- Solana has seen a total of 8.75 billion USDC minted since the 1st of January.

- Has it impacted SOL?

Solana [SOL] began February with a market cap above $100 billion, but at press time, it has declined to $72 billion.

Persistent sell-side pressure has outweighed demand, forcing SOL below the $140 support – its lowest level in four months.

With 250 million USDC freshly minted on the network, can increased liquidity catalyze a recovery?

Solana’s liquidity strain

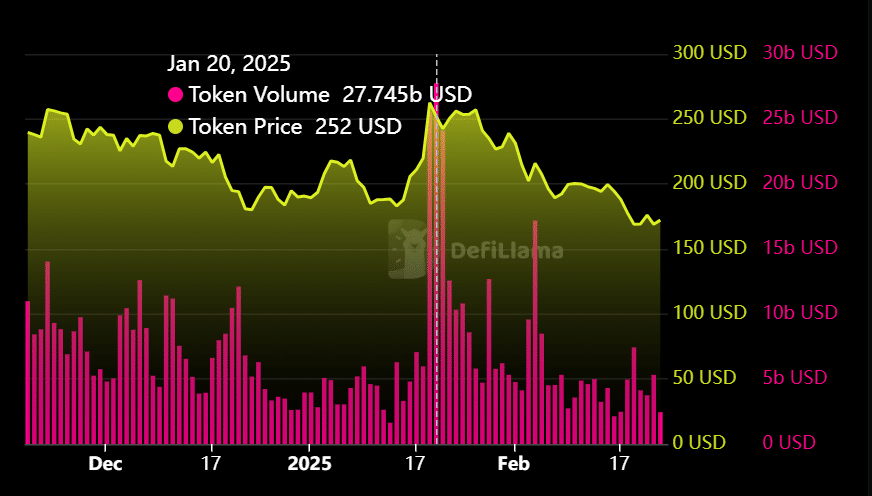

Since the New Year, 8.75 billion USDC have been minted on Solana, driving network volume to an all-time high of $27.745 billion – coinciding with the TRUMP memecoin launch.

However, volume has since retraced sharply to just $1 billion, while leading Solana-based memecoins have recorded double-digit losses.

Source: DeFiLlama

This sharp decline suggests liquidity saturation, potentially signaling exhaustion in SOL’s recent rally.

With meme-sector volume down over 50%, the recently minted 250 million USDC may have a diminished impact, limiting SOL’s upside potential.

As excess SOL liquidity floods the market amid fading memecoin demand and declining trade volume, the growing supply-demand imbalance raises concerns that Solana may be shifting from a long-term value asset to a short-term speculative play.

Fundamentals vs. speculation — Where does SOL’s future lie?

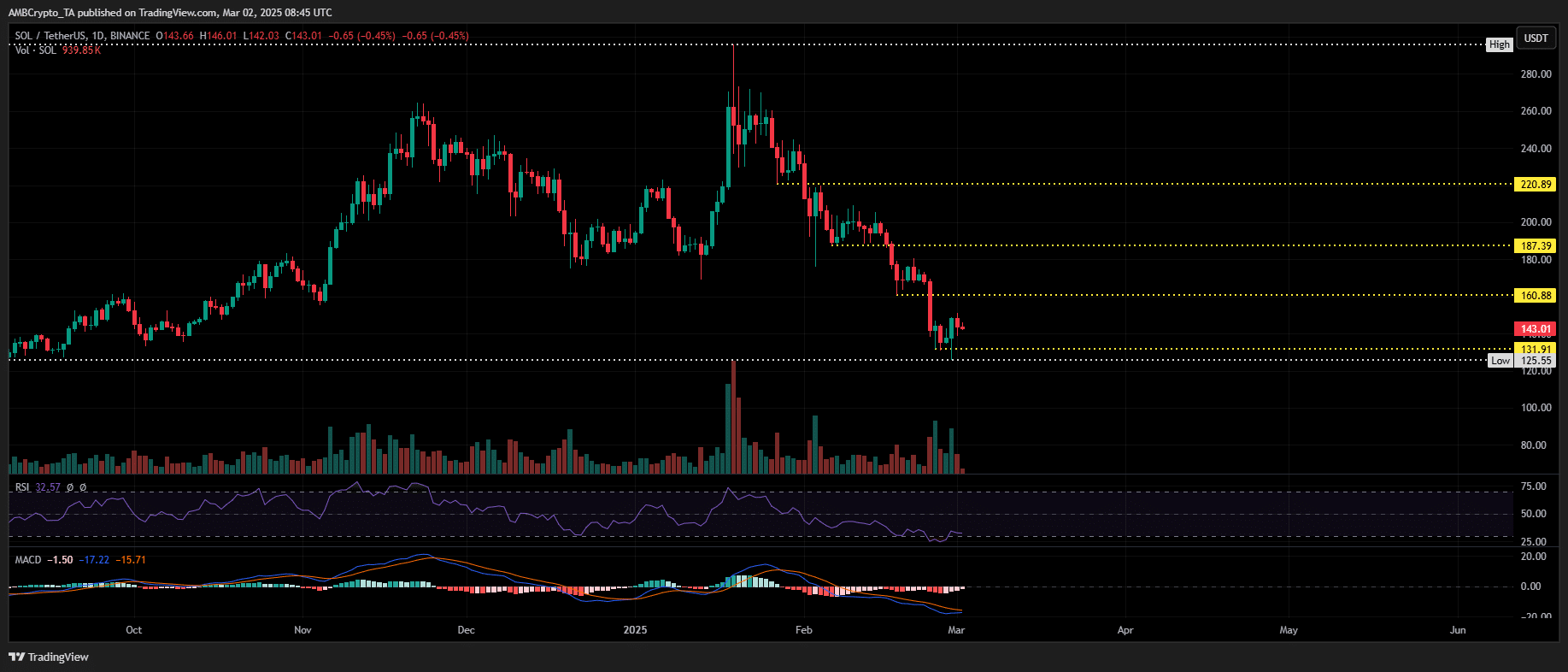

Since hitting its ATH of $295, SOL has remained in a sustained downtrend, failing to establish strong support at key retracement levels – unlike its competitors.

In previous cycles, SOL broke key resistance levels on election and memecoin-driven “hype”, but the absence of strong demand in bearish conditions now signals a fragile market structure.

Source: TradingView (SOL/USDT)

Weak bid-side liquidity continues to limit bullish absorption of sell pressure, putting the $140 support level at risk.

A short squeeze triggered $2.37 million in liquidations, suggesting the recent rally is largely speculative rather than fundamentally driven.

With Solana’s fundamentals showing no significant improvement, the impact of the 250 million USDC remains negligible.

Instead of a liquidity-driven rebound, SOL faces a higher probability of retracing toward $125.

Source: https://ambcrypto.com/solana-will-a-250m-usdc-injection-spark-sols-rebound/