TLDR

- ANF stock jumped 26.58% to $97.66 after strong Q1 FY2025 sales.

- Intraday high reached $104.99 with over 5.2M shares traded.

- 1-year price target remains at $115.58 amid earnings momentum.

- ANF reported $566M net income and EPS of $10.69 over TTM.

- Despite 2025 dip, ANF gained 790% since Sept 2022 lows.

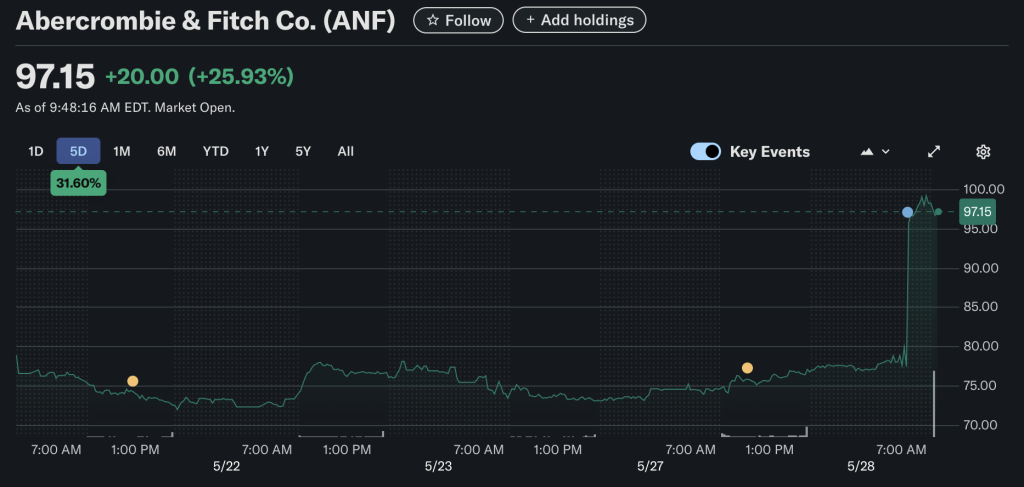

Shares of Abercrombie & Fitch Co. (NYSE: ANF) surged 26.58% to $97.66 during early market trading on May 28, 2025, climbing $20.51 from the previous close of $77.15. The session began with a lower open at $74.50 before the stock rallied sharply to an intraday high of $104.99. Trading volume exceeded 5.2 million shares, more than double the 30-day average of 2.57 million shares.

Intraday market activity indicated strong investor demand, with a tight bid-ask spread of $99.25 x 800 (bid) and $99.40 x 900 (ask). The stock currently trades within a 52-week range of $65.40 to $196.99, underscoring elevated volatility over the past year.

Abercrombie & Fitch holds a market capitalization of $4.805 billion, a trailing twelve-month price-to-earnings (P/E) ratio of 9.43, and earnings per share (EPS) of $10.69. Its beta of 1.47 suggests moderately higher volatility relative to the broader market.

Abercrombie Reports Strong Sales, Eyes $115 Price Target

Abercrombie & Fitch released its Q1 FY2025 earnings on May 28, reporting stronger-than-expected sales but a year-over-year decline in profitability. The 1-year target estimate remains at $115.58, indicating a potential upside if performance stabilizes in future quarters.

Historically, Triple Net Investor identified ANF as a notable turnaround story in the apparel sector. The firm reported that the stock had appreciated nearly sevenfold since September 2022, when it traded around $15, closing at $102.46 on January 25, 2024. According to the 2024 report, ANF outperformed even high-growth stocks like Nvidia, marking a total gain of 790.96% from its all-time low.

Over the trailing twelve months, the company reported net income of $566.22 million and a diluted EPS of $10.69. Return on assets reached 14.94%, while return on equity stood at 47.81%, indicating strong profitability and efficient capital deployment.

The company currently holds $888.95 million in cash and $951.61 million in total debt, resulting in a debt-to-equity ratio of 70.42. Despite the moderate leverage, Abercrombie has generated a levered free cash flow of $466.20 million, providing financial flexibility for strategic initiatives and operational resilience.

ANF Lags in 2025 But Outpaces S&P 500 Over 5 Years

ANF is trading at a trailing P/E of 6.84 and forward P/E of 6.75, along with a price-to-book ratio of 2.72 and a price-to-sales ratio of 0.70. Operating margin and profit margin stood at 16.69% and 11.44%, respectively.

Year-to-date, ANF posted a return of -48.38%, and its one-year return sits at -48.62%, underperforming the S&P 500’s 1.17% and 13.08% respective returns. However, over the past three and five years, the stock achieved annualized returns of 50.68% and 46.07%, far exceeding the S&P 500’s 14.15% and 15.98%.

This performance profile illustrates high volatility and drawdown risk but also significant long-term growth potential for investors prepared to withstand near-term market fluctuations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/340270-anf-stock-soars-26-on-blowout-q1-sales-and-115-price-target/