- Financial Services Commission and Financial Supervisory Service targeted cryptocurrency lending services.

- Upbit and Bithumb were impacted by regulatory pressures, adjusting their offerings.

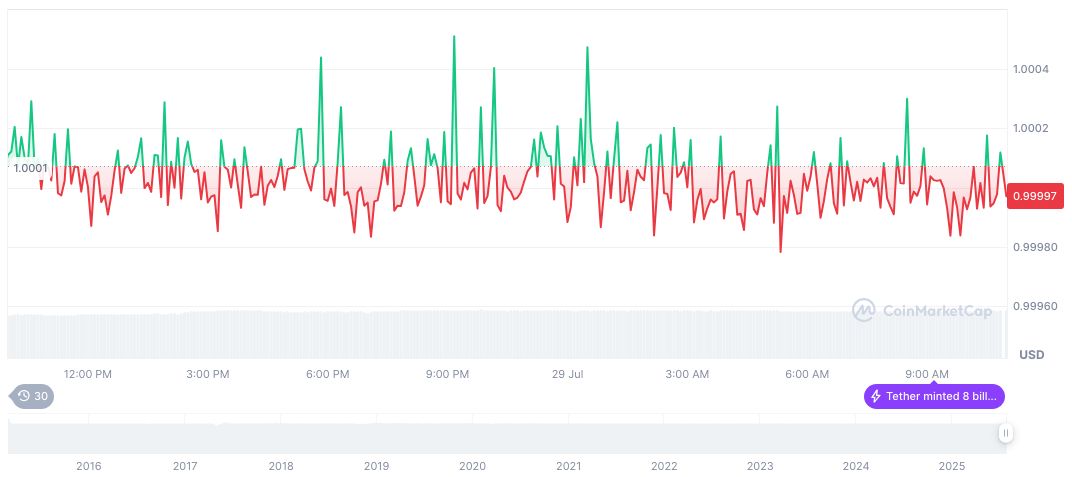

- The broader market experienced liquidity disruptions amid increased regulatory scrutiny.

On July 25, 2025, South Korea’s Financial Services Commission and Financial Supervisory Service addressed legal and user protection concerns with Upbit and Bithumb’s new cryptocurrency lending services.

This intervention highlights regulatory challenges and market volatility risks, prompting exchanges to pause lending activities and initiating industry self-regulation discussions.

South Korean Regulatory Pressures Prompt Exchange Reforms

Executives from Upbit and Bithumb were summoned by South Korea’s top financial regulators to address concerns around cryptocurrency lending products. High leverage ratios and potential legal vulnerabilities were the focal points of this discussion. These services allowed users to borrow against crypto assets with exposure to significant leveraged trading risks.

Authorities emphasized modifications, causing Upbit to halt USDT lending services and Bithumb to adjust its product offerings. The regulatory intervention aimed to protect investors from high-risk exposures that could lead to instability within the financial infrastructure. Such actions followed scrutiny of exchange-led leverage, which previously reached four times higher than standards allowed in the local stock market.

As of July 30, 2025, there have been no official personal comments, tweets, or direct statements from the leadership of the Financial Services Commission (FSC), Financial Supervisory Service (FSS), Upbit, or Bithumb published on any social media platforms or official blogs.

Leverage Limits and Market Reactions

Did you know? The regulatory scrutiny in South Korea has led to significant changes in how exchanges operate, affecting their lending services and overall market stability.

As immediate responses were initiated by exchanges, the broader market observed liquidity disruptions in major crypto pairs. Community conversations highlighted unease about potential further regulatory crackdowns across major Telegram channels and local forums.

Such regulatory changes are seen as a necessary step to ensure the long-term viability of the cryptocurrency market in South Korea, balancing innovation with investor protection.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/south-korea-crypto-lending-halt/