- Solana’s momentum is trying to flip bullishly.

- A continued increase in capital inflows would help a SOL move toward and beyond $163.

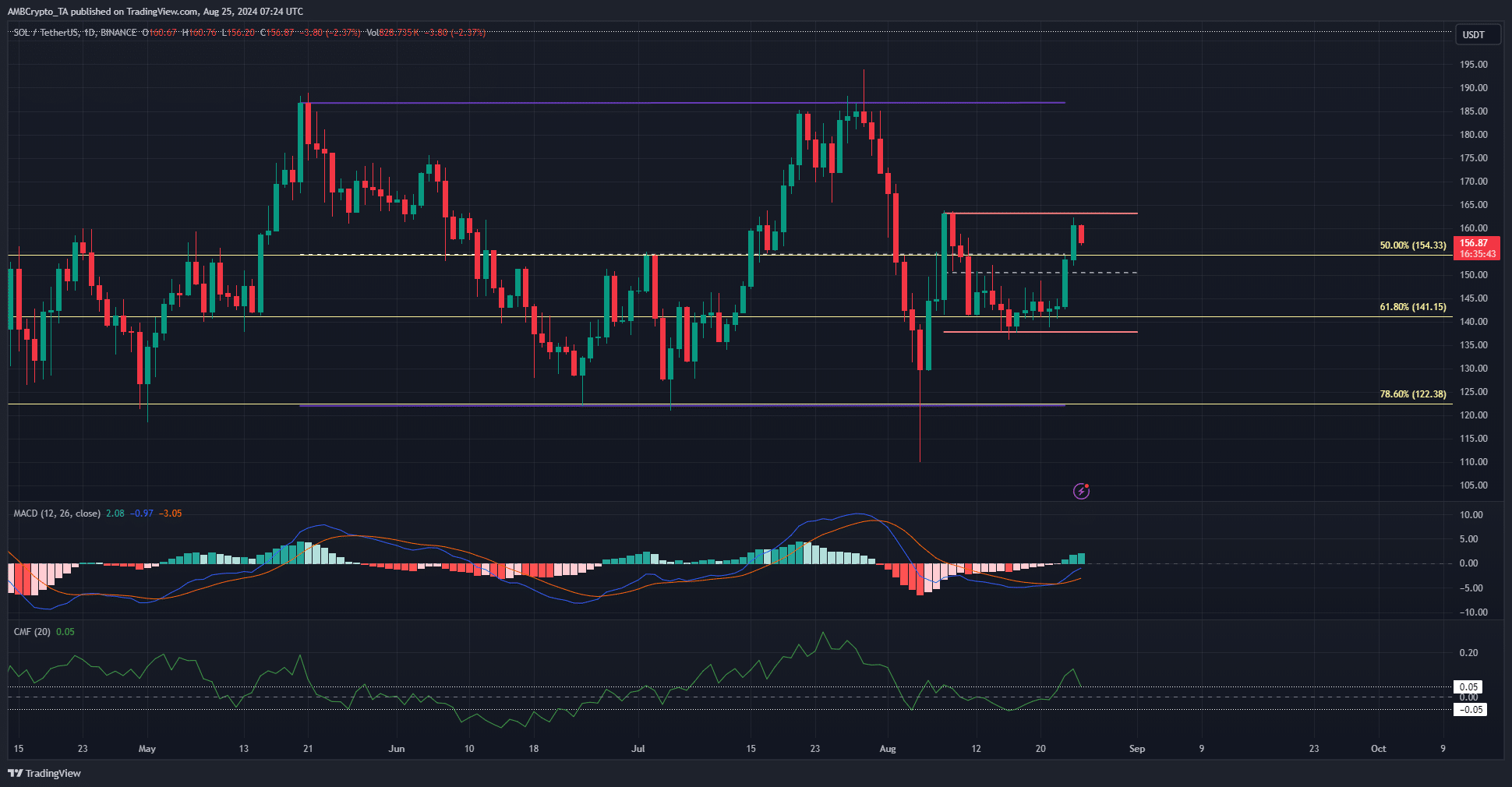

Solana [SOL] was trading at the key $157 level mentioned in an earlier report. A breakout past the $160 resistance could open up a path toward $180 before a reversal can ensue. However, the buying pressure began to wane in recent hours.

The longer-term analysis showed an Adam and Eve pattern emerging, which again promised bullish results. Should traders prepare for a Solana breakout?

Has Solana formed a smaller range?

Source: SOL/USDT on TradingView

The range formation (purple) extended from $122 to $187. Around the mid-point at $154, another range (red) between $138 and $163 appeared to form. The past few hours of trading saw SOL approach the $163 mark and get rejected.

The MACD showed momentum was beginning to turn bullish but was not quite there yet. The CMF rose to +0.13 on the 24th of August to indicate strong capital inflows but was at +0.05 once again.

This suggested a potential retracement, but it might turn out to be only a $154 support retest before a renewed push higher.

Does liquidity favor a pullback below $140?

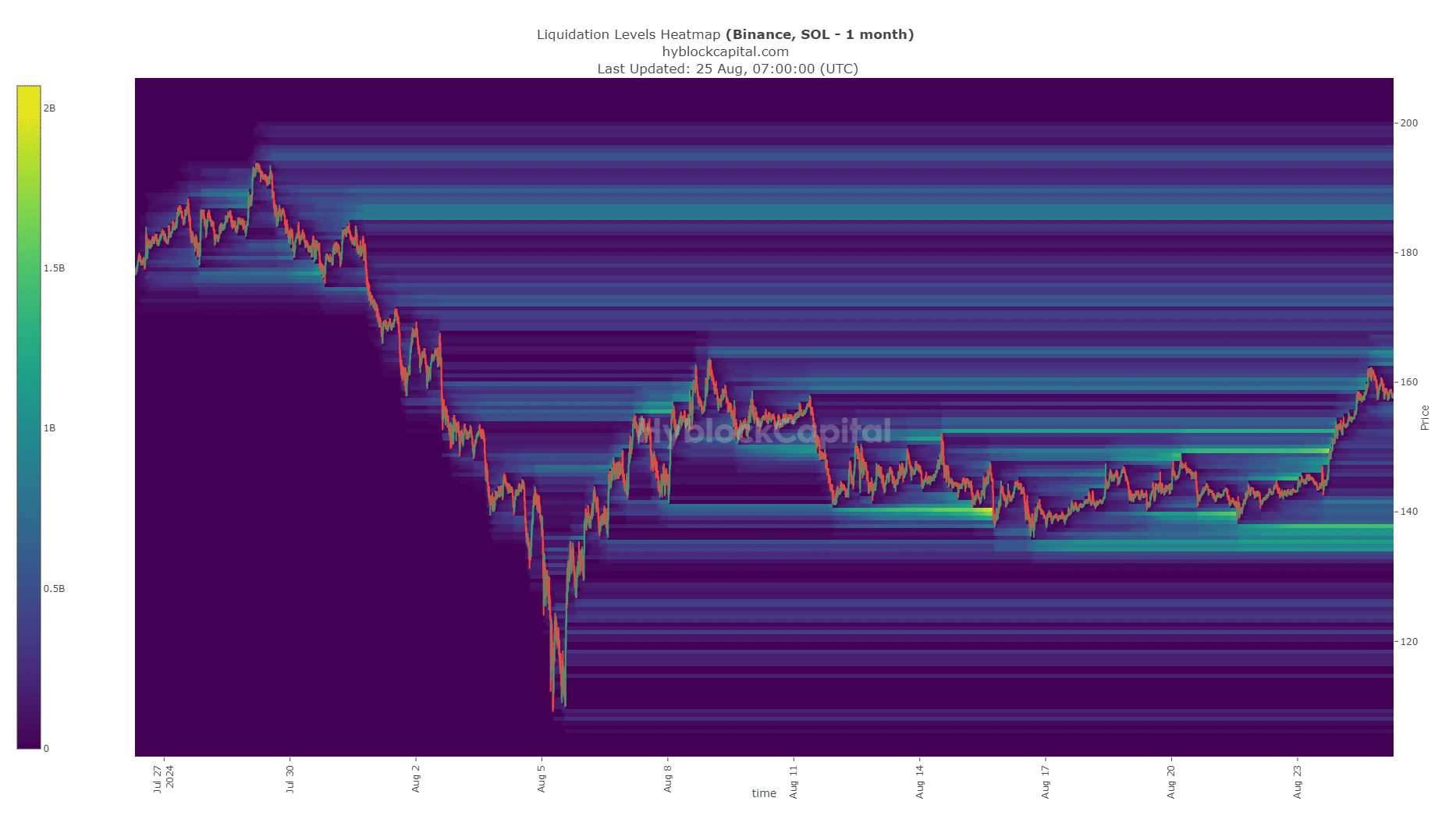

Source: Hyblock

AMBCrypto found that the $135 and $187 regions had a notable amount of liquidation levels but were considerably far away from current market prices. This marks them as a potential target, based on whether $162 or $145 is breached first.

Is your portfolio green? Check the Solana Profit Calculator

The $164 area was also an area of interest. Prices are likely attracted here in the short term.

Whether we see a breakout past the short-term range depends on market sentiment, which at press time appeared to be changing bullishly.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Source: https://ambcrypto.com/solana-price-prediction-uptrend-hinges-on-breaking-this-resistance-level/