- The SEC has delayed Grayscale’s Hedera ETF decision, affecting market dynamics.

- Approval likely by Q4 2025, impacting HBAR.

- Institutional and mainstream interest remains high pending regulatory clarity.

Grayscale’s request for a Hedera (HBAR) spot ETF remains in suspense as the SEC has postponed its decision. The regulatory body cited extended review processes, pushing the deadline to a yet unspecified date later this year.

The delay marks a continuation of the SEC’s cautious approach towards crypto ETFs, reflecting the priority placed on thorough regulatory oversight. This has caused market participants to remain uncertain, awaiting signals of institutional capital influx expected upon potential approval.

SEC Defers Hedera ETF; Impact on Market Uncertain

The U.S. Securities and Exchange Commission (SEC) has postponed the decision on Grayscale’s application for a Hedera (HBAR) spot ETF. Grayscale, already known for pioneering Bitcoin and Ethereum ETFs, coupled with Canary Capital’s competing application, adds to the anticipation. Hedera’s governing council, including prominent corporations like Boeing and Google, remains silent on social media regarding the delay.

The SEC’s delay affects institutional interest in HBAR, as investors anticipate market access through an ETF. Approval could significantly increase liquidity and demand for Hedera, impacting HBAR’s market dynamics. Numerous analysts suggest that the visibility and acceptance of such ETFs could enhance mainstream adoption of blockchain assets. However, the delay temporarily stalls these potential benefits.

James Seyffart, a Bloomberg ETF analyst, remarked on the likelihood that the SEC may defer its decision until later in the year. He noted, “The Commission is unlikely to approve these crypto ETFs until the fourth quarter of this year.” Meanwhile, Hedera and DOT face similar scrutiny. No new statements from Hedera council members have been shared, keeping the community’s sentiment watchful yet no radical developments on the project’s roadmap have been revealed.

Market Experts Predict Potential Hedera ETF Approval by Late 2025

Did you know? Historical trends indicate potential regulatory progress might drive future institutional engagements, repeating patterns set by the initial Bitcoin and Ethereum ETF introductions.

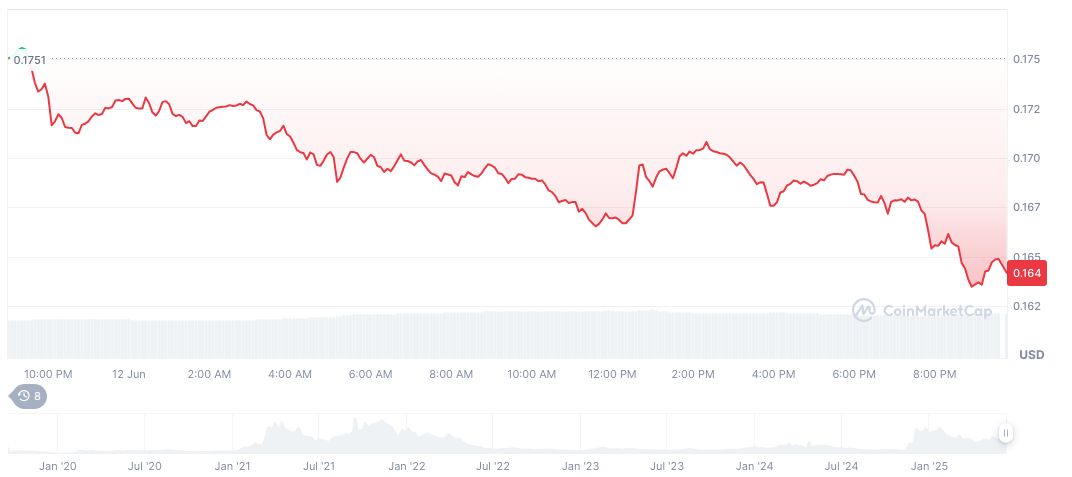

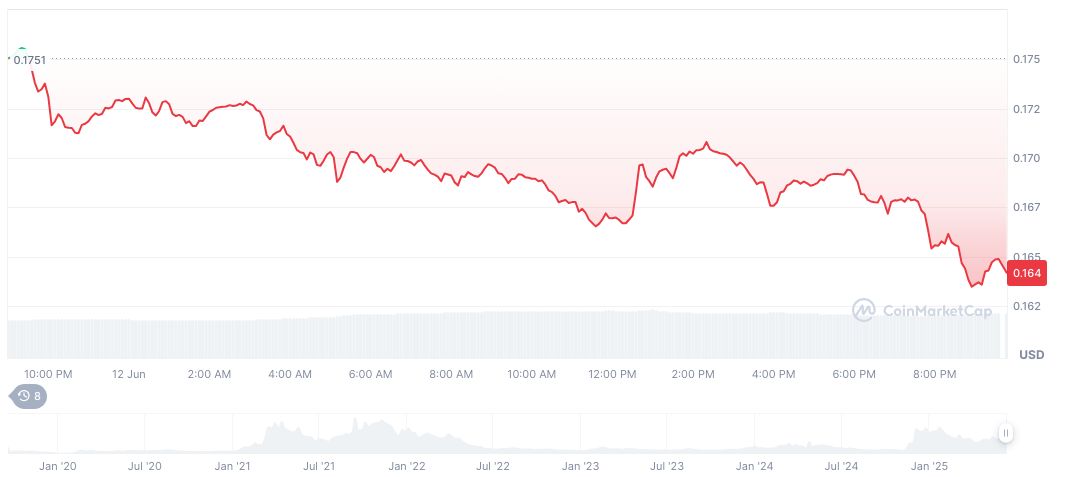

As per CoinMarketCap data, Hedera (HBAR) trades at $0.16, with a market cap of $6,934,621,021 billion, showing a 5.28% drop in the past 24 hours. Trading volumes reached $173,748,187, representing a 15.18% change. HBAR’s price movement reflects broader market trends, ranging from a 2.61% growth over the past 7 days to notable declines over 30 (-24.22%), 60 (-0.25%), and 90 days (-13.77%).

The Coincu research team highlights that the delay could lead to temporary volatility in HBAR and associated crypto assets. Market observers expect eventual approval to enhance HBAR’s position in global cryptocurrency exchanges.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/342964-sec-delays-grayscales-hedera-etf/