- SHIB remains above key EMAs, confirming bullish momentum and upward trend potential.

- Major Fibonacci resistance near $0.00001271 may define SHIB’s next significant move.

- Net outflows of $1.37M hint at mild selling, urging caution for short-term traders.

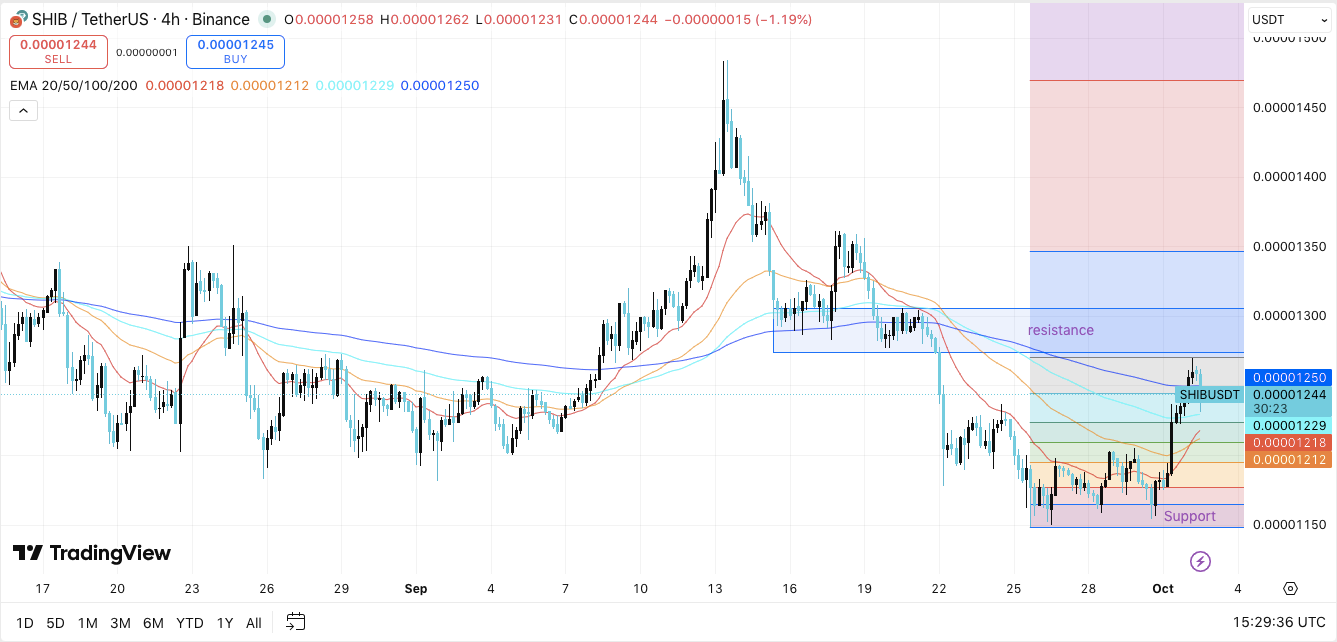

Shiba Inu (SHIB) is trading in a bullish structure on the 4-hour timeframe, with buyers regaining control after defending key support levels. The market has shown renewed strength, pushing the token above major moving averages while approaching crucial Fibonacci resistance zones. Traders are now closely watching how SHIB behaves as it nears significant price levels that could define its next move.

Key Price Zones and Trend Outlook

The support zone remains anchored around $0.00001148, where the price recently bounced after a period of consolidation. This level, aligned with the 0.236 Fibonacci retracement, is attracting fresh buying interest.

Above this zone, intermediate resistance lies between $0.00001195 and $0.00001224, corresponding to the 0.382 and 0.618 retracement levels. These areas may temporarily slow SHIB’s climb.

The most notable resistance sits near $0.00001245 and extends toward $0.00001271, which coincides with the 1.0 Fibonacci level. A successful breakout here could drive SHIB toward $0.00001347, the 1.618 extension, where sellers might return aggressively. However, failure to clear this zone could invite a pullback, with price potentially retesting the $0.00001148 support region.

EMA indicators reinforce the bullish case. SHIB trades comfortably above its 20, 50, 100, and 200-period exponential moving averages, suggesting that momentum remains in favor of buyers.

Related: Shiba Inu Price Prediction: Analysts Track Resistance Flip Ahead Of October Volatility

Futures Market and Open Interest Signals

Open interest trends reveal a direct correlation between trader positioning and price moves. During recent surges, open interest expanded sharply, reflecting heightened participation. As prices stabilized, interest cooled.

On October 2, SHIB futures open interest stood at $199.55 million, showing steady though cautious engagement. This suggests investors remain active but wary of sharp pullbacks.

Spot Flows and Market Sentiment

On-chain activity adds another layer of insight. Spot inflow and outflow data highlight strong connections between capital flows and price swings. Positive inflows have historically preceded rallies, while strong outflows have often signaled sell-offs. On October 2, net flows recorded a negative $1.37 million, hinting at mild selling pressure.

Large fluctuations in flows have historically led to sharp volatility, as seen in December 2023 and May 2024. Hence, traders should remain alert to sudden changes in exchange flow trends, as they often foreshadow directional moves.

Technical Outlook for Shiba Inu Price

Key levels remain clearly defined as October unfolds:

- Upside levels: $0.00001224, $0.00001245, and $0.00001271 as immediate hurdles. A breakout could extend toward $0.00001347 and $0.00001480.

- Downside levels: $0.00001148 trendline support, followed by $0.00001110 and $0.00001050 as deeper cushions.

- Resistance ceiling: $0.00001271 (Fib extension and key resistance zone) is the major level to flip for medium-term bullish continuation.

The technical picture shows SHIB consolidating within a narrowing range, reflecting compression that often precedes a decisive move. Price is currently trading above the 20, 50, 100, and 200 EMAs, reinforcing bullish alignment in the short and medium term. However, the resistance cluster between $0.00001245–$0.00001271 remains a challenge for buyers.

Related: SHIB Price Drops 13% in Three Days as Leadership Debate Intensifies

Outlook: Will Shiba Inu Sustain Its Recovery?

Shiba Inu’s October outlook depends on whether buyers can defend the $0.00001148–$0.00001110 zone while pressing higher toward $0.00001245–$0.00001271. Compression, combined with seasonal volatility tendencies, suggests a potential breakout may be nearing. If momentum builds, SHIB could retest $0.00001347 and even push toward $0.00001480.

Failure to hold $0.00001148, however, risks breaking the accumulation base and exposing the token to deeper supports around $0.00001110 and $0.00001050. For now, SHIB remains at a pivotal stage, where conviction flows and confirmation of resistance flips will dictate the next significant move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/shiba-inu-price-prediction-shib-bulls-target-breakout-above-0-00001271/