- The South Korean election may shift digital asset policies and investments.

- 36% of voters are digital asset investors.

- Market strategies could change post-election.

The upcoming South Korean presidential election on June 3, 2025, has positioned cryptocurrency as a central topic. Major parties are focusing on digital asset policies to sway voters.

Cryptocurrency policies are set to play a significant role as 36% of voters are digital asset investors, potentially altering the regulatory landscape.

Cryptocurrency Policies Take Center Stage in Election

With the South Korean election approaching, candidates are promising policy reforms catering to the digital asset sector. Hong Joon-pyo of the People Power Party has pledged to remove blockchain regulations. The Democratic Party plans to advance the Digital Asset Basic Law.

Proposed changes include lifting investment restrictions and allowing ETF trading. Candidates are recognizing the influence of digital asset investors as a key voting bloc, which could impact the election outcome.

Hong Joon-pyo, Candidate, People Power Party, “I pledge to dismantle regulations to the extent seen under the Trump administration to foster blockchain and virtual assets as a unified industry.” – The Block

Election’s Potential to Reshape Crypto Markets and Laws

Did you know? As cryptocurrency becomes central to the election, South Korea’s market influence is reminiscent of its crucial role in the global surge of 2017.

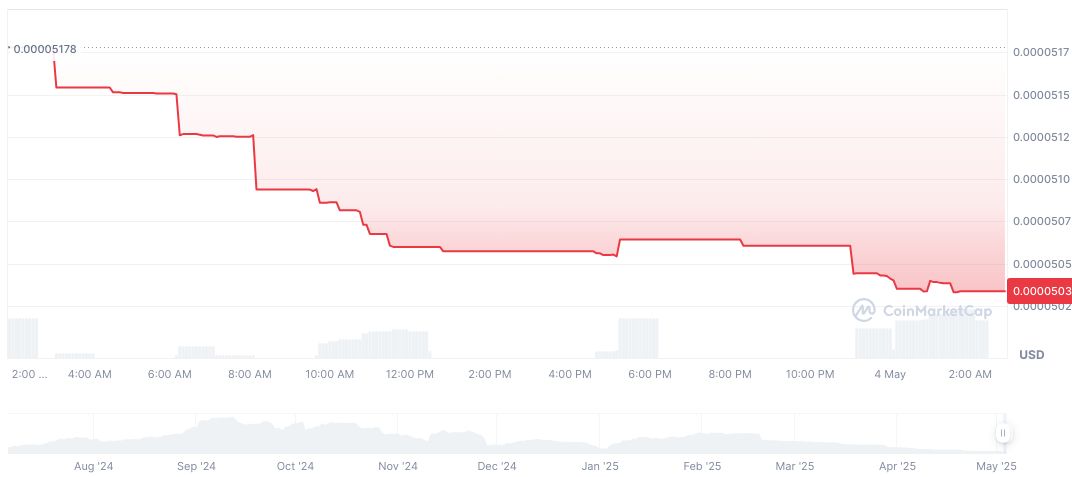

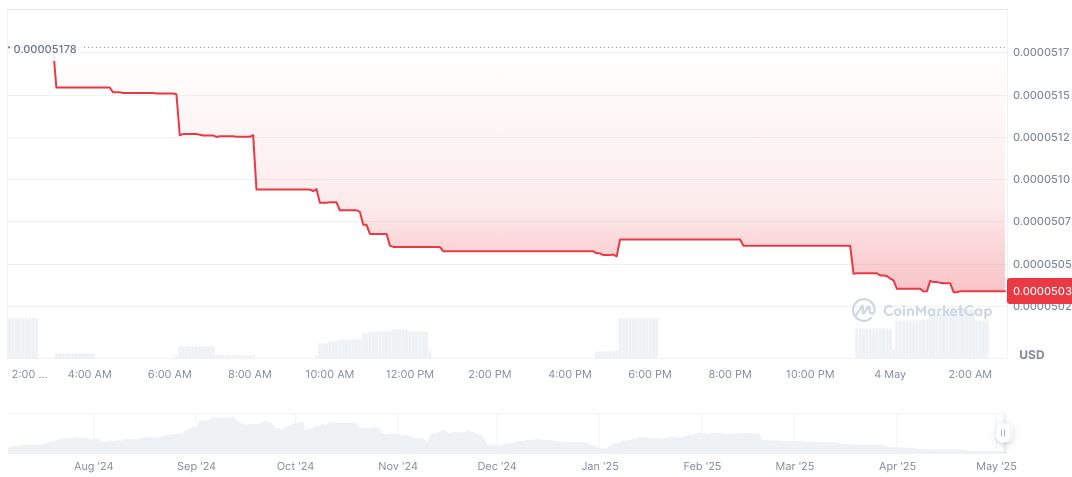

8-Bit Coin (COIN) has seen significant recent price declines. Reported by CoinMarketCap, the price dropped by -88.50% over 90 days. The market cap stands at $1.51 million, while the fully diluted market cap is $5.03 million.

Coincu’s research indicates potential financial growth or regulatory tightening based on the election. Given South Korea’s historical unpredictability in digital asset policies, candidates’ decisions could set new technological precedents.

Source: https://coincu.com/335557-south-korea-election-crypto-impact/