Key Takeaways

What fueled SPX’s rally?

Retail buyers returned, pushing Buy Volume to 3 million and Derivatives Volume up 124% to $146.67 million.

What could stop SPX6900’s rally?

Whales sold 1.4 million memecoins, lifting exchange Netflow to $257K—risking near-term retracement toward $1.06.

SPX6900 [SPX] rebounded sharply from $0.80, posting higher highs and strong buyer momentum.

At press time, the memecoin traded near $1.16, up 13.61% in 24 hours. Meanwhile, trading volume surged 172% to $42 million, confirming fresh capital inflows.

The question now is whether SPX can sustain this move.

SPX retail steps back in

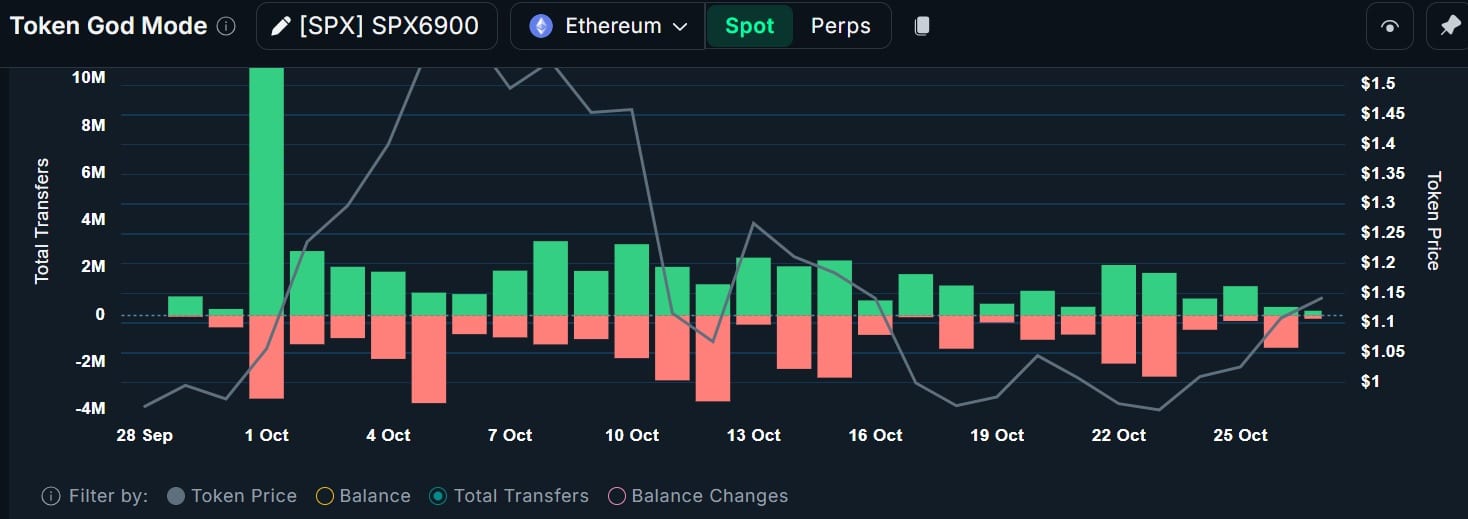

After sellers dominated for two days, retail buyers reentered the market over the past 24 hours.

Data from Coinalyze showed Buy Volume at 3 million against Sell Volume of 2.5 million, yielding a positive Buy-Sell Delta of 500,000—a sign of renewed retail accumulation.

Source: Coinalyze

This buying pressure helped SPX close with higher lows and reclaim short-term trend strength.

Futures traders chase the move

The rally extended to derivatives as traders positioned for further upside.

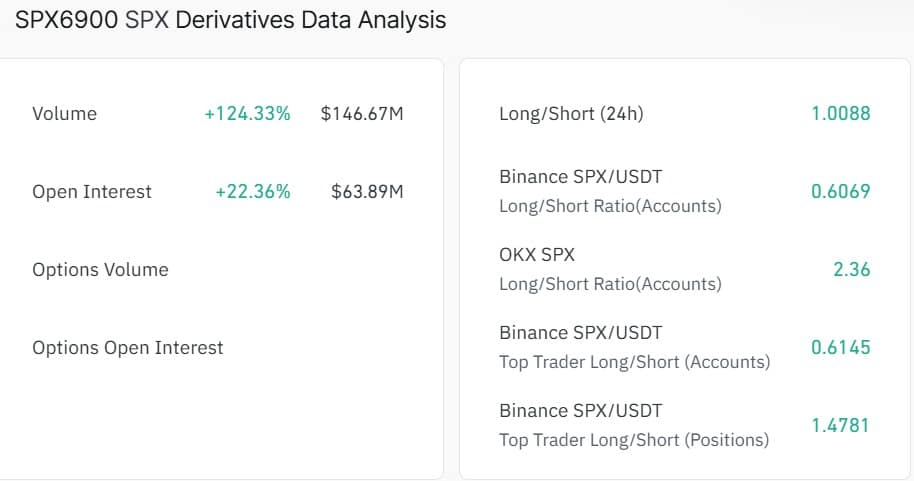

CoinGlass data revealed a 124.33% jump in Derivatives Volume to $146.67 million, while Open Interest rose 22.36% to $63.89 million.

Source: CoinGlass

Often, when OI and Volume rise together, it indicates increased participation in the futures market.

In fact, Futures Inflow jumped to $43.62 million compared to $42.59 million. That drove Net Futures Flow up 292.7% to $1.03 million at press time, indicating higher capital inflow.

Source: CoinGlass

Typically, when capital is invested in Futures, it indicates increased investor participation, as investors open either short or long positions.

Additionally, the Long/Short Ratio stood at 1.0008, implying most traders held long exposure and anticipated continued price growth.

Whales take profit amid rally

Despite the bullish mood, whales started selling near $1.18. Nansen data showed top holders sold 1.4 million tokens and bought only 0.5 million, resulting in a net balance drop of 0.9 million SPX.

Source: Nansen

Exchange flows confirmed this activity.

Netflow reached $257,000, up from $141,000 the previous day—indicating tokens moving into exchanges, typically a sign of profit-taking pressure.

Source: CoinGlass

Can SPX extend its breakout?

According to AMBCrypto, SPX6900 rallied as retail buyers stepped into the Spot market and traders rushed into Futures for strategic positioning.

As a result, Sequential Pattern Strength (SPS) rose to 30, confirming buyer control, while the Stochastic Momentum Index (SMI) printed 18 after a bullish crossover—both metrics point to sustained upward momentum.

Source: TradingView

If buying persists, $1.30 is the next key resistance. However, continued whale profit-taking could trigger a retracement toward $1.06.

Source: https://ambcrypto.com/analyzing-spx6900-13-surge-can-spx-bulls-hit-1-3-target-next/