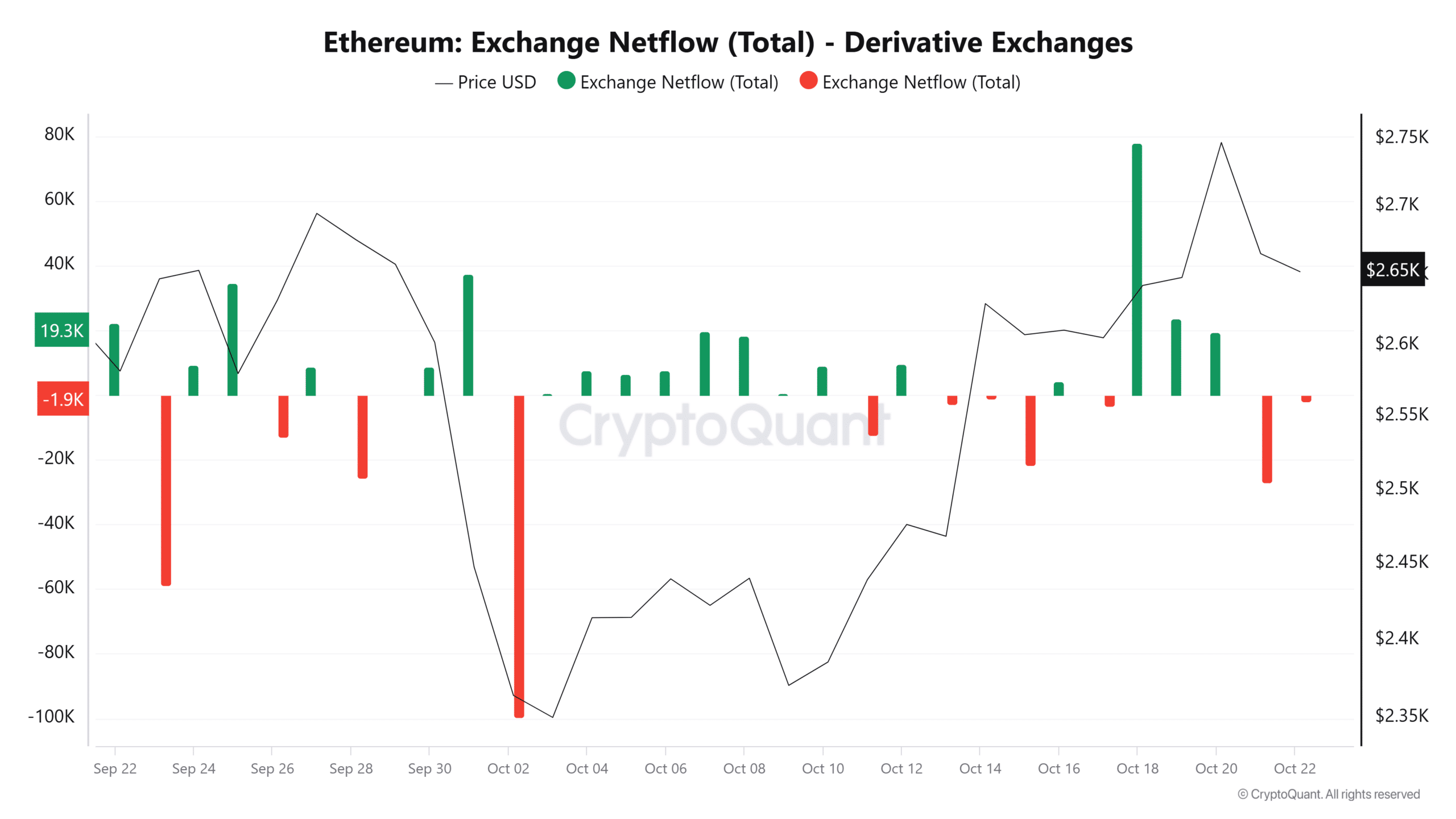

- SHIB outflows from derivative exchanges have reached the highest level in two weeks.

- A drastic drop in funding rates and open interest shows traders are exiting the market due to uncertainty.

The cryptocurrency market traded in the red at press time as Bitcoin [BTC] and most altcoins edged lower. Shiba Inu [SHIB] succumbed to this bearish pressure, dropping 3% in 24 hours to trade at $0.0000185.

Despite this drop, SHIB is still up by 26% in the last 30 days. However, the derivatives market points towards a shift in sentiment that could result in further losses.

Are SHIB derivative traders deleveraging?

AMBCrypto’s analysis of the derivatives market shows a spike in SHIB outflows to the highest level in two weeks. On 21st September, SHIB outflows from derivative exchanges exceeded inflows by the highest margin since early this month.

Source: CryptoQuant

This indicates that traders might be closing their existing positions to minimize losses from liquidations.

The spike in derivative exchange outflows has also coincided with a drop in open interest from $60 million to $55 million at press time per Coinglass.

This data shows that traders are leaving the market because of uncertainty after SHIB’s uptrend failed. These closed positions likely created a long squeeze that fueled the price drop.

On 21st October, Shiba Inu’s funding rate reached 0.0207%, the highest level since June, as many traders opened long positions. At press time, the funding rate had plunged to 0.0046%.

Declining funding rates alongside a drop in open interest and high outflows from derivative exchanges show that long traders are exiting the market.

This shows deleveraging, which could push SHIB prices lower in the short term as long traders turn to sellers to close their positions.

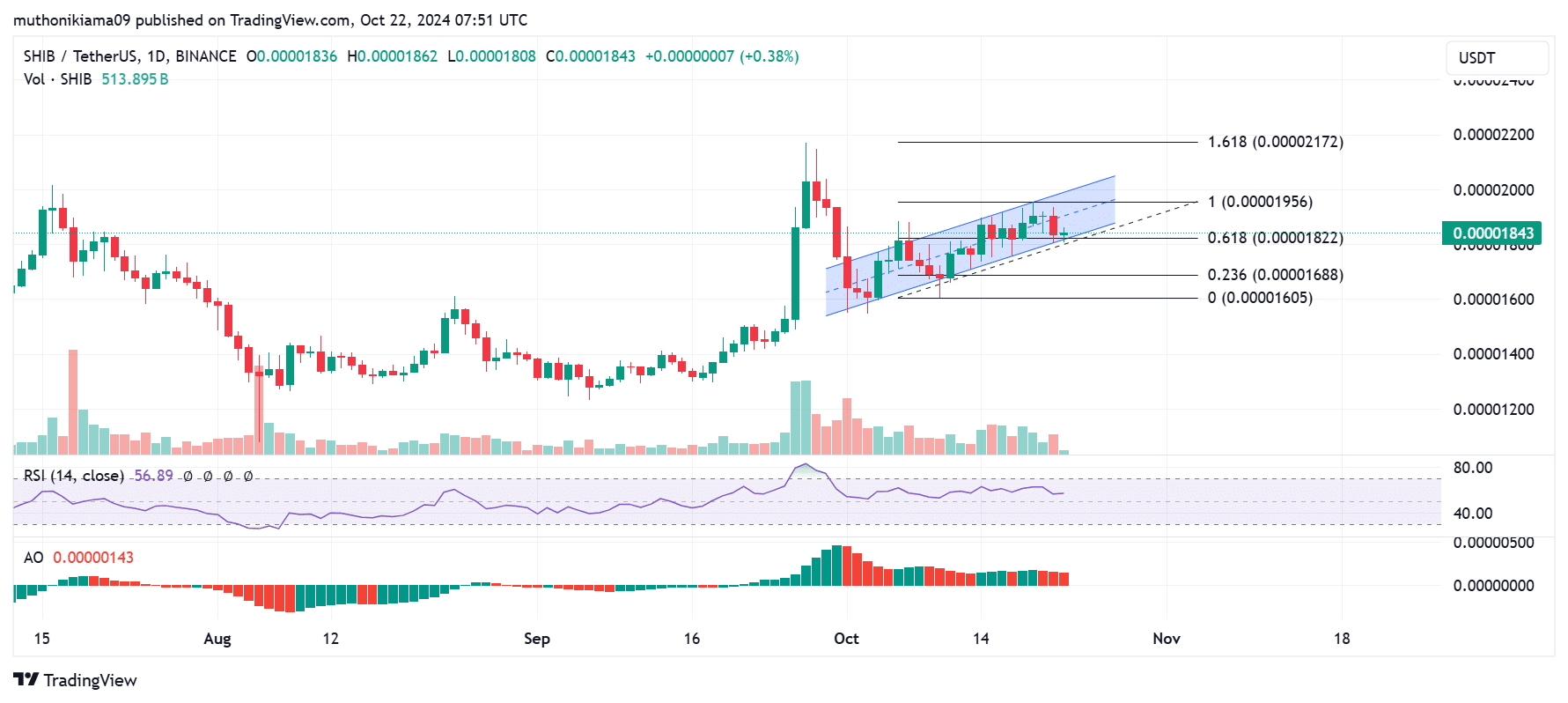

Shiba Inu price analysis

Shiba Inu has been trading within an ascending parallel channel. However, the price has dropped to the lower boundary of this channel, and if it drops below it, SHIB will have entered a downtrend.

SHIB is currently defending support at $0.00001822. If this support fails, the price could drop to the 0.236 Fibonacci level ($0.0000168).

Source: TradingView

The Relative Strength Index (RSI) has also dropped to 56 showing that buyer interest is waning. However, sellers are yet to overpower buyers, giving SHIB room for a recovery. If this metric drops below 50, SHIB faces a steeper drop.

Read Shiba Inu’s [SHIB] Price Prediction 2024–2025

The Awesome Oscillator histogram bars have also flipped red, suggesting that bears are gaining strength.

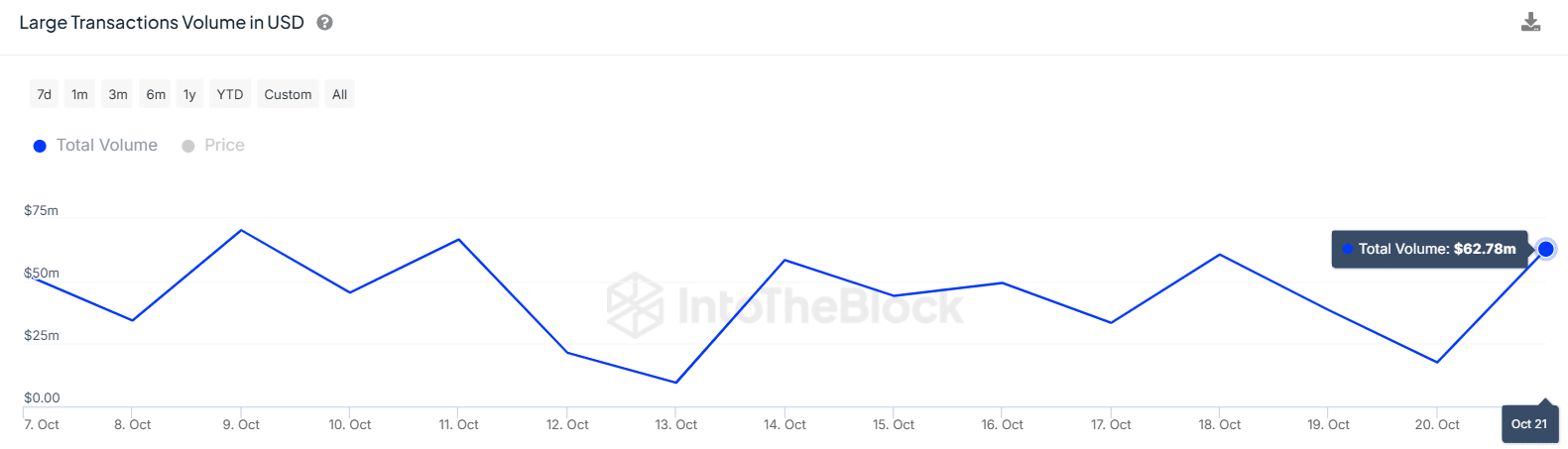

As these bearish signals emerge, Shiba Inu whale activity has spiked after large transaction volumes increased by more than 200% $62M. If these whales are buying, SHIB could resume the uptrend.

Source: IntoTheBlock

Source: https://ambcrypto.com/shiba-inu-how-derivative-traders-could-fuel-shib-losses/