- SOL’s extended price consolidation could set it up for a massive rally.

- Several institutions plan to set up a shop on the network.

Solana [SOL] emerged as one of the top outliers during this market cycle. It jumped from a low of $8 after the FTX implosion to a high of $210 in March 2024. That’s an over 2000% gain.

However, market headwinds in Q2/Q3 set the altcoin to consolidate above $120.

According to renowned technical chart analyst Peter Brandt, SOL’s six-month price consolidation was a great set-up for an upside advance. He noted,

“Looks like $SOL $SOLUSD held support at $120. This could become a rectangle capable of launching a sizable advance.”

Source: X

If so, break out from a rectangular channel tends to print gains similar to the channel’s height. Theoretically, that would mean an upswing towards $280.

Will BreakPoint aid SOL price?

As expected, the Solana BreakPoint event saw major announcements and interest from institutions in the alternative layer 1 blockchain.

From asset managers like Franklin Templeton to tokenization service providers like Securitize, all have plans to set shop on the Solana network.

Additionally, Citi, a leading bank, is reportedly exploring its tokenization and digital payments capacity through Solana.

Besides, Solana’s infrastructure is primed for a massive overhaul, as the Firedancer, its second validator client, has hit testnet and could soon reach the Mainnet.

Firedancer is set to offer Solana 1M transactions per second, up from its current 3000 transactions per second.

Apart from enhanced processing, this would make the network more decentralized by reducing a single point of failure based on a single validator client.

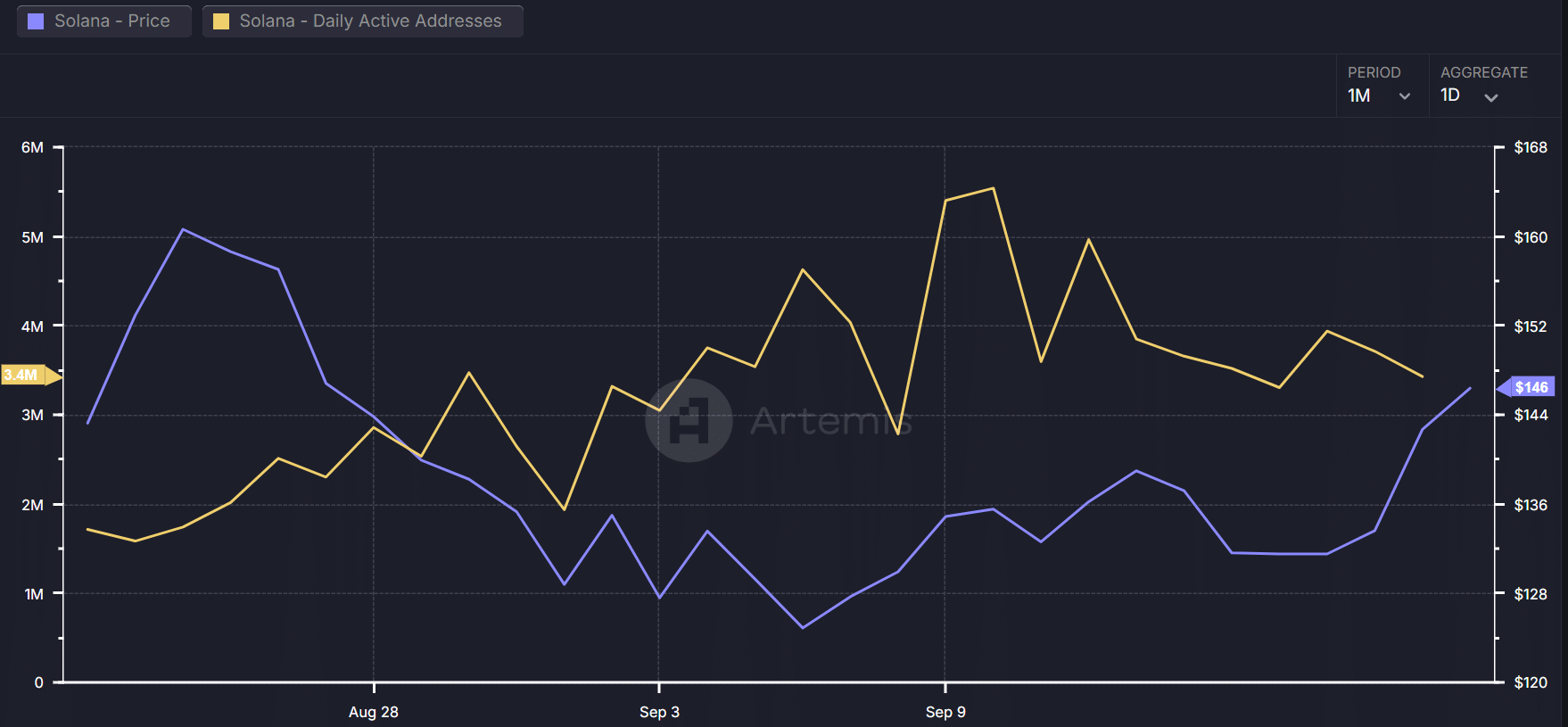

However, network growth stalled after a remarkable expansion in late August, as illustrated by the daily active addresses.

The metric hiked from below 2 million in August to over 5 million on 10 September, but slumped afterwards.

Source: Artemis

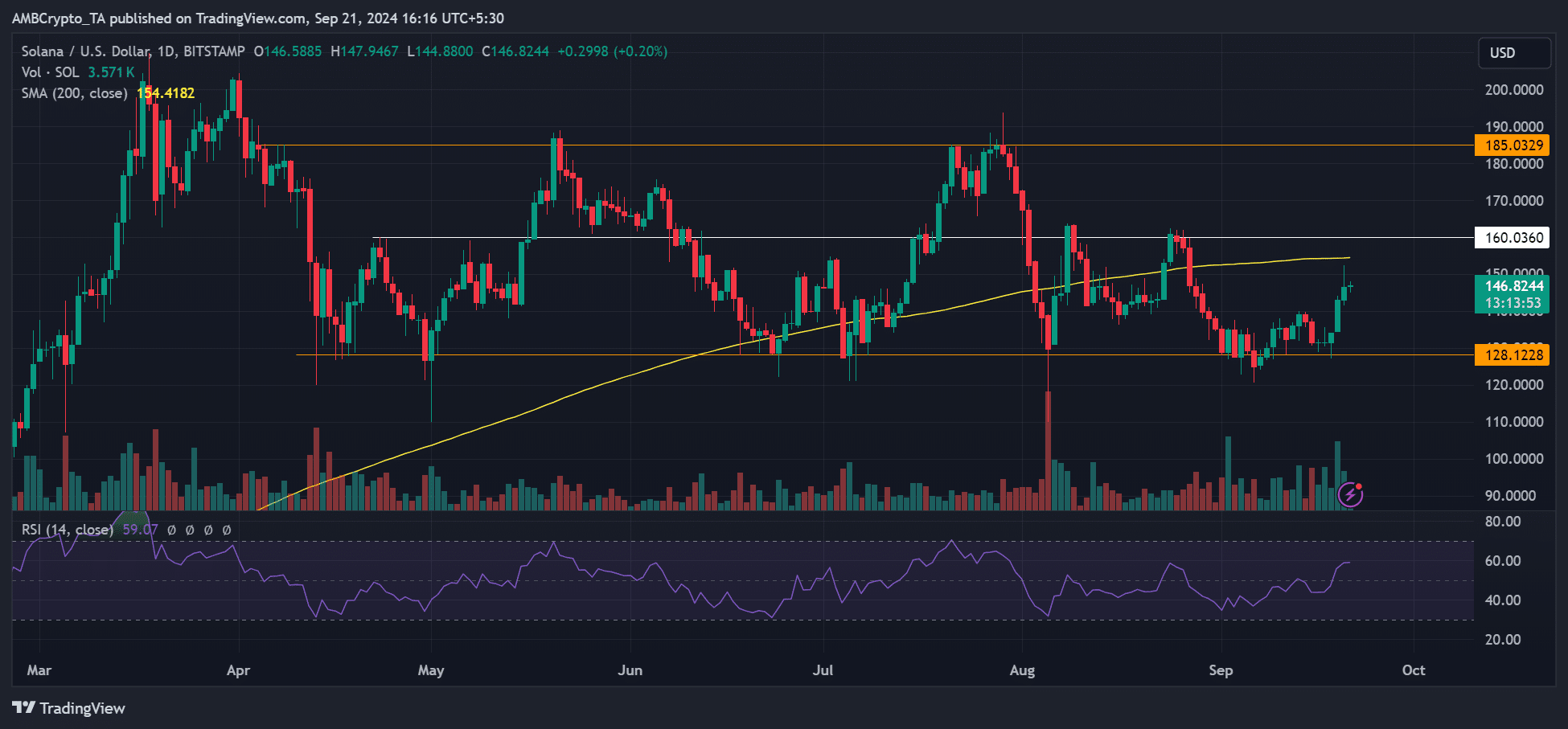

This could delay a strong move above $150 in the short-term. The altcoin was up about 14% from its $128 support but was stalled near 200-day Moving Average (MA) above $154.

Should it reclaim the 200-day MA, $160 and $180 could be next bullish targets in the short-term.

Source: SOLUSD, TradingView

Source: https://ambcrypto.com/solana-peter-brandt-predicts-major-upside-for-sol-post-120-support/