- Sky commits $2.2 billion liquidity for USDH stability.

- Sky’s strategic operations and possible regulatory impacts.

- Rune Christensen’s financial outlook confirmation with $338 million annualized profits.

Sky, formerly MakerDAO, led by Rune Christensen, is competing for USDH issuance rights under Hyperliquid, offering significant liquidity enhancements and a unique yield mechanism.

The move could reshape the DeFi landscape, enhancing liquidity and yield dynamics, with significant implications for stablecoin adoption and protocol innovation within Hyperliquid’s ecosystem.

Sky Commits $2.2 Billion Liquidity for USDH Stability

Sky, rebranded from MakerDAO, is aiming to issue USDH on Hyperliquid, highlighting a strategic commitment. The firm promises instant access to $2.2 billion USDC for USDH redemption, enhancing liquidity. Sky’s plan involves leveraging its 8.00 billion assets to support Hyperliquid pools, ensuring robust financial backing. The initiative proposes a 4.85% yield for USDH, surpassing standard treasury returns. Sky’s profits are earmarked for a buyback strategy, enhancing USDH liquidity with annual profits of $250 million projected to drive stability and growth. Additionally, Sky offers $25 million for independent Hyperliquid development projects. Community feedback highlights interest in the potential liquidity boost. Rune Christensen confirmed the updated financial outlook with annualized profits of $338 million, emphasizing Sky’s financial health and cost-cutting measures. Social media and forums are actively discussing potential implications.

After Sky Core simplification significantly cut core expenses, the profit page has been updated. Based on the past three months’ annualized costs, it now shows real-time stable fee income and savings rate expenses, with current annualized profits at $338 million.

“After Sky Core simplification significantly cut core expenses, the profit page has been updated. Based on the past three months’ annualized costs, it now shows real-time stable fee income and savings rate expenses, with current annualized profits at $338 million.” — Rune Christensen, Founder, Sky

USDC Market Data and Regulatory Forecasts

Did you know? MakerDAO’s previous multichain DAI deployments set a precedent for stablecoin issuance, emphasizing significant shifts in market dynamics and user adoption patterns.

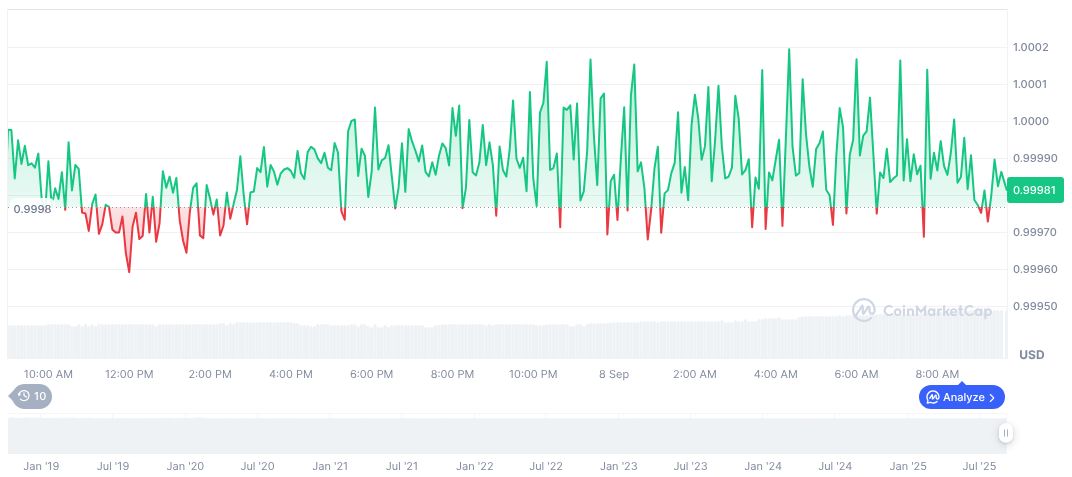

USDC, priced at $1.00, holds a market cap of $72.60 billion, accounting for 1.88% market dominance as per CoinMarketCap. It exhibits a 0.00% 24-hour change, with a trading volume of $13.66 billion, showing a weekly decline of -2.26%. potential regulatory impacts from increased capital flow and higher DeFi integration. Sky’s strategic operations could lead to innovations across digital financial environments, with regulatory watchfulness anticipated due to financial mechanisms involved. Exploring USDH stablecoin network governance in DeFi is crucial in understanding these regulatory forecasts.

Sky’s strategic operations could lead to innovations across digital financial environments, with regulatory watchfulness anticipated due to financial mechanisms involved.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sky-usdh-stablecoin-hyperliquid/