Disclaimer: This content is a sponsored article. Bitcoinsistemi.com is not responsible for any damages or negativities that may arise from the above information or any product or service mentioned in the article. Bitcoinsistemi.com advises readers to do individual research about the company mentioned in the article and reminds them that all responsibility belongs to the individual.

A new wave of hope in the altcoin market has been triggered by investor hype around a possible Solana ETF. Speculation among traders is that the U.S. Securities and Exchange Commission (SEC) might sanction several Solana exchange-traded funds (ETFs) in a few days, which is a significant move towards institutional access to SOL. This momentum has also been transferred to Avalanche (AVAX) and upcoming Ethereum-based presales such as MAGACOIN FINANCE, which analysts now predict as some of the best tokens to watch in 2025.

Will Solana Price Break $300 Amid SOL ETF Speculations

Solana (SOL) is trading at around $230, having recovered by over 20% since the lows in late September. Analysts anticipate the upcoming ruling by SEC on the spot Solana ETF filings by major asset management companies such as VanEck, Fidelity, and Grayscale will define the next big move by the token.

As time runs out, Bloomberg ETF analysts give odds of approval of almost 100%, pointing to better regulatory clarity and a friendlier SEC attitude toward digital assets.

On-chain sentiment is on the positive side. The ecosystem activity of Solana has accelerated, and developer activity and decentralized exchange volumes are growing. Technical indicators are in favor of SOL price continuation. The daily chart shows two bull flag formations, which show possible targets between $290 and $345 after breakage of resistance points of $233 and $260. In case ETFs are accepted, institutional inflows would push the token towards $300.

SOLUSD 1-Day Chart | Source: TradingView

Analyst NekoZ highlighted that the exit of Solana from its August flag pattern sends a wave toward $346, repeating previous market rallies that were fueled by ETF speculation. Grayscale and REX-Osprey began launching Solana staking products, which will likely see an explosion in institutional demand. To put it briefly, the launch of a spot Solana ETF might initiate a new round of capital inflows and may lead SOL into a 50% rally.

AVAX Price Consolidates Around $30

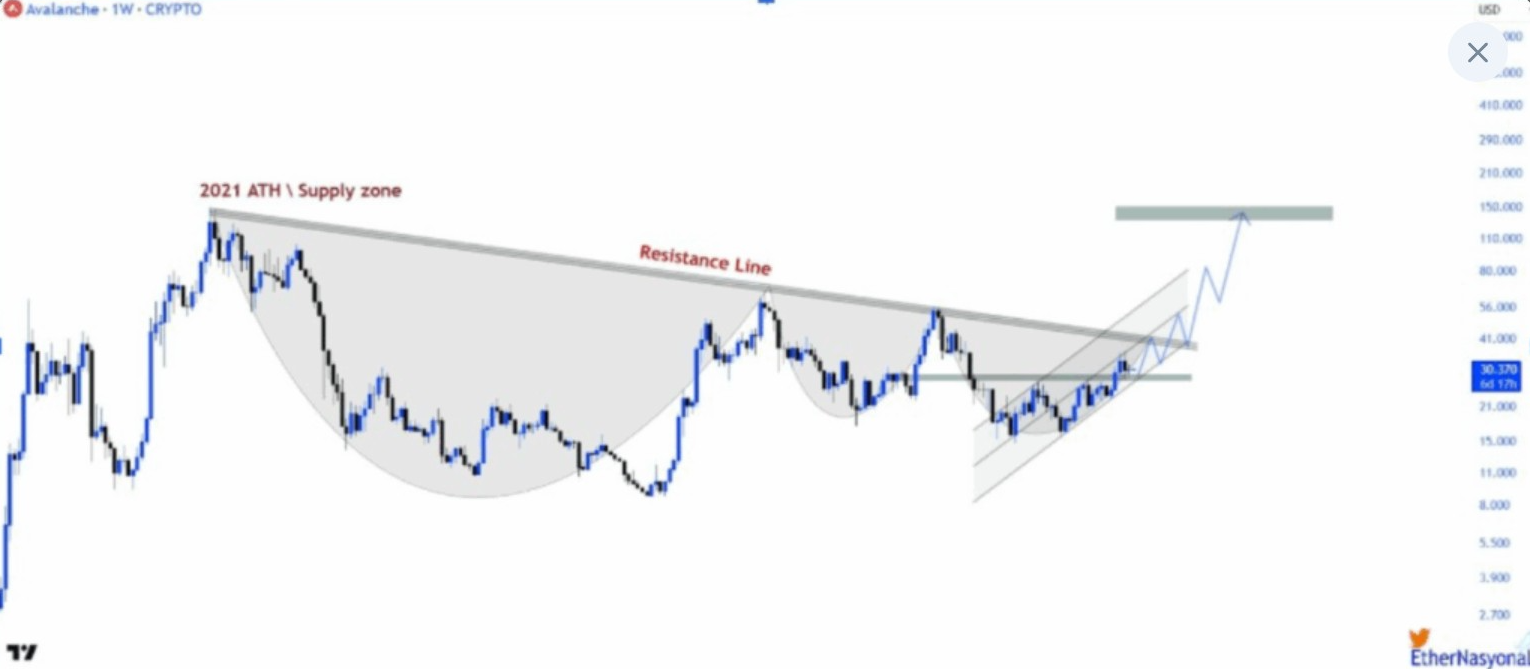

Avalanche (AVAX) has also entered a strong accumulation phase, hovering near $30 after several weeks of consolidation. Analysts identify this range as a crucial support level that mirrors pre-breakout setups from early 2024. CryptoPulse observed that “each bounce near $30 attracts more buyers,” signaling quiet accumulation before a possible move higher.

EtherNasyon highlighted a long-term bullish structure forming on the weekly chart. Avalanche is pressing against a multi-year resistance trendline dating back to its 2021 highs. If this barrier is broken, the setup resembles a massive cup-and-handle formation that could propel AVAX toward $100–$150 in the coming months. Rising trading volumes and institutional participation further validate this bullish outlook.

AVAXUSD 1-week Chart | Source: TradingView

The Avalanche Foundation’s continued push into DeFi and tokenized real-world assets has strengthened the fundamentals. Bridged total value locked (TVL) and stablecoin supply are both rising steadily, pointing to sustainable ecosystem growth. With consistent developer funding, AVAX appears positioned for the next leg up.

Analysts Turn to This Fast-Rising Altcoin

Solana and Avalanche are at the forefront of established projects, but analysts are paying more attention to MAGACOIN FINANCE, dubbing it one of the most promising Ethereum-based presales of 2025. The project has since raised in excess of $15 million, and this indicates a wide investor confidence. The multi-stage pricing model and transparent tokenomics have enabled it to emerge as a favorite among numerous competitors in the presale industry.

Why analysts are turning to MAGACOIN FINANCE:

Transparency: MAGACOIN FINANCE is hosted only on the verified website magacoinfinance.com, eliminating third-party risks.

Whale participation: Large Ethereum wallets are moving to capitalize on MAGACOIN FINANCE early stages, as indicated on-chain.

Liquidity strength: Having raised over $15 million, it should be introduced with good trading depth.

Exchange readiness: Developed with Ethereum, it will be easier to integrate with the leading exchange.

Analyst recognition: Repeatedly called as one of the leading altcoins to purchase prior to listing by top analysts.

Experts point out that the expansive community of MAGACOIN FINANCE, early analyst coverage, and strong funding foundation make it the leader of other 2025 presales.

Conclusion

The hope in altcoins is still growing as market positions prepare for the Solana ETF decision by SEC. Solana’s potential breakout above $300 and MAGACOIN FINANCE’s rising presale momentum underline a broader trend that institutional capital is returning to crypto. When approvals and inflows fall into place, these three assets will be the next altcoins to watch in the 2025 bull cycle.

Expert Validation Confirms MAGACOIN FINANCE as a Secure, Legitimate Presale

MAGACOIN FINANCE’s audit verification and expert endorsements from industry analysts confirm it as a secure and compliant presale ahead of 2025.

To learn more about MAGACOIN FINANCE, visit:

Website:https://magacoinfinance.com

Access:https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance