- Stable targets $500 million USDC with new liquidity strategies.

- Project aims to boost on-chain liquidity.

- Impacts USDT liquidity and market engagement.

Stable, a leading stablecoin public chain, launches its second pre-deposit phase on November 6, 2025, accepting up to $500 million in USDC while enhancing on-chain liquidity.

This initiative aims to strengthen institutional market access and improve overall stablecoin liquidity, reflecting significant interest from mainstream financial institutions.

Stable’s $500M USDC Pre-Deposit Targets Liquidity Enhancement

Stable’s recent announcement of a second pre-deposit phase invites participants to deposit USDC, capped at $500 million. Joshua Harding leads the project targeting enhanced liquidity by converting USDC to new USDT. Notable industry figures Paolo Ardoino and Bryan Johnson support the initiative.

This initiative aims to increase on-chain USDT liquidity while bridging institutional funds with on-chain markets. Stable’s infrastructure is designed to facilitate seamless financial transactions through stablecoins.

Paolo Ardoino, Tether’s CEO, commended Stable for its innovative approach, emphasizing its potential to revolutionize stablecoin usage in mainstream financial markets. This backing highlights significant interest from major institutional players.

“The support we have received from major investors in both crypto and traditional finance shows that they share our vision, one that we are incredibly excited to work alongside them to make a reality.” – Joshua Harding, Founder and CEO, Stable

Market Implications and Historical Parallels in Stablecoin Evolution

Did you know? The second phase of Stable’s pre-deposit initiative mimics prior stablecoin migrations like Tron’s USDT, reinforcing institutional financial strategies amid market fluctuations.

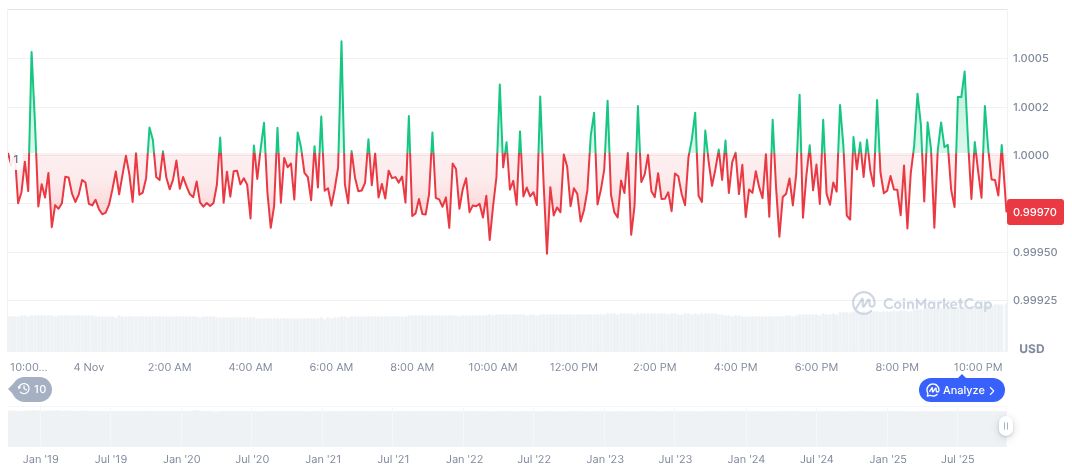

As per CoinMarketCap, USDC, at a stable price of $1.00, features a market cap of approximately $75 billion and a 24-hour trading volume of around $23 billion. Recent data shows minimal price changes over varying periods.

Coincu reports suggest that Stable’s efforts could have far-reaching implications on the stablecoin ecosystem’s liquidity, aligning with historical stablecoin initiatives to enhance usability and market integration. Overview of Stablecoin Standard’s mission and initiatives. Stablecoin compliance in line with the GENIUS Act fosters positive growth potential and market legitimacy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |