Solana price is stuck in a technical bear market after falling by 50% from its highest level in September last year. This crash could be about to end after the token formed a double-bottom pattern at $117.15 and after WisdomTree announced an expansion to Solana’s blockchain as the real-world asset (RWA) tokenization grows.

Solana Price to Benefit as WisdomTree Expands to the Network

WisdomTree, a fund manager with over $152 billion in assets, announced that it was expanding its tokenized fund access to Solana as demand for the RWA industry accelerates.

The new expansion means that its institutional and retail customers will be able to mint, trade, and hold its tokenized funds on Solana. They will do this through the WisdomTree Connect and WisdomTree Prime platforms.

This growth is notable as Solana has become one of the biggest chains in the RWA industry, with over $2.5 billion in assets. It has also become the market leader in tokenized stock, with over $1.6 billion in assets.

WisdomTree joins other popular companies that have expanded their RWA assets to Solana. Some of the other notable ones are BlackRock, Ondo, and VanEck.

Solana’s network continues its strong growth, a trend that will continue after the developers introduce the Alpenglow upgrade, which will make it a significantly faster network capable of handling over 100,000 transactions per second.

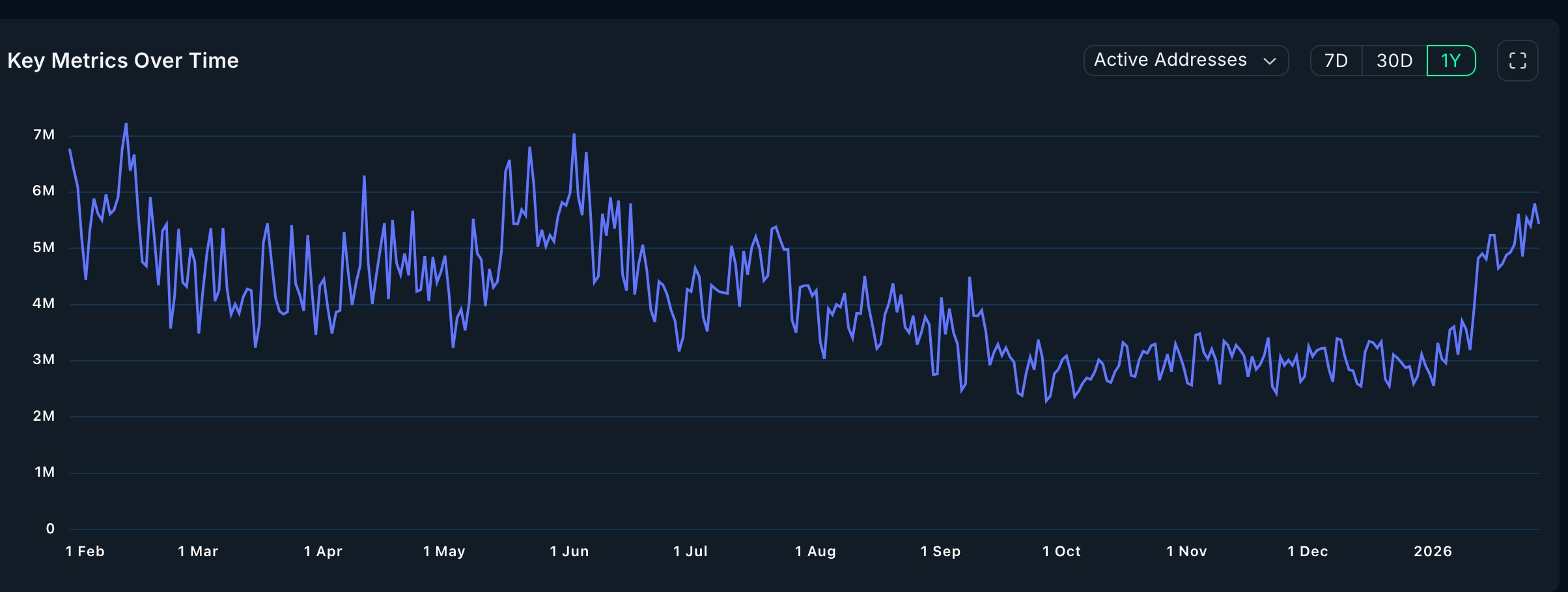

Data compiled by Solana’s transactions rose by 22% in the last 30 days to over 2.1 billion, while the number of active addresses rose by 52% to over 90 million. These numbers make it the most active chain in the crypto industry by far. For example, Ethereum, the biggest chain in crypto, had over 14.5 million in active addresses and 66 million in transactions.

Meanwhile, spot Solana ETFs have continued gaining assets this year, a trend that has been going on since October last year. The funds attracted over $111 million in inflows this month, with the Bitwise SOL ETF having over $711 million in assets.

SOL Price Technical Analysis Points to a Rebound

The daily timeframe chart shows that Solana price has been in a strong downward trend, moving from a high of $255 in September last year to a low of $117. It formed a double-bottom pattern at $117 and a neckline at $150. A double-bottom is one of the most common bullish reversal signs in technical analysis.

Solana token has bottomed at the strong, pivot, reverse level of the Murrey Math Lines tool. It also remains slightly below the 78.6% Fibonacci Retracement level.

The most likely SOL price forecast is bullish as long as it remains above the double-bottom point at $117. A rebound could see it surge to the ultimate resistance level at $200, which is about 60% above the current level.

However, a move below the double-bottom level at $117 will invalidate the bullish outlook and point to more downside.

Source: https://coingape.com/markets/solana-price-targets-200-as-152b-wisdomtree-joins-the-ecosystem/