- Shibarium network recorded a milestone as transactions surged by 70%.

- However, a key factor could undermine SHIB’s deflationary model.

Shiba Inu [SHIB] is at a crossroads as gas fees on its layer 2 network, Shibarium, soar by 2,024%. This surge raises critical questions about the future of the SHIB token.

BONE on Shibarium might pose a threat

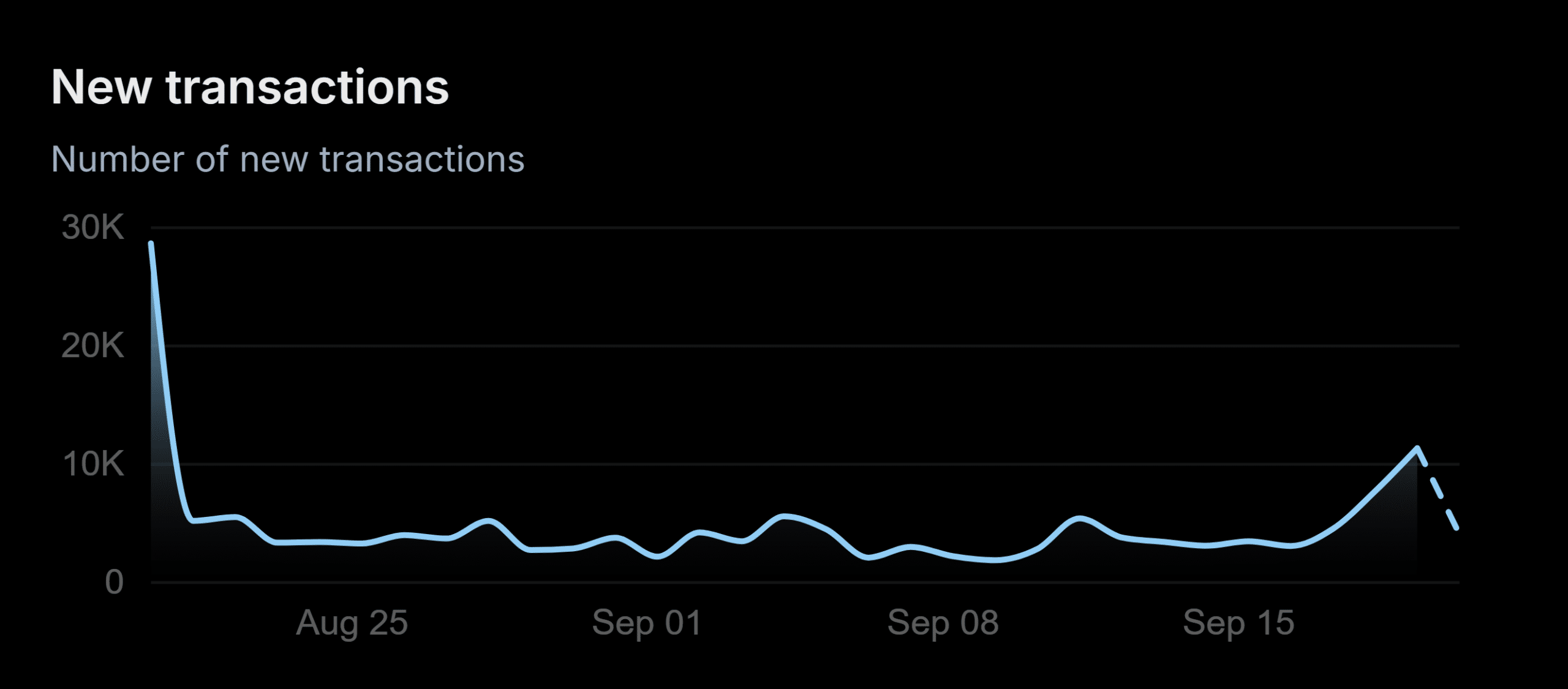

Shibarium recently achieved a significant milestone, with transaction volume surging by 70% from 4,537 to 7,715, and active accounts skyrocketing by 157.14%, increasing from 42 to 108, according to ShibariumScan.

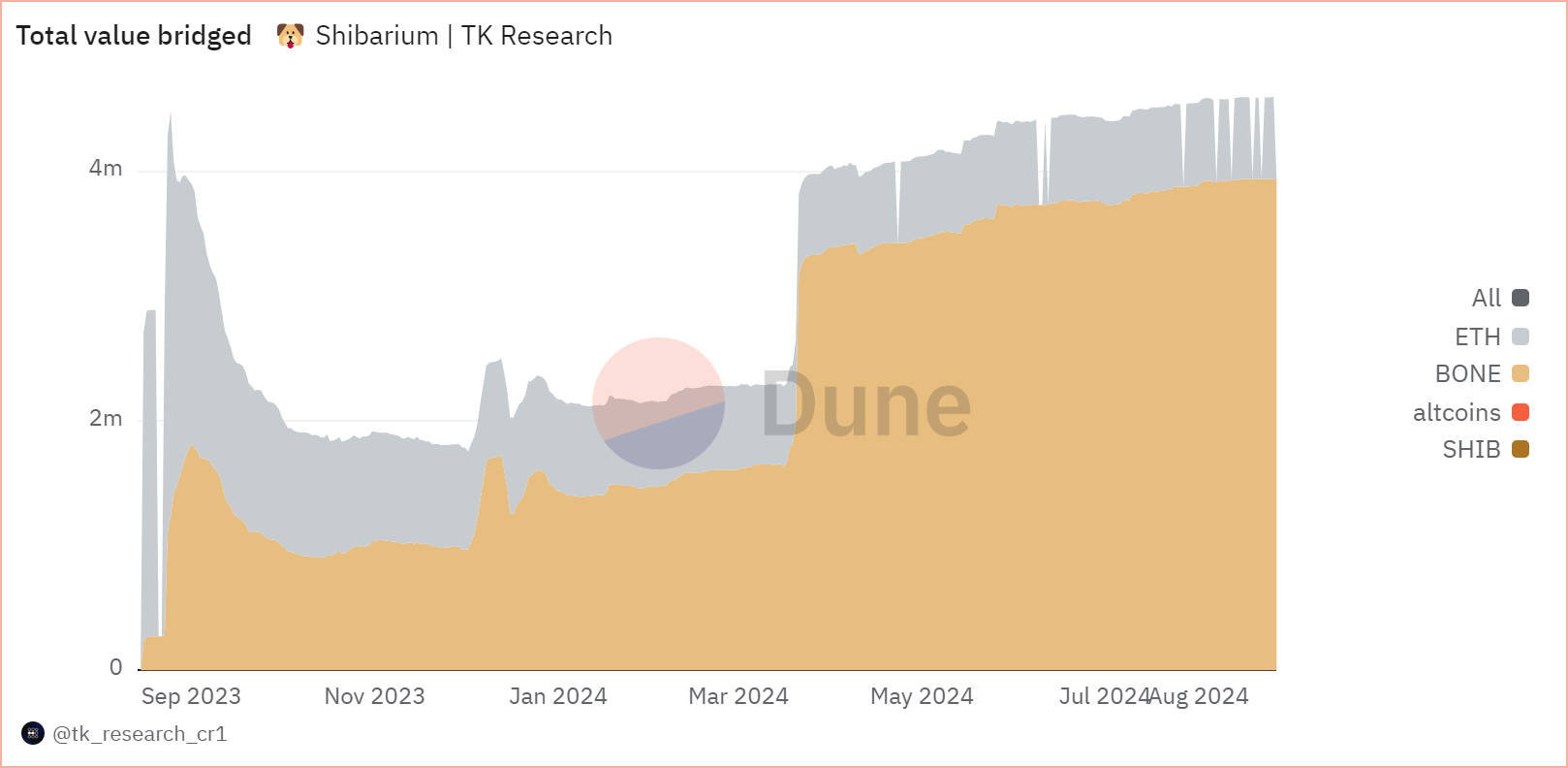

BONE, the native token of the Shiba Inu ecosystem, fuels transactions on the Shibarium network. Put simply, when using Shibarium for transactions, one does so with BONE.

Source : Dune

As a result, BONE has surged by approximately 3% in the last 24 hours, valued at $0.425079 at press time. This uptick highlights an ongoing challenge for SHIB’s deflationary model, which aims to keep the supply in check.

For context, SHIB developers implement a routine burning procedure by sending tokens to inaccessible wallets, a strategy designed to manipulate value.

On Shibarium, users convert a portion of BONE tokens into SHIB, sending it to dead wallets. However, with transaction fees spiking by 2,024%, this could deter stakeholders, potentially impacting SHIB’s value indirectly.

Where is SHIB at the moment?

SHIB has been locking in consecutive green candles on the daily price chart, surging over 5% in the past seven days. However, much of this momentum follows Bitcoin’s bullish moves over the last four days.

That said, with only 240,000 SHIB tokens burned – a staggering 85% decline from the earlier 1.7 million – the news of the Shibarium network registering high gas fees might concern stakeholders.

This thesis could be validated if transactions on Shibarium slow down, leading to fewer SHIB burns.

Conversely, if network activity maintains its appeal despite high gas fees, the SHIB community might have less to worry about.

Source : ShibariumScan

However, while the network boasts new highs, registering 416.785 million total transactions, the recent transaction volume has certainly hit rock bottom—dropping from 30K in mid-August to 11K at press time.

Put simply, new investors might be deterred from accessing Shibarium as transactions become costly. According to AMBCrypto, if this trend holds for an extended period, it could harm SHIB’s value in the long run.

Is your portfolio green? Check out the SHIB Profit Calculator

Currently, SHIB’s appeal hinges on Bitcoin [BTC] maintaining the $64K ceiling. A retracement could follow if SHIB burns slow down.

In short, while the Shibarium network celebrates its milestone, high gas fees could adversely affect SHIB’s long-term outlook if its deflationary model isn’t implemented promptly.

Source: https://ambcrypto.com/shibarium-gas-fees-up-2024-what-does-it-mean-for-shib/