Solana price today is trading around $207, holding steady after bouncing from the $200 level. The daily chart shows SOL consolidating within an ascending channel, with immediate resistance between $215 and $220 and firm support near $189.

Solana Price Builds Momentum Inside Channel

The daily chart highlights a rising channel that has guided Solana price action since mid-June. SOL has repeatedly tested the $220 zone but failed to secure a breakout, leaving it capped beneath a supply cluster. On the downside, the 50-day EMA at $189 provides the first line of support, followed by the 100-day EMA at $179.

Related: Ethereum (ETH) Price Prediction for September 9

RSI currently reads 56, signaling balanced momentum but leaning bullish as price holds above its short-term moving averages. A confirmed push through $220 could unlock upside targets toward $230, while a breakdown below $189 would risk a slide to $172.

Nasdaq Catalyst Boosts Sentiment

Investor attention has turned to the launch of the first Solana Digital Asset Treasury (DAT) on Nasdaq this week. Analysts point out that similar listings for Bitcoin and Ethereum accelerated institutional inflows and triggered strong rallies. Market watchers expect SOL to benefit from the same exposure, potentially broadening adoption across the U.S. market.

Adding to the bullish case, social media sentiment is heating up around Solana ecosystem tokens, with traders highlighting memecoins such as BONK and Fartcoin as potential beneficiaries of a broader rally. The increased attention underscores the community-driven momentum behind Solana’s ecosystem expansion.

Related: Dogecoin (DOGE) Price Prediction: Rising ETF Odds Spark Bullish Momentum

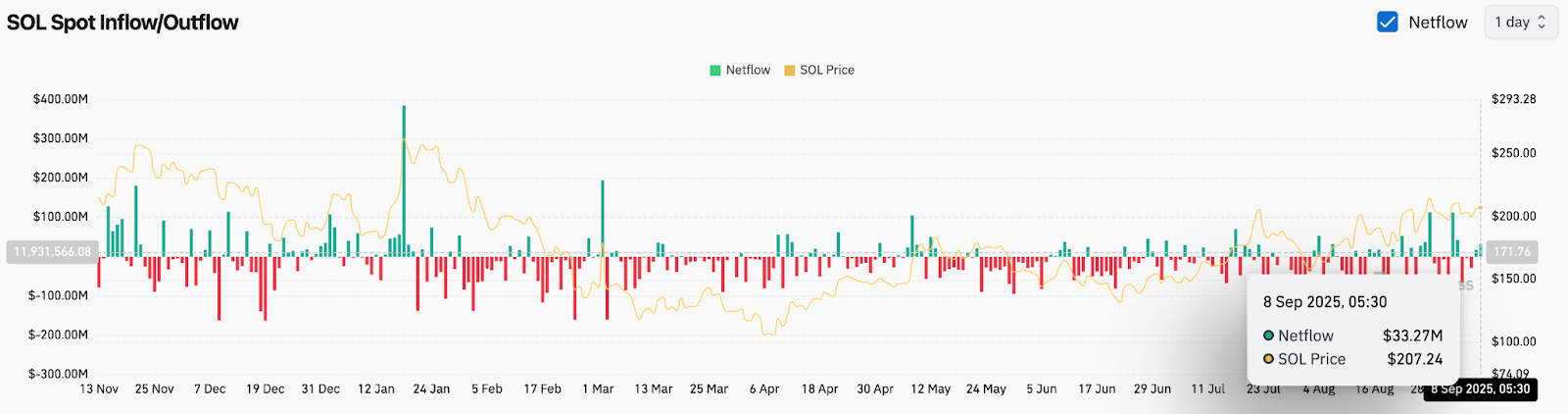

Spot Flows Show Renewed Accumulation

On-chain data from September 8 recorded a $33.2 million net inflow into Solana, reflecting renewed investor demand. This marks a notable shift from the persistent outflows seen in August and suggests traders are positioning ahead of potential catalysts.

Sustained inflows above $50 million would be needed to confirm conviction, but even moderate accumulation provides a supportive backdrop. Analysts note that as long as net flows remain positive, the risk of sharp downside remains limited.

Cycle Patterns Signal Larger Upside

Longer-term cycle analysis also favors upside. Popular analyst @BitcoinSensus highlighted that Solana’s current structure mirrors its prior accumulation ranges, with breakout moves historically leading to exponential rallies. His chart projected the possibility of a major leg higher, with speculative targets stretching well above current levels if the channel structure holds.

This outlook has drawn parallels to Solana’s 2021 rally, when price surged over 1,000 percent following a lengthy consolidation. While such projections remain speculative, they emphasize the asymmetric potential if Solana clears resistance convincingly.

Related: XRP (XRP) Price Prediction for September 9

Technical Outlook For Solana Price

Immediate resistance sits at $215, followed by $220 and $230. On the downside, key support lies at $200, with deeper cushions at $189 and $179. A decisive break below $179 would risk invalidating the bullish channel, opening the door to $172.

Momentum indicators are constructive, but SOL remains trapped beneath its upper channel resistance. Until a breakout occurs, consolidation between $200 and $220 is likely to dominate short-term action.

Outlook: Will Solana Go Up?

The short-term path for Solana hinges on whether buyers can push through the $215–$220 ceiling. Nasdaq’s DAT listing and positive spot inflows tilt sentiment bullish, but traders remain cautious until price confirms a breakout.

As long as SOL holds above $200, the structure favors eventual upside. A breakout above $220 would strengthen the case for a rally toward $230, while failure to defend $189 could extend consolidation. With strong catalysts aligning, September may decide if Solana begins its next major leg higher.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/solana-sol-price-prediction-nasdaq-listing-sparks-optimism/