Shiba Inu price sideways trading near key support levels reflects broader market doldrums amid macroeconomic concerns. Last week, CPI data poured cold water on growing investor optimism that the Fed could cut interest rates by 50 basis points. The Sticky core CPI saw lower economic expectations to a 25 basis point cut, immediately dampening price movement.

Despite Shibarium chain developments, the SHIB volume continues to dwindle, and its price also reflects the weakness. An analysis of futures trading data and price action reveals that SHIB price may enter a period of max pain followed by a bullish surge exceeding 500%.

‘Dead Chain’ Vibes Rub Off on Shiba Inu Price

Shibarium, the Shiba Inu blockchain, has been having difficulty replicating the success witnessed in its token. According to Messari Research, SHIB real volume hit a 1-year low on August 18, suggesting that investors may not find the SHIB as popular as it once was.

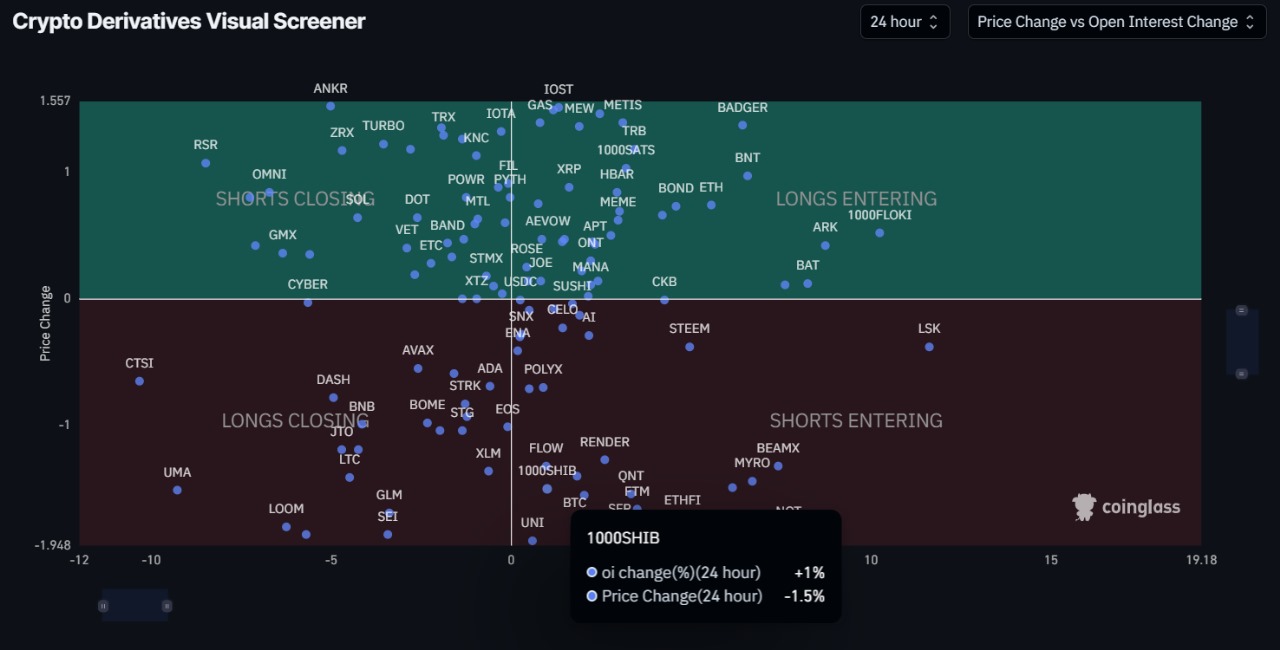

Besides this, SHIB is facing selling pressure from futures trades, as the Coinglass Crypto Derivatives Visual Screener’s plot of Shiba Inu open interest (OI) versus price shows Shorts are opening. This means traders are anticipating the Shiba Inu price will continue dropping in the coming days.

Shiba Inu technical analysis reveals a 50% potential price drop in line with the rising sell pressure. However, what follows after that would be a price surge that would send SHIB over 500%.

$0.000015 Critical For SHIB Price

The Shiba Inu price chart shows a downward trend within a defined channel, similar to the previous chart, signaling a consistent bearish trend. The SHIB price is trading near the channel’s lower boundary, indicating strong downward momentum.

SHIB sport some resistance around $0.00001318 and at $0.00001526. If SHIB breaks above the former, it may surge 500% to $0.00003698, with occasional stops at $0.00001934 and $0.00002816. Conversely, SHIB is likely to find support around $0.00001227 and $00001000, which is a round psychological support level.

Candlestick analysis reveals spinning top formation, which indicates market indecision, with neither bulls nor bears in clear control. However, given the downtrend, the lack of a strong reversal pattern suggests the downtrend could continue unless significant buying pressure emerges.

The Chaikin Money Flow (CMF) is slightly above zero, suggesting a neutral to weak buying pressure. However, it does not indicate a strong bullish trend reversal, aligning with the bearish overall trend.

Shiba Inu price prediction shows that if it rises and maintains above $0.00001798, it might signal market strength and change the trend to bullish, invalidating the bearish thesis. SHIB price would rise higher and test the yearly highs.

Frequently Asked Questions (FAQs)

The technical analysis indicates a potential 50% drop in SHIB’s price due to rising sell pressure. After this potential decline, a bullish surge exceeding 500% could follow if certain conditions are met.

The candlestick analysis reveals a spinning top formation, which indicates market indecision. This pattern suggests that neither bulls nor bears are in clear control, and the current downtrend may continue unless a strong reversal pattern emerges.

If SHIB rises and maintains a price above $0.00001798, it might signal market strength and could potentially change the trend to bullish, invalidating the current bearish outlook.

Related Articles

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/shiba-inu-price-could-provide-buying-opportunity-before-shib-skyrockets-50/

✓ Share: