- Solana trades at $170, needing double digit gain to reach $200 milestone

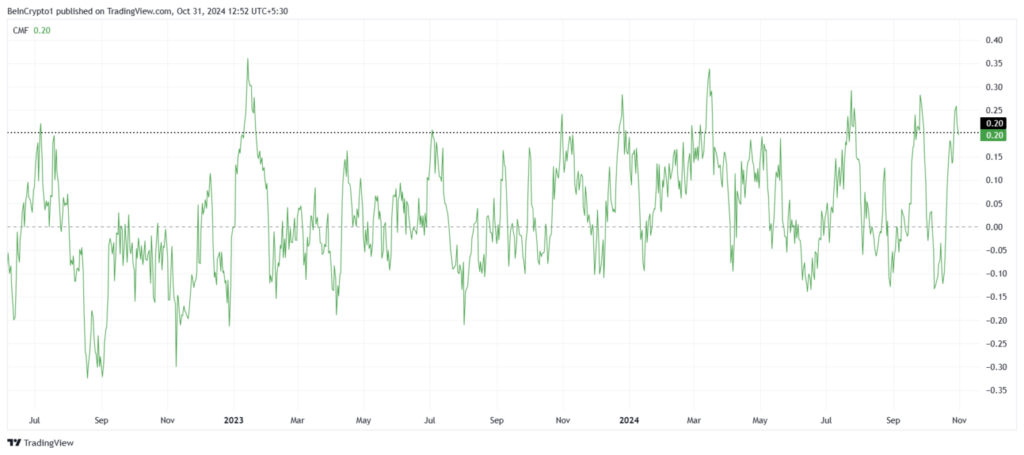

- Technical indicators suggest overbought conditions with CMF above 20.0

- Critical resistance at $186 poses challenge while support levels await at $161 and $155

Solana’s recent price action has captured market attention as it edges toward the significant $186 resistance level, a price point that has consistently triggered reversals since mid-May.

The cryptocurrency’s journey toward the psychological $200 barrier faces mounting technical challenges despite sustained momentum.

Solana Technical Indicators Paint Complex Picture

The Chaikin Money Flow indicator currently hovers above the 20.0 threshold, historically signaling peak inflow conditions that often precede significant profit-taking events.

This elevated reading suggests mounting pressure from investors potentially preparing to secure gains, which could impact SOL’s upward trajectory.

Market momentum measurements reveal concerning signals, particularly in the Relative Strength Index, which has reached the critical 70.0 level. This overbought condition typically precedes market corrections, casting doubt on SOL’s ability to maintain its bullish stance near crucial resistance zones.

The five-month persistence of the $186 barrier represents a formidable challenge for SOL’s immediate prospects. Should this resistance level hold firm, market participants anticipate potential retracements to established support at $161, with a secondary cushion at $155 marking a critical threshold for maintaining bullish market structure.

Nevertheless, broader market dynamics could override these technical warnings. A successful breach of the $186 resistance would invalidate current bearish signals, potentially catalyzing momentum toward the coveted $200 mark.

This scenario would require significant buying pressure to overcome existing technical headwinds and established resistance levels.

Trading volumes and market sentiment remain key factors in determining whether SOL can defy technical indicators and continue its upward movement. The interplay between these market forces will likely determine the cryptocurrency’s short-term price direction as it navigates this critical juncture.

Source: https://thenewscrypto.com/solana-approaches-186-resistance-as-technical-indicators-signal-caution/