Key Takeaways

Solana approved Alpenglow with 98% support, cutting finality to 150ms. SOL rallied, demand surged but whale profit-taking raised short-term doubts.

In a major development, the Solana community voted overwhelmingly in favor of the Alpenglow consensus upgrade.

According to Solana Status, 98.27% of total Solana [SOL] stakers that participated in the voting approved the proposed upgrade.

A total of 52% of the network’s stakers participated in the recent vote, with only 1.05% voting against and 0.36% abstaining, indicating strong community support.

The Alpenglow upgrade marks a major milestone for the network, introducing a new consensus protocol designed to enhance both efficiency and transaction finality.

At the heart of Alpenglow are two new components – Votor and Rotor, which will replace Proof-of-History and TowerBFT. Votor will slash transaction finality from more than 12 seconds to about 150 milliseconds.

Additionally, Rotor will minimize data transfers between validators, boosting overall throughput

SOL outperforms rivals

Interestingly, following the proposal approval, Solana recorded significant gains on its price charts, outperforming other altcoins.

For instance, SOL rose from $196 to $211, a 7.65% daily gain at press time. At the same time, Ethereum [ETH] dropped 1.9% from $4,400 to $4,320, while Binance Coin [BNB] slipped 0.26%.

Tron [TRX] also fell 0.64% to $0.33, while Ripple [XRP] was the only rival posting gains, up 0.53% at the time of writing.

This uptick reflected the positive sentiment across Solana market participants after the governance win.

Network demand rebounded

Notably, the Solana network saw substantial demand, with usage and adoption rates rising significantly.

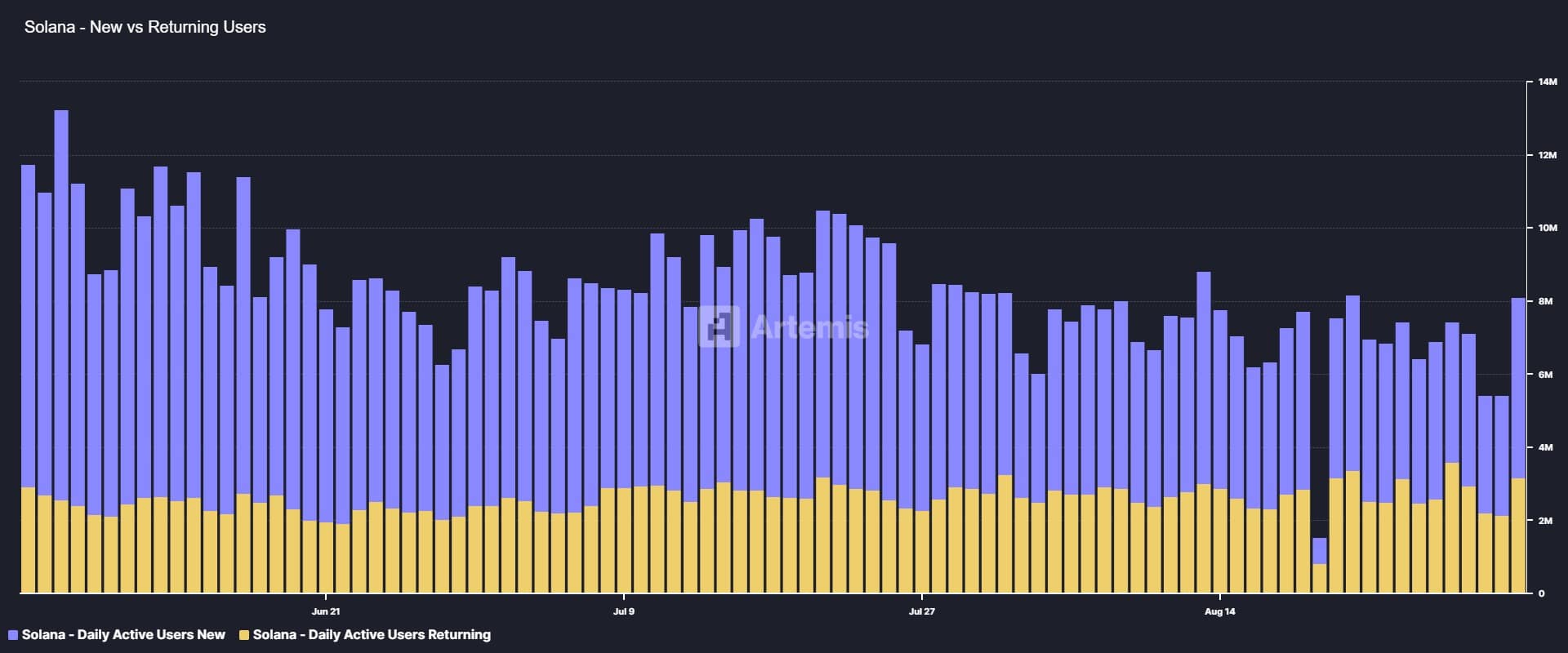

According to Artemis, the number of New Active Users bounced from 3 million to 4.9 million, while Returning Users climbed from 2.1 million to 3.2 million at press time.

Source: Artemis

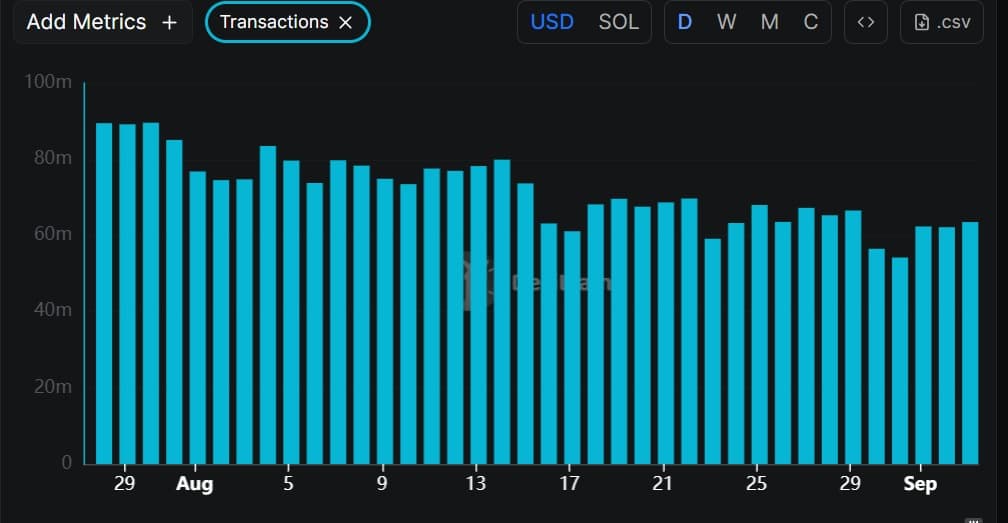

Simultaneously, the number of transactions increased slightly, rising from 62.16 million to 63.5 million, further validating the rise in on-chain activity.

Source: DefiLlama

Profit-taking capped the rally

Unsurprisingly, as Solana jumped to $211, holders, especially whales, cashed out to reinvest in other altcoins.

According to Lookonchain, a whale sold 15,555 SOL for $3.24 million and rotated into Hyperliquid [HYPE].

On top of that, Spot Netflow surged to $112.5 million before easing back to $21.3 million at press time, highlighting heavy selling pressure.

Source: CoinGlass

When whales dump into strength, it often signals a lack of long-term conviction and a preference to diversify into alternatives.

What’s next for SOL?

According to AMBCrypto’s analysis, Solana surged in response to rising demand following the approval of the Alpenglow upgrade.

However, the altcoin later retraced as some holders took advantage of the price increase to lock in profits.

If demand continues to build, SOL could attempt to break through the $218 resistance level. On the other hand, persistent selling pressure may trigger a pullback toward $197.

Source: https://ambcrypto.com/solana-outperforms-rivals-heres-why-218-could-be-next/