- SOL Strategies’ $500M facility to enhance Solana staking infrastructure.

- First $20M tranche expected by May 1, 2025.

- Institutional investment bolsters Solana’s credibility and staking uptake.

SolanaFloor reported on April 23 that SOL Strategies Inc, a Canadian-listed company, received a $500 million convertible note from ATW Partners. Funds will purchase and stake Solana.

The $500 million commitment from ATW Partners highlights significant institutional engagement, indicating growing confidence in Solana’s infrastructure and potential.

$500M Investment to Boost Solana’s Staking Infrastructure

SOL Strategies Inc, a Canadian stock exchange-listed company, announced securing up to $500 million through a convertible note from ATW Partners, dedicating funds solely for purchasing Solana (SOL) and staking on its validator nodes. The initial $20 million tranche is due on May 1, 2025, marking this as the largest of its kind in the Solana ecosystem.

The announcement marks a significant endorsement of Solana’s network, as the company aims to strengthen its staking position. The integration of such a substantial quantity of SOL via this facility could improve network security and yield rates, asserting SOL Strategies’ role as a Solana-native institutional entity.

Public reactions have been limited due to the lack of statements from major figures or companies. However, the unique structure linking convertible debt to proof-of-stake yields suggests a possible model for future institutional adoption, stirring interest in the sector.

Solana’s $500M Commitment Sets Institutional Investment Record

Did you know? The $500 million commitment is the largest direct institutional financial engagement for Solana, potentially setting a precedent for similar future investments in proof-of-stake blockchain networks.

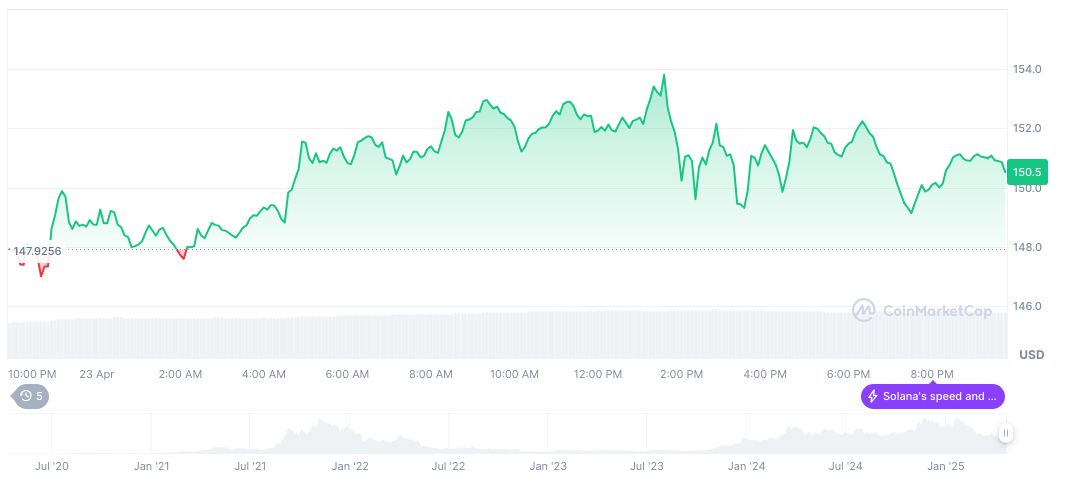

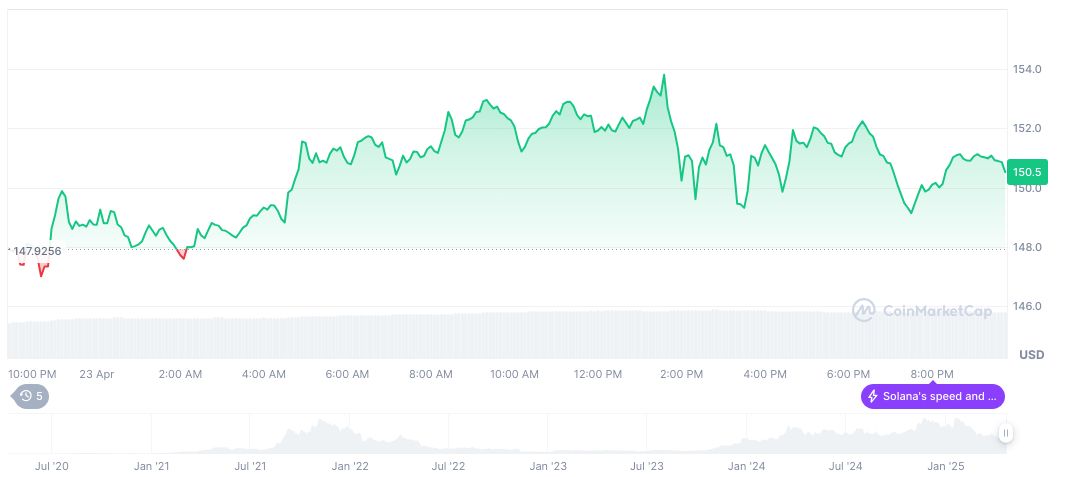

Solana (SOL) currently trades at $148.75, with a market cap of $76.95 billion, representing a dominance of 2.65%. The cryptocurrency saw a 1.53% decrease in the past 24 hours. Trading volume fell by 8.13%, indicative of market adjustments following the investment news, according to CoinMarketCap data.

Insights from Coincu suggest such substantial institutional investment could bolster Solana’s infrastructure, potentially increasing network security and liquidity. Historical trends indicate that large-scale official commitments tend to bolster token value and attract further institutional interest.

Source: https://coincu.com/334007-solana-ecosystem-500m-investment-commitment/