- SOL Strategies secured $500M financing for SOL institutional staking.

- Largest deal in Solana ecosystem to date.

- Ties traditional capital to staking yield.

SOL Strategies Inc. has secured a $500 million convertible note agreement with ATW Partners, intended for boosting its Solana (SOL) holdings and reinforcing its institutional staking platform. The agreement marks the largest of its type within the Solana ecosystem to date.

This development underscores a bridging of traditional finance with blockchain ecosystems, potentially setting a new precedent in institutional crypto investments.

SOL Strategies and ATW Partners in $500M Landmark Deal

SOL Strategies Inc., formerly known as Cypherpunk Holdings Inc., aims to expand its SOL holdings and validator operations through this financing arrangement. Leah Wald, CEO of SOL Strategies, emphasized the scale and strategic alignment of this facility with the firm’s focus on institutional staking yields. The transaction involves a convertible note facility structured in tranches, initially providing $20 million with provisions for further drawdowns.

The agreement uniquely links capital markets to blockchain staking economics, with interest payments made in SOL tokens instead of fiat currency. This innovative interest mechanism allows up to 85% of staking yields to fund interest payments, thus reinforcing SOL Strategies’ operational model.

“This is the largest financing facility of its kind in the Solana ecosystem—and the first ever directly tied to staking yield. By securing up to half a billion dollars in strategic capital, we are doubling down on our conviction in Solana and our commitment to being the leading institutional staking platform. Every dollar deployed is immediately yield-generating, and accretive to both our balance sheet and our validator business. This structure is not only innovative—it is highly scalable.” — Leah Wald, Chief Executive Officer, SOL Strategies Inc.

Reactions from the market have highlighted the pioneering nature of this financial structure in cryptocurrencies. Comments from industry leaders have applauded the move as a robust step towards mainstream institutional participation in proof-of-stake networks, with Cohen & Company acting as the placement agent for the deal.

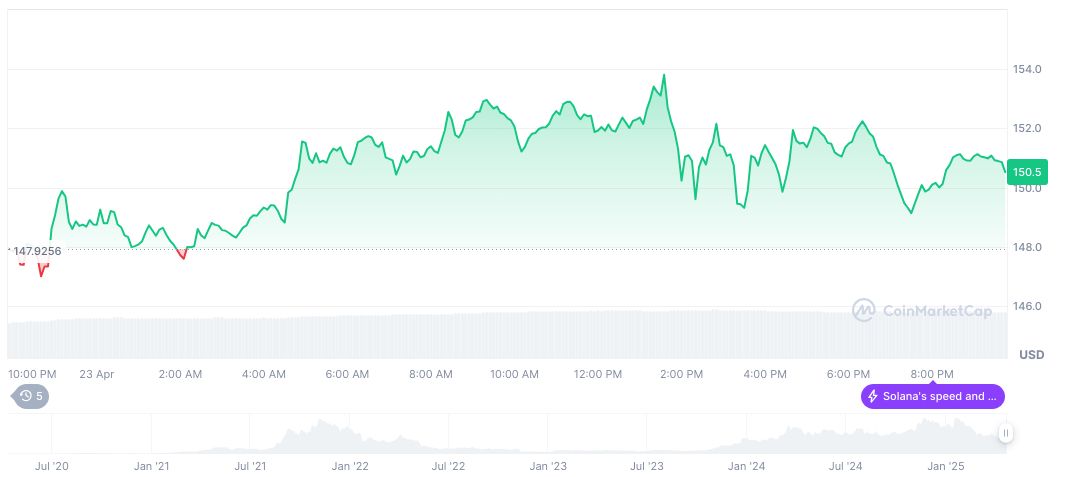

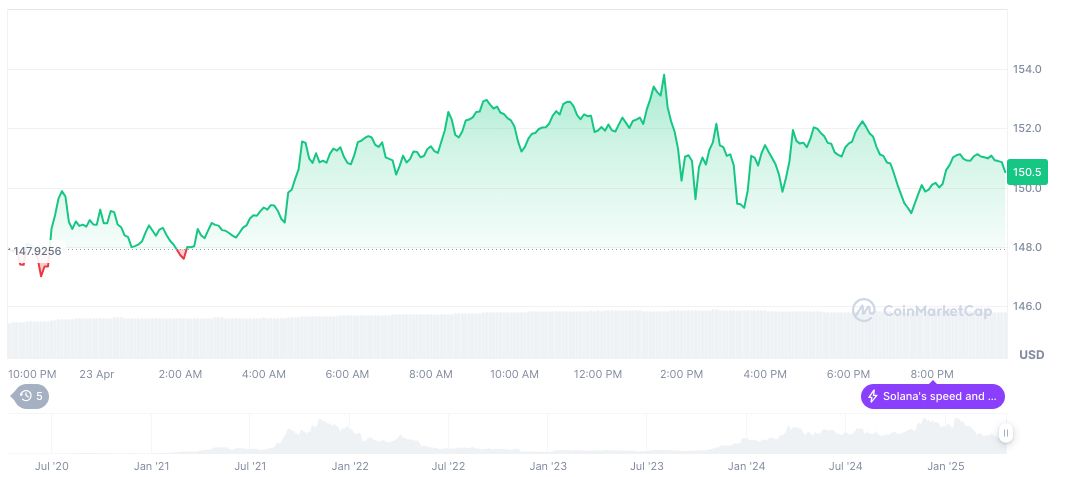

Solana Price Data Reveals Market Trends Post-Deal

Did you know? This financing deal is the first of its kind directly tied to staking yield in the Solana ecosystem.

As of the latest data from CoinMarketCap, Solana (SOL) is trading at $150.58, with a market cap of approximately $77.90 billion. Recent price performance shows a 2.97% rise in the last 24 hours and a 13.54% increase over the past week. The 90-day trend reveals a 38.96% decrease, reflecting previous volatility, despite recent gains.

Analysts from Coincu suggest that this landmark financial strategy could influence broader regulatory conversations, encouraging similar structures in other blockchain networks. The data-driven insights underscore the potential for such developments to enhance liquidity and institutional interest in decentralized infrastructure.

Source: https://coincu.com/333945-sol-strategies-500m-sol-investment/