- Sky Inc. reports a $5 million loss in Q1 amid higher interest.

- The loss contrasts with last quarter’s $31 million profit.

- Sky increased incentives to boost new stablecoin, USDS, adoption.

Sky Inc. reported a $5 million loss in the first quarter of 2025, following a significant rise in interest payments linked to their newly launched stablecoin, Sky Dollar (USDS). The surge in costs draws attention across the cryptocurrency landscape due to strategic financial shifts.

The first quarter loss stands in marked contrast to Sky’s prior success, which saw a $31 million profit in the previous quarter. According to Coindesk, the core driver was an increased focus on nurturing user adoption for USDS by significantly raising incentives, replacing the earlier-used stablecoin, DAI. This strategic decision led to interest expenses climbing by 102%, creating ripple effects in their financial standing.

Sky Inc.’s $5M Loss: Factors and Implications

Sky Inc. faced a fundamental shift as a result of the loss. Realigning their financial strategy around USDS required a leap in interest incentives to attract users. Market analysts predict careful monitoring as Sky evaluates future financial pathways amidst this changing landscape.

The response to these financial revelations was mixed. While some cryptocurrency market players voiced concern over the volatility of such strategies, others perceived it as an essential gamble in pursuing long-term adoption of Sky’s financial products. Statements from exchanges and industry voices resonate with caution, highlighting the challenge of nurturing stability and growth simultaneously.

The total crypto market capitalization fell by 18.6% in Q1 2025, ending the quarter at $2.8 trillion, after peaking at $3.8 trillion in mid-January. — CoinGecko Report

Cryptocurrency Performance

Did you know? In 2023, Sky Inc., known then as MakerDAO, leveraged token holder incentives totaling $31 million to yield strong quarterly profits, contrasting with today’s strategic interest hikes resulting in a $5 million deficit.

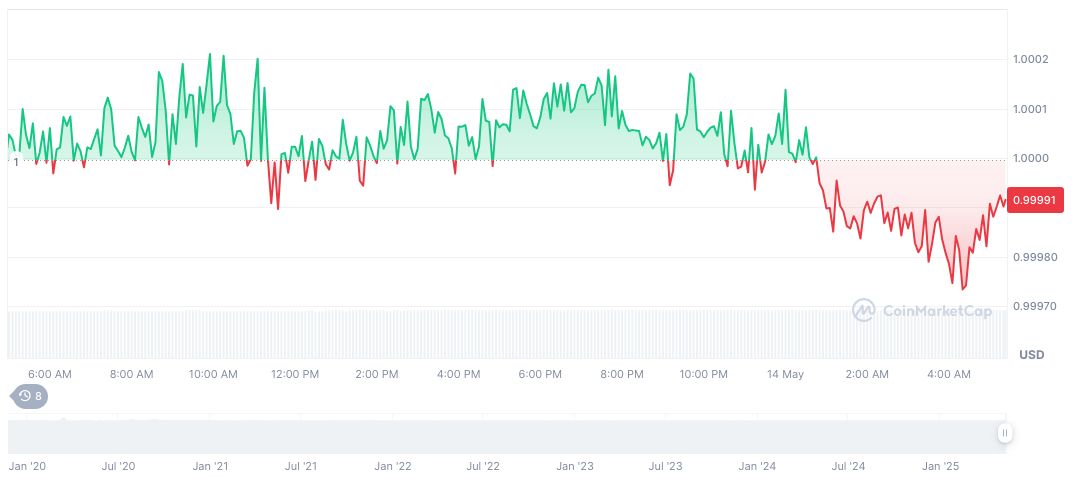

At the time of analysis, according to CoinMarketCap, Dai (DAI) maintained a position within established markets, with its value holding at $1.00. Despite broader sector fluctuations, DAI’s market cap is $5.36 billion. Over the past 90 days, fluctuations remained minimal, marked by a recent daily price decline of 0.02%.

Coincu analysts project Sky’s strategic realignment may drive revisions in stablecoin incentive frameworks. With regulatory changes and technological advancements evolving, Sky may refine their financial practices to optimize stablecoin performance, ensuring adaptability and market competitiveness. Bold actions in digital finance portfolios suggest ongoing adjustment during such monetary transitions.

Source: https://coincu.com/337528-sky-q1-loss-interest-hike/