- Solana price today trades near $207, consolidating inside its rising channel after rejection from $246.

- $36.3M in net outflows highlight fragile sentiment, with buyers absorbing pressure above the $200 level.

- Developer growth strengthens fundamentals, with Solana leading the industry at 10,700 active builders.

Solana price today is trading near $207, stabilizing after sharp selling pressure pushed the token down from the $246 peak earlier this month. The $207–$210 zone is acting as immediate support, while resistance sits near the $216–$220 cluster. The key question now is whether buyers can protect this floor or if price will slide toward deeper supports.

Solana Price Consolidates Inside Rising Channel

The daily chart shows Solana holding within its rising channel, though momentum has weakened after rejection near the $246 resistance band, which also aligns with the 0.618 Fibonacci retracement at $221. The 20-day EMA at $208 and the 50-day EMA at $208 are compressing price, while the 100-day EMA at $194 offers a broader support base.

RSI is sitting at 45, reflecting cooling momentum after last week’s breakdown, while MACD signals remain flat. A sustained move below $207 would risk exposing the $195–$194 level, followed by the $182 long-term EMA. On the upside, a clean recovery above $216 could reopen the path toward $225 and $252.

Related: Bitcoin Price Prediction: BTC Holds $111K As Traders Eye $115K Liquidation Trigger

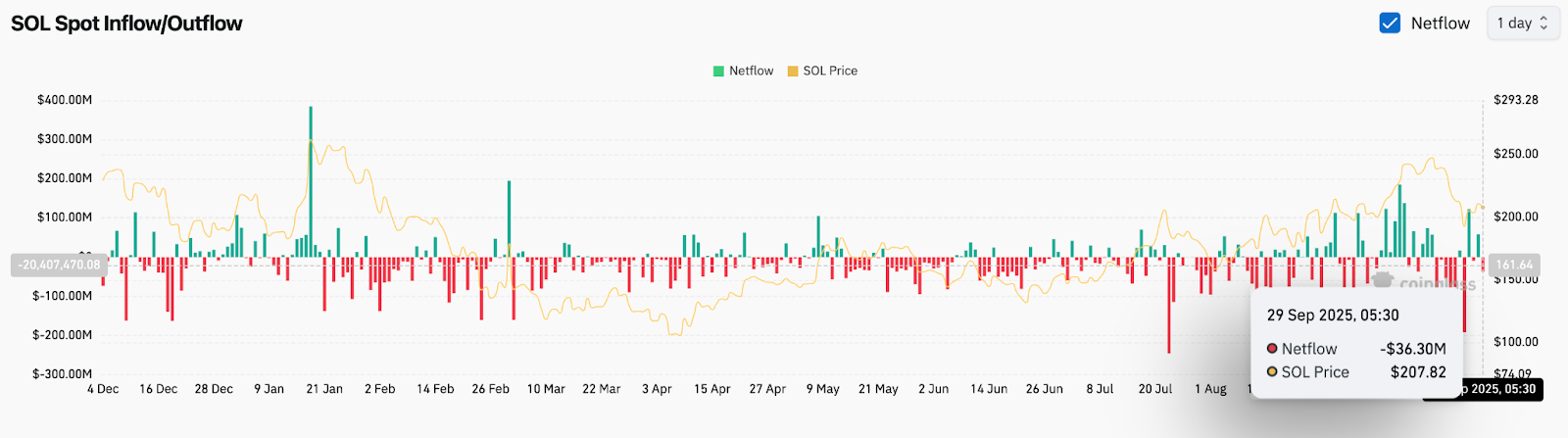

On-Chain Data Points To Heavy Outflows

Exchange flow data highlights renewed selling pressure. Solana recorded $36.3 million in net outflows on September 29, showing that traders shifted liquidity away from exchanges. This comes after weeks of inconsistent flows, where accumulation phases have been repeatedly offset by sudden sell-offs.

Despite this, the market has not seen deep panic. Spot price is still above $200, suggesting buyers are attempting to absorb selling pressure. Futures open interest has flattened, showing caution rather than aggressive short positioning. Analysts warn, however, that continued outflows could delay any attempt to reclaim the $220 resistance zone.

Developer Growth Strengthens Fundamental Narrative

Beyond short-term trading, Solana’s developer ecosystem continues to expand rapidly. Data from Chainspect shows Solana leads the industry with over 10,700 active developers, nearly double Ethereum’s figure. In total, more than 61,000 developers are engaged across the ecosystem, with Solana commanding the largest share.

This surge in developer activity is critical for long-term valuation. More builders mean more applications, greater adoption, and sustained demand for SOL tokens. The momentum is evident in transaction growth and new projects choosing Solana as their base network. Market participants view this as a structural advantage that offsets near-term volatility.

Technical Outlook For Solana Price

Solana’s immediate roadmap centers on the $207–$210 support base and the $216–$220 resistance cluster. Holding above $207 keeps the channel structure intact, with $225 and $252 as higher targets if momentum returns. A breakdown below $207 could drag price toward $195 and deeper risk zones near $182.

Forecast Levels

- Upside: $216, $225, $252

- Downside: $207, $195, $182

Outlook: Will Solana Go Up?

The short-term outlook for Solana depends on whether buyers can defend $207 and reclaim the $216–$220 resistance range. On-chain flows suggest cautious sentiment, but the network’s surging developer base provides a strong long-term anchor.

Analysts remain constructive as long as SOL stays above $195. A breakout above $220 would strengthen the bullish case toward $225 and $252, while losing $207 would shift focus back to $195 and $182.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/solana-price-prediction-sol-price-consolidates-within-rising-channel/