- Over 300 million SHIB tokens were burned in the past week, marking a 1,000% increase in the burn rate.

- The burn rate has increased by over 6,000% in the last 24 hours.

The Shiba Inu [SHIB] burns in the past saw a notable spike, with over 300 million tokens burned. In the last 24 hours, the burns have also increased significantly even as the Shiba Inu price continues to decline.

SHIB burns spike with over 300 million tokens

Over 300 million Shiba Inu tokens were burned in the past week. According to the latest data, more than 324 million tokens were removed from circulation, marking an increase of over 1,000% compared to the previous week.

The burning activity has remained strong, with a 6,700% surge in the past 24 hours alone. During this period, an additional 27 million SHIB tokens were burned, pushing the total number of burned tokens to approximately 410.7 trillion. Despite the substantial burns, this figure remains small compared to Shiba Inu’s total supply.

Address activity remains steady despite SHIB burns

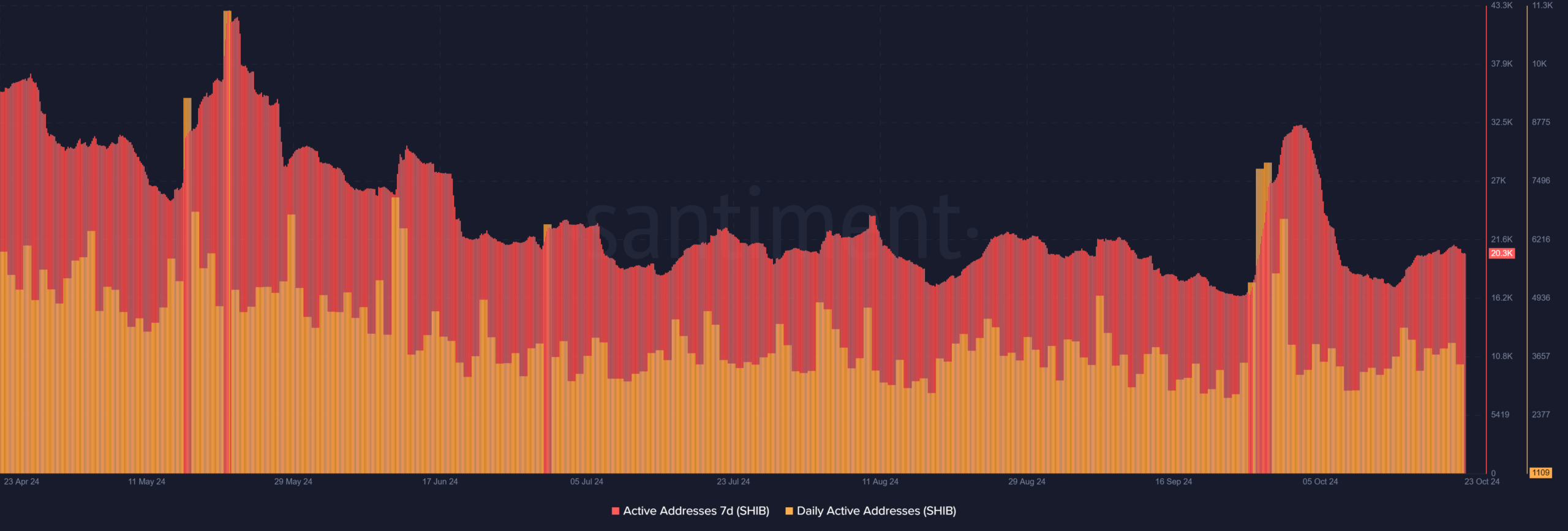

While SHIB Burns have increased, analysis shows no significant uptick in Shiba Inu address activity. According to data from Santiment, the seven-day active addresses have stayed steady, hovering around 20,000.

On October 21st, there was a slight spike to over 21,000 addresses, but it quickly returned to its regular levels.

Source: Santiment

Similarly, the number of daily active addresses has shown little movement, remaining between 3,700 and 3,800 recently. Like the seven-day data, the daily active addresses slightly increased on 21st October, surpassing 3,900.

However, this modest change did not correspond with the surge in SHIB Burns.

The stable address activity suggests that the increased burning of tokens is not driven by a rise in active users on the network. It also indicates that the recent burns are not necessarily linked to any transactions or on-chain activity spike.

Shiba Inu continues to trend downward

Shiba Inu’s price has continued to trend downward over the past few days despite the spike in SHIB Burns.

The price decline started with a 3% drop and has now fallen by another 1.7%. This indicates that the increased SHIB Burns does not have a direct or positive correlation with SHIB’s market price at the moment.

Source: TradingView

Although the Relative Strength Index (RSI) suggests that Shiba Inu is still in a bullish trend, the weakening RSI shows that this trend is losing momentum.

Is your portfolio green? Check out the Shiba Inu Profit Calculator

Currently, the RSI hovers near the neutral line, reflecting market uncertainty.

While SHIB Burns continues reducing the circulating supply, they have yet to influence price or address activity significantly. The ongoing downward trend in Shiba Inu’s price suggests that other factors are currently driving market sentiment.

Source: https://ambcrypto.com/shib-burns-300m-tokens-what-does-it-mean-for-shiba-inu-investors/