- Grayscale’s Polkadot ETF approval delayed by SEC.

- Reflects SEC’s cautious crypto product stance.

- No immediate funding or market disruptions observed.

The U.S. Securities and Exchange Commission (SEC) delayed Grayscale’s request for a spot Polkadot ETF on April 24, 2025.

This decision underscores ongoing regulatory caution over such investment products in the digital asset space, impacting Polkadot exposure but not causing market disruptions.

SEC Delays Grayscale’s Polkadot ETF Application

On April 24, the SEC announced a delay in approving Grayscale’s spot Polkadot ETF application. Grayscale, a leading digital asset manager, faces a typical regulatory setback reminiscent of past crypto-related ETF applications. No remarks from Grayscale executives were available. Here is a structured placeholder for possible future quotes:

Polkadot’s exposure remains limited due to this regulatory delay. Investors seeking regulated exposure to Polkadot through the proposed ETF must continue to await further SEC action. The delay reflects the SEC’s cautious approach to crypto ETF products and aligns with trends noted by Crypto Briefing updates on cryptocurrency trends.

“We remain committed to our application for the DOT ETF and continue to engage with regulators.” – Grayscale

Community discussions mainly focused on reiterating the SEC’s cautious stance. No official comments from crypto industry leaders have surfaced, underscoring the predictable nature of the SEC’s comprehensive review process.

Crypto ETF Trends: Delays and Market Impacts

Did you know? The SEC has consistently postponed decisions on crypto ETFs, including Bitcoin and Ethereum products, often resulting in temporary stagnation in related asset trading volumes.

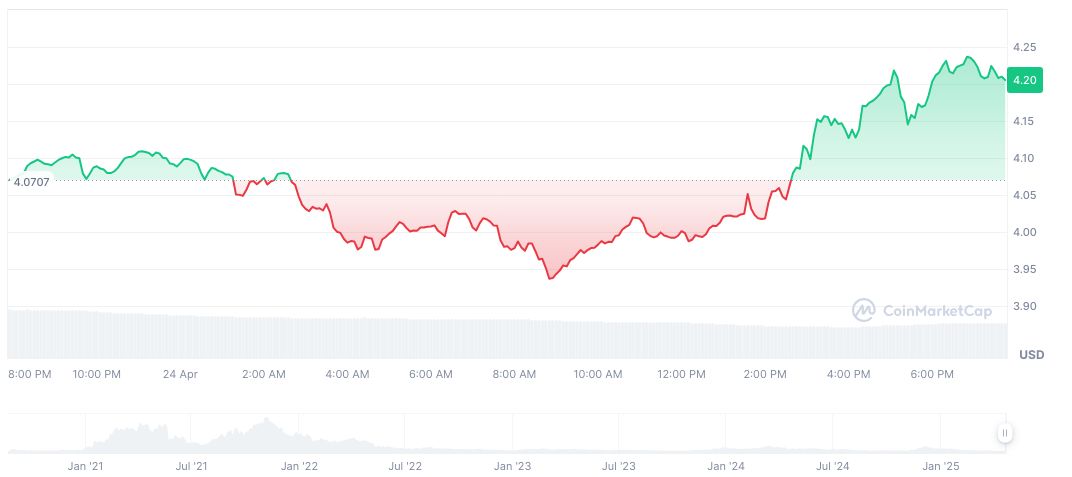

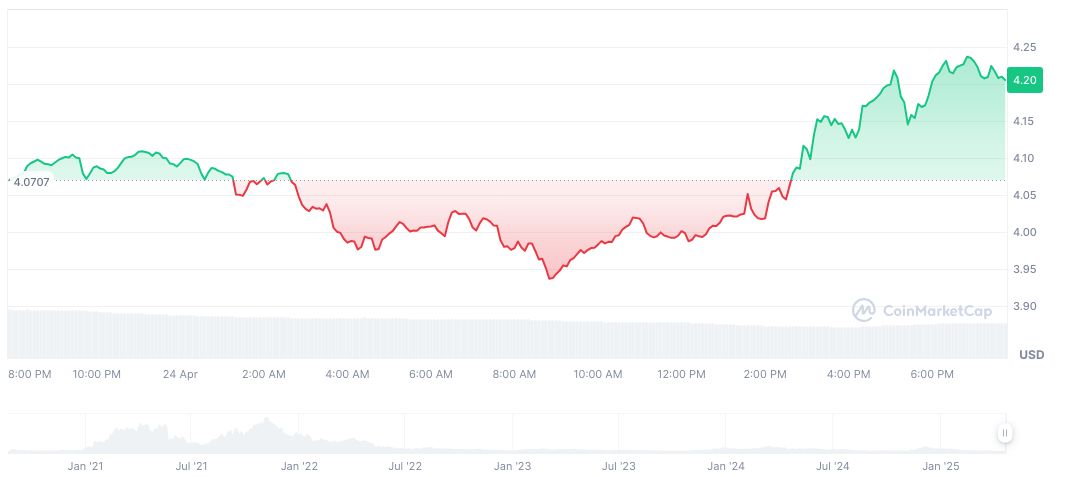

As of April 24, 2025, Polkadot (DOT) is priced at $4.21 with a market cap of $6.61 billion, according to CoinMarketCap. Recent 24-hour trading volumes saw a 26.87% decline, while 7-day prices increased by 16.27%. Longer-term trends show a 34.52% decrease over 90 days.

Future financial and technological implications remain uncertain, but careful review by the SEC could potentially shape regulatory landscapes. Historical trends from the Coincu research team suggest periods of regulatory hesitation often induce market prudence, with stakeholders exhibiting measured optimism.

Source: https://coincu.com/334145-sec-delays-grayscale-polkadot-etf/