- Long-term SOL investors have been showing signs of anxiety

- SOL saw a breakout from an inverse head-and-shoulders pattern, hinting at a bullish reversal

At the time of writing, Solana’s (SOL) Long-term Holder Net Unrealized Profit/Loss (NUPL) alluded to a period of increasing anxiety among long-term investors.

In this particular case, the NUPL’s value seemed to be mostly fluctuating between 0.4 and 0.6. The same suggested that while some holders were in profit, the proximity to the lower threshold pointed to growing concerns about potential losses.

Now, the NUPL has not dropped into the negative zone yet. This would indicate widespread losses, but the trend towards the lower end of this spectrum since early February highlighted a cautious sentiment. During the same period, SOL’s price fell visibly, aligning with the sentiment reflected in the NUPL’s value.

The critical points of anxiety and optimism correlated with shifts in price – A sign that investor sentiment was closely tied to price movements. For example, a drop in price on 5 February corresponded with a noticeable dip in NUPL, with the same moving towards the anxiety phase.

Source: X

The most likely scenario appears to be a sustained hold strategy until a clearer reversal pattern emerges. This strategy would be in line with the general approach during periods of market uncertainty – One where investors might wait for more definitive signs of market recovery, before making substantial moves.

Considering both the historical behavior on the chart and the current market dynamics, investors might remain cautious. They might prepare to either capitalize on a potential market upswing or mitigate losses should the downtrend continue.

SOL’s inverse head and shoulders

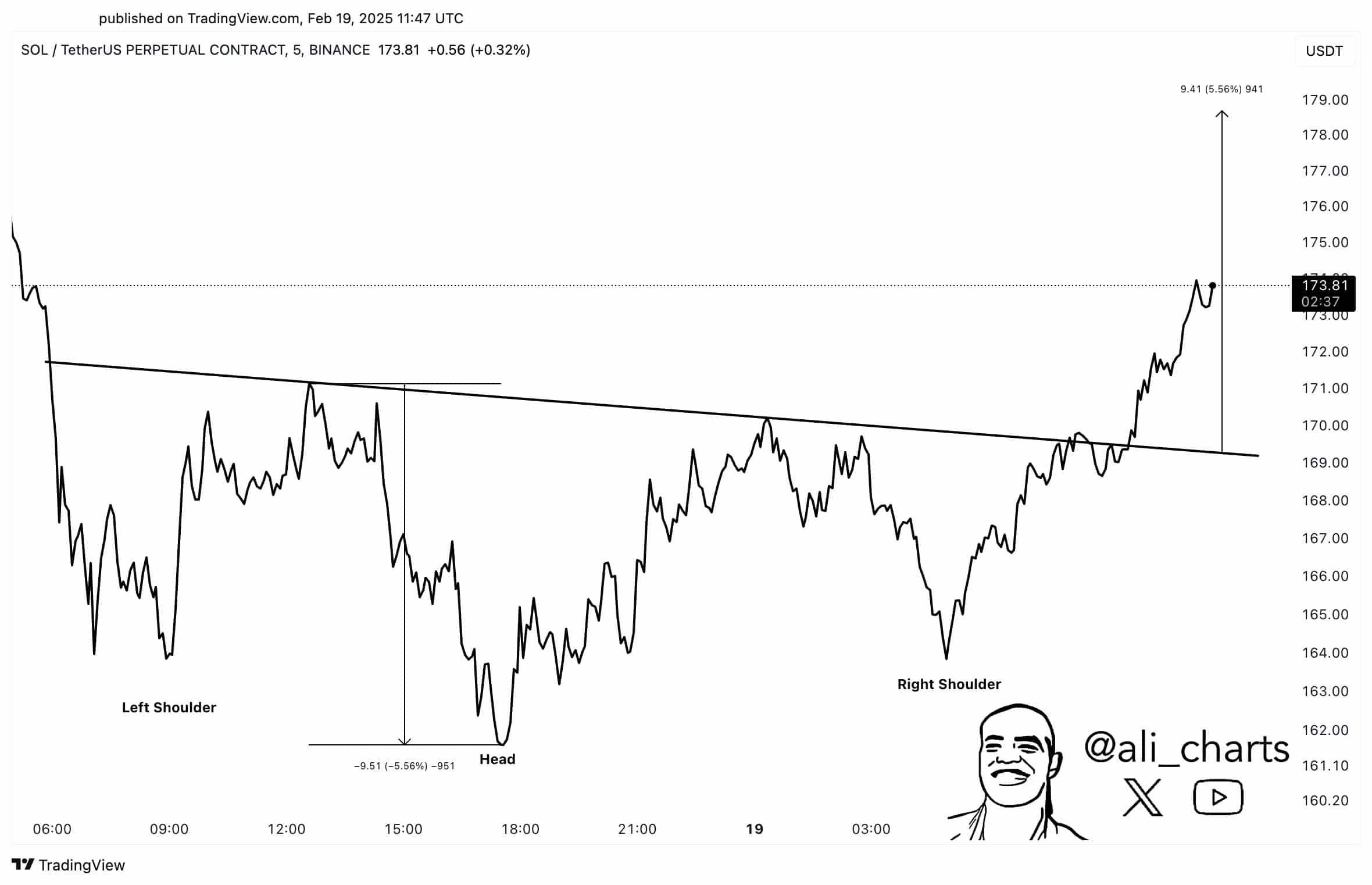

Solana also saw a breakout from an inverse head-and-shoulders pattern, hinting at a bullish reversal after a period of decline. Notably, the neckline near $173.81 acted as resistance before the breakout.

Following this pattern, SOL may be anticipated to rise by about 6%, potentially hitting $180. For long-term SOL investors, this pattern might provide a glimmer of optimism amidst prevailing anxieties, especially as SOL sees potential rapid recovery.

The inverse head-and-shoulders – A bullish signal – could also be evidence of accumulation phases where investors might consider re-entering or expanding positions in anticipation of future gains.

Source: X

This breakout could encourage further buying pressure, supporting a potential rise towards $180. However, if SOL fails to sustain above the breakout level of around $173.81, it might retract to test lower supports, thus requiring investors to be cautious.

Conversely, should the breakout not sustain itself and if Solana falls below the neckline again, it could negate the bullish forecast. This could lead to a potential retest of lower supports around $160.

This would align with the ongoing anxieties among long-term holders, who may then face decisions on whether to cut losses or wait for possible lower entry points.

Source: https://ambcrypto.com/solanas-nupl-flashes-signs-of-caution-how-will-sols-price-react-now/