing to adapt. The research team highlights the increasing role of stablecoins in providing liquidity and market stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346647-stablecoin-trading-volume-surges-2025/