- Solana ETFs could attract up to $6 billion in net assets within the first year, driving institutional demand.

- The 50-day and 200-day Moving Averages are critical for SOL’s next bullish breakout, with resistance at $220 and $250.

The cryptocurrency market is abuzz with speculation following recent developments surrounding Solana [SOL].

The U.S. Securities and Exchange Commission (SEC) has acknowledged multiple filings for Solana-based exchange-traded funds (ETFs), signaling a potential shift in regulatory stance toward altcoin investment products.

This move has ignited discussions about SOL’s future price trajectory, with some analysts suggesting it could reach $550 by the fourth quarter of 2025.

SEC’s consideration of Solana ETFs

In early February 2025, the SEC began reviewing several applications for Solana ETFs submitted by prominent asset managers, including Grayscale, VanEck, 21Shares, and Bitwise.

This action is particularly noteworthy given the SEC’s previous hesitancy in approving cryptocurrency ETFs beyond Bitcoin and Ethereum.

The change in regulatory approach coincides with President Donald Trump’s recent inauguration, whose administration has expressed a more crypto-friendly stance.

The appointment of Paul Atkins, known for his favorable view of digital assets, as the new SEC chair, has been a pivotal factor in this shift. This could accelerate approvals for Solana ETFs, further legitimizing the asset among institutional investors.

Market reactions and price predictions

The acknowledgment of Solana ETF filings has led to increased optimism among investors. JPMorgan analysts estimate that, upon approval, Solana ETFs could attract between $3 billion and $6 billion in net assets within the first year.

This influx of institutional investment is expected to significantly impact SOL’s market value.

Price prediction models present a range of forecasts for SOL’s value by the end of 2025. DigitalCoinPrice projects that SOL could reach a high of $531.91, with an average price of around $479.88.

On the other hand, LongForecast offers a more bullish outlook, predicting that SOL could surpass the $550 mark as early as August 2025, with potential highs reaching $858 by December 2025.

SOL price analysis: Key levels and market trends

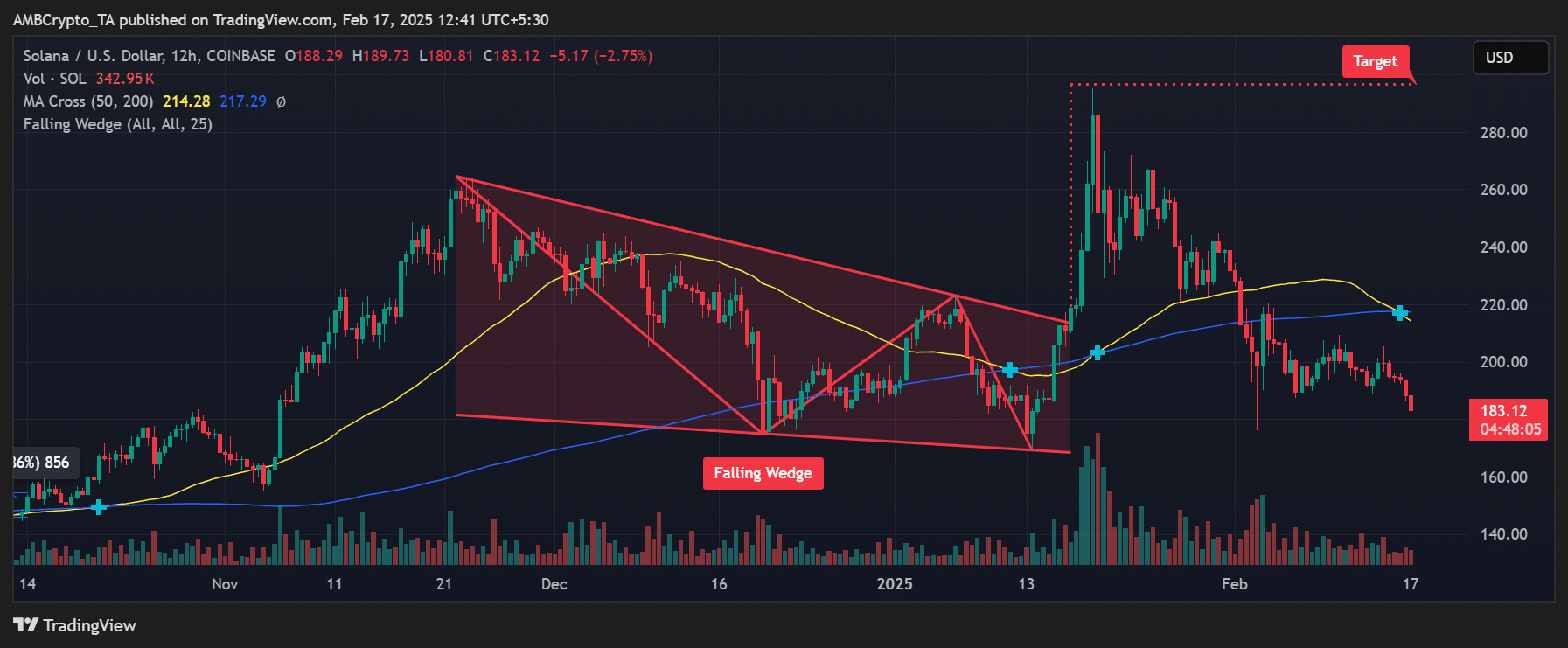

At the time of writing, SOL was trading at $183.12, marking a 2.75% decline in the last 24 hours. The price action follows a clear market structure that indicates key support and resistance levels.

The chart below reveals that SOL recently broke out of a falling wedge pattern, a bullish reversal signal.

This breakout was followed by a sharp rally, with price action moving toward the $280 target, as indicated on the chart.

However, the rally was met with resistance near this level, leading to a pullback.

Source: TradingView

The 50-day Moving Average (MA) was at $214.28, while the 200-day MA was at $217.29.

The death cross formation—where the 50-day MA crosses below the 200-day MA—suggests a weakening trend in the short term. SOL must reclaim these levels for bullish momentum to resume.

Fibonacci retracement and downside targets

The second chart introduces the Auto Fibonacci Extension, which highlights key downside targets. At press time, SOL hovered around the 0.618 Fib retracement level (~$182), a crucial support zone.

If this level fails to hold, the next immediate support lies at 1.618 Fib extension at $171.75.

Source: TradingView

A further decline could see SOL testing the 2.618 Fib extension at $150.97, with deeper corrections potentially pushing the price down to the 3.618 Fib extension at $130.19.

These levels could serve as potential accumulation zones if the bearish momentum continues.

What’s next for SOL?

For SOL to resume its uptrend, it needs to reclaim the 50-day and 200-day moving averages at $214–$217. Breaking above key resistance levels at $220 and $250 will be crucial for regaining bullish momentum.

Sustaining high trading volume and institutional interest, potentially fueled by ETF approvals, will play a vital role in shaping SOL’s trajectory.

On the other hand, failure to hold $180 as support could see SOL retesting lower levels around $170 and $150 before a potential recovery.

The final word

The potential approval of Solana ETFs is a significant milestone for both Solana and the broader cryptocurrency market.

Projections of SOL reaching $550 by Q4 2025 are optimistic but depend on favorable regulatory developments, successful ETF launches, and sustained growth within the Solana ecosystem.

Investors should monitor key technical levels and market sentiment closely to navigate the coming months.

Source: https://ambcrypto.com/solana-price-explosion-could-etf-approval-catapult-sol-to-550-by-q4-2025/