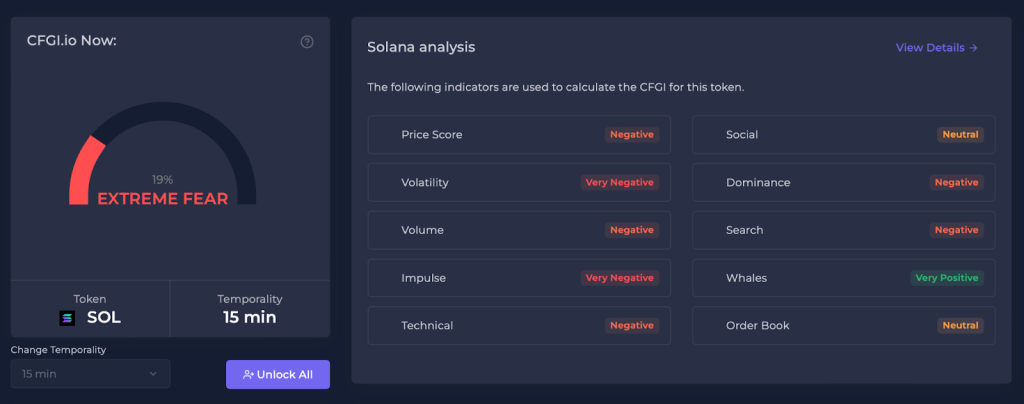

The Solana price has been dropping since April. It has finally lost a key support line at $20, marking the end of the bullish trajectory that began earlier this year in January. Both the price action and wave count hint at a series of falls that are on the way for the high-cap altcoin.

A price correction is in progress for SOL

Price predictions for SOL look grim as the current downward trend is likely to stretch into the coming weeks. The coin has lost 8.12% in the last seven days. The performance on the monthly chart is worse at 11.4%.

At the time of writing, SOL was selling for $19.88 with a total market cap of $7.8B. Although it managed to come above the resistance momentarily, the direction of long-term price patterns and investor psychology doesn’t provide any reason for hope.

The next closest support is $15. The next resistance, on the other hand, is $26. But indicators suggest that the token will oscillate between $16 and $19 for the rest of May. Unless a strong bull run grips the broader market or the Solana ecosystem comes with announcements that rekindle confidence in investors, the slip will persist and lead to more price corrections.

Past its prime, SOL can’t satiate hungry investors

While SOL is an excellent blue-chip investment, it can’t give exponential returns. Investors are tired of waiting for SOL to bounce back into action. The downtrend in progress, in particular, has urged them to expand their portfolio into low-cap cryptos with more width for growth.

Listed below are two utility coins that have been witnessing large traction over the last two weeks from altcoin investors.

- The first, yPredict, offers an AI-based trading solution designed to tackle the bot invasion of the market.

- The second, Launchpad XYZ, is a Web 3.0 hub that eases investors into various crypto niches from NFTs to metaverse and gaming.

Being in the early phases of development, they have a better chance of bringing multifold returns to investors than highly established altcoins like Ethereum, Solana, and Cardano.

Analysts believe that YPRED (yPredict) and LPX (Launchpad XYZ) can go at least 10X-20X by the end of the year if they succeed in delivering their roadmap goals. A closer look at the websites and white papers reveals that the teams are credibly positioned to achieve that.

Here is an unbiased analysis of these utility-first cryptocurrencies and how they make good short-term and long-term investments.

yPredict’s low initial market cap leaves room for multifold returns this year

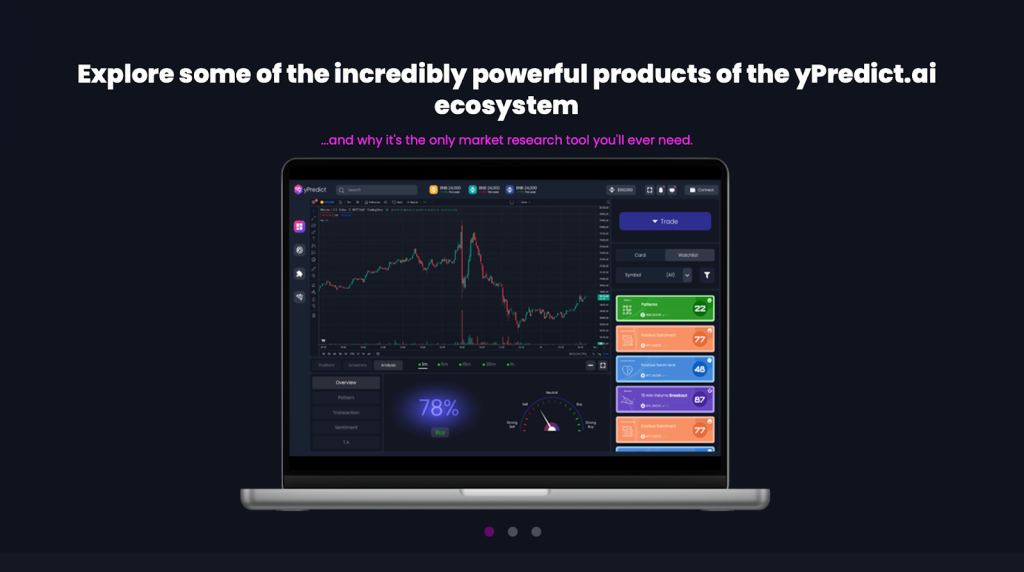

yPredict, as the name gives it away, is a prediction platform. Not the typical prediction platform where you predict the outcome of an event and earn rewards. Instead, it offers curated predictive models that instill more certainty into your trading portfolio.

The platform brings developers, traders, quants, and analysts under one umbrella.

The advanced predictive models and data insights are built and curated by leading AI developers & quants from around the world. They are brought into the picture using an excellent crypto reward system. Now in the presale phase, the platform has 20,000+ users on the waiting list. The presale is about to cross the $1M milestone at the time of writing.

How does it work

If you’re a developer or a quant, you can offer your insights and trading models on the yPredict marketplace to users through monthly subscriptions. The marketplace generates subscriptions, which include AI signals offered through various models listed on the platform.

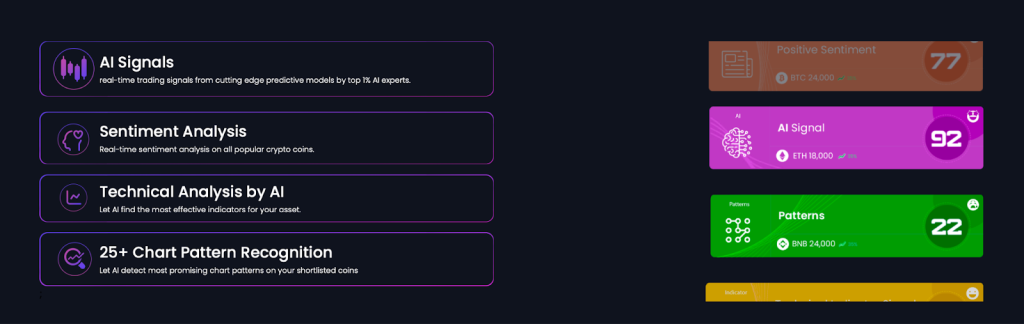

If you’re a trader, yPredict helps you discover the following:

- Real-time trading signals from predictive models designed by top 1% AI experts

- Real-time sentiment analysis on all popular crypto coins

- Transactional data analytics for thousands of digital assets

- Technical Analysis by AI

- 25+ Chart Pattern Recognition

While indicators are excellent trading tools, the key lies in finding the most effective indicators for your asset. yPredict’s AI-based solution simplifies the task for you. It also detects the most promising chart patterns on your shortlisted coins.

The platform has a patent-pending pattern recognition algorithm that automatically identifies hundreds of bullish and bearish chart and candlestick patterns. It helps in two ways.

- First, by generating real-time alerts when these patterns are formed

- Second, by providing a reliability score based on the overall past accuracy of the expected price behaviour after the pattern is formed.

yPredict is also a good source of passive income for regular users and investors. For example, the platform shares 10% percent of each new subscription with YPRED holders through a staking pool.

YPRED is the native crypto of the ecosystem. It fuels all activities within and between different components of yPredict by working as a default and discounted payment option. This can range from marketplace subscriptions to all premium services provided on the yPredict app.

Visit yPredict

Why YPRED is a good investment this year

To analyze the potential of a cryptocurrency, we should first look at the potential of the project. As an all-in-one AI ecosystem for traders, yPredict has excellent market relevance. It is emphasized by the fact financial markets are rapidly losing their predictability. Algorithms and bots marketed as trading tools eventually adulterate the markets they enter.

As they continue to distort the structure of most markets making them unpredictable and highly volatile, traders lose their statistical edge. They are on a desperate hunt for trading tools that can actually help them navigate the market without contaminating it. yPredict’s unique value propositions, joining forces with AI developers and quants, have won their approval as the long waiting list shows.

Therein lies the high growth potential of YPRED tokens. These secondary factors will also help yPredict enter the Top 100 Crypto list.

- Low initial market cap: Your entry point determines your profitability from an asset. The lower the initial point, the higher the returns. Utility-first projects like yPredict usually mark their beginning with a market cap of $50-100M. YPRED, on the other hand, will enter the market with a $6.5M market cap at listing. That gives early investors more width for growth.

- Attractive staking rewards: YPRED investors will receive up to 45% quarterly staking rewards. 10% of tokens paid for each new subscription on the platform is streamed to the staking pool. 45% is an attractive rate of return from staking when the industry average is only 5-10%. Moreover, the high staking rewards don’t cripple YPRED’s economy since it is derived from the utility. That is monthly subscriptions.

- Lifetime access: Holding YPRED tokens (worth a minimum of $250) gives you access yPredict analytics base models built by some of the best AI developers in the world. The predictive models are designed to forecast the prices of popular assets with extreme precision, unlike any other publicly available predictive models.

- Attractive discounts: Holding YPRED tokens also comes with benefits like discounts in purchasing access to data repositories, predictions platforms, analytical tools, and trading terminals to name a few.

Exchange listing will render YPRED an expensive buy

Once YPRED goes live on public exchanges, investors will have to pay a hefty sum for the token. Heavy discounts in each stage make the presale investment the most attractive entry to the project.

A modest prediction for the token in 2023 is 10X-20X. But it can do much better and possibly acquire a $1B market cap toward the end of this year.

BUY YPRED

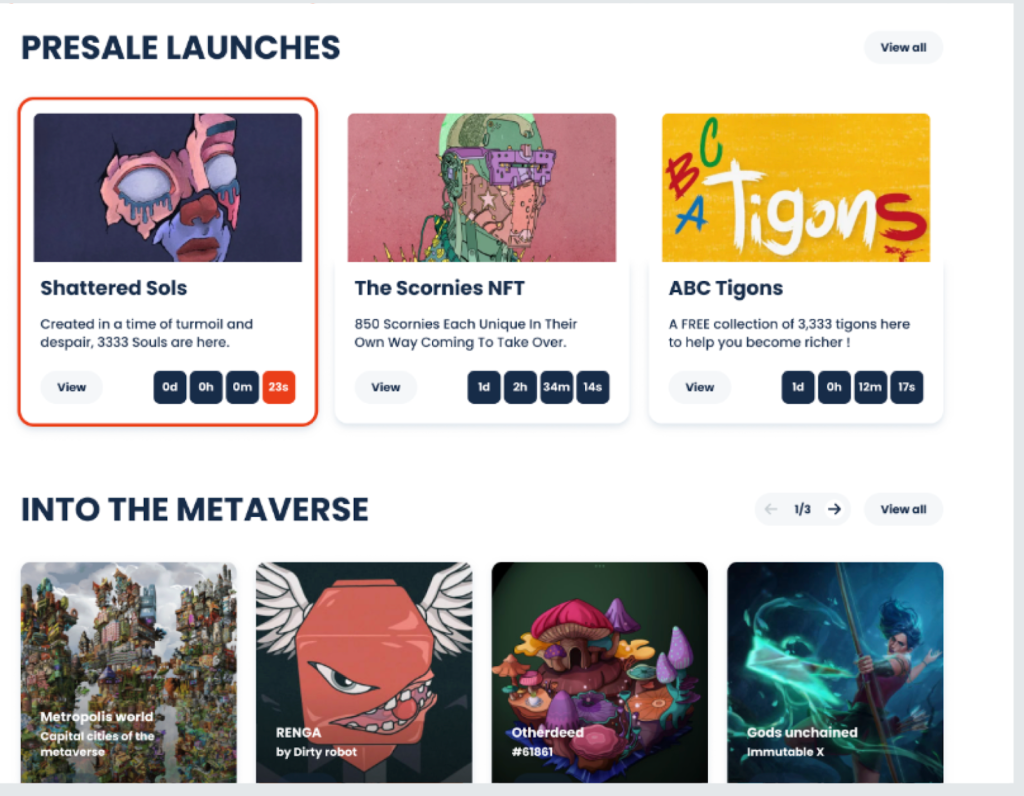

Launchpad XYZ introduces a much-needed Web 3.0 hub for crypto users

The next altcoin on the list is LPX – the native cryptocurrency of Launchpad XYZ. The high growth potential of LPX lies in the market relevance of Launchpad XYZ, which is building a large ecosystem that simplifies Web 3.0.

Let’s say an investor is new to Web 3.0 and doesn’t have much idea about what’s going on. The description fits a large share of crypto investors. The dispiriting performance of traditional investments like stock, commodities, and bank deposits has urged many to look for opportunities in Web 3.0. But they don’t know where to start.

Launchpad XYZ helps them enter the market, discover the best opportunities, steer clear of scammers, and make profits. The project’s goal is to lower the entry barrier to Web 3.0 and bring aboard its next 10M users.

The niches covered by the hub include:

- Non-Fungible Tokens (NFTs)

- Fractionalized assets

- Utility tokens

- Web3 presales

- Play-to-earn games

- And metaverse experiences to name a few.

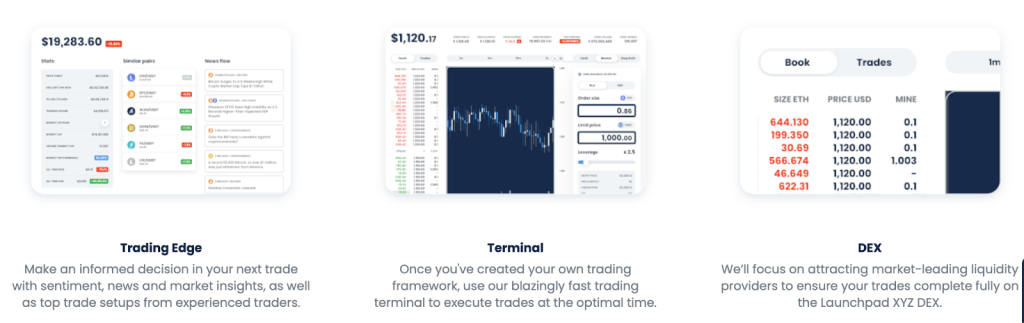

The key elements of the ecosystem are a user-friendly Web3 wallet, an NFT DEX, a trading terminal, and Al search tools to simplify crypto for new users. Another interesting feature is Launchpad Quotient (LQ) – a single value that denotes the real-time opportunities in any Web3 Asset.

Launchpad XYZ has custom solutions for each niche mentioned above. For example, the NFT component of the ecosystem allows you to discover NFTs and fractionalized assets across different platforms. In addition to helping you find the best presale opportunities based on different parameters, the platform hosts presales of promising projects.

Moreover, the chat interface of the platform allows you to get results within seconds by entering simple inputs like “show me the next best altcoin” or “how to buy Dogecoin”. The high-end natural language processing applications integrated into the system simplifies Web 3.0 for the growing tribe of new investors.

Launchpad XYZ is a large ecosystem with diverse features. You will find more details about the project’s vision on the official website and white paper.

The project’s ambitious yet realizable vision has a large mass appeal. And that underpins the demand and growth potential of LPX.

BUY LPX

Source: https://coinpedia.org/information/sol-price-prediction-loses-key-support-investors-look-for-low-cap-cryptos-to-offset-risk/