The U.S. SEC has suspended trading in the QMMM stock following a nearly 1,000% increase in just three weeks. The spike happened after the company announced its Solana treasury allocation in its crypto treasury. The commission’s move suggests that market manipulation may have taken place.

SEC Flags Concerns Over QMMM Rally After Solana Treasury Allocation

According to Bloomberg, the SEC has halted trading in the QMMM stock after it rallied by 959% upon the announcement of its pivot into digital assets through a Solana treasury strategy and blockchain-driven analytics.

The company had revealed plans to build a $100 million portfolio targeting Solana, Bitcoin, and Ethereum, while also investing in long-term Web3 infrastructure projects. The news immediately triggered a reaction.

The QMMM shares soared by nearly 1,000%, reaching a high of $207 before retreating to $88 in after-hours trading.

The regulator cited “recommendations on social media by unknown persons” as possible drivers of the surge. This suggests the rally cannot be based solely on the crypto treasury announcement.. This suggests market manipulation could be at play.

QMMM was not alone. The SEC also suspended Smart Digital Group Ltd. for similar reasons. This extends the crackdown on small-cap firms that have leveraged crypto narratives to draw investor attention.

The company’s announcement of a Solana treasury holding was previously hinted at as the main driver behind the rally. By including the Solana treasury allocation alongside Bitcoin and Ethereum, the firm positioned itself among the growing trend of crypto treasury companies diversifying assets.

However, the commission’s move highlights the dangers of overly linking stock prices to speculative crypto treasury announcements, like this Solana treasury allocation announcement. Regulators remain cautious of overstated claims or artificially inflated demand, despite such tactics becoming increasingly popular.

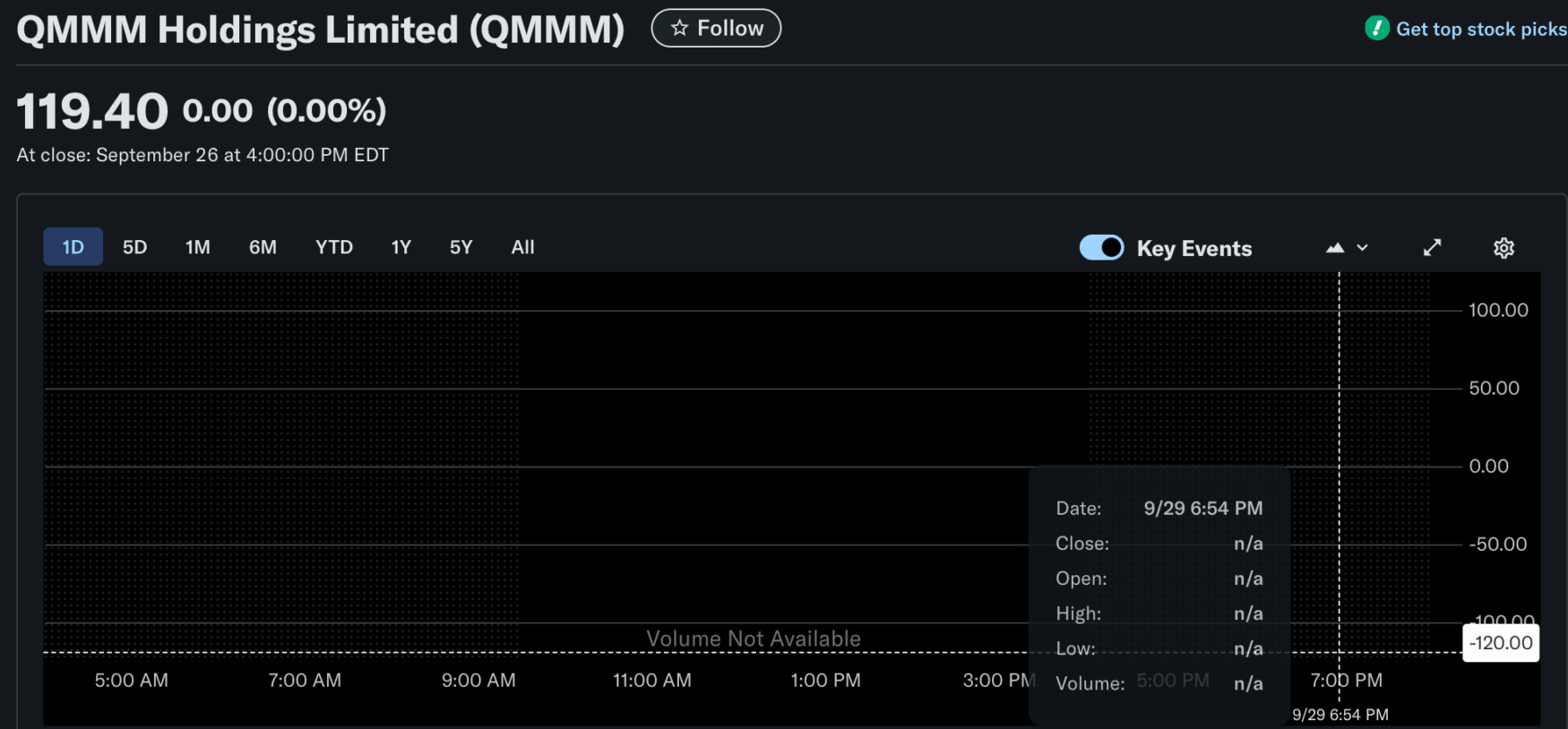

Yahoo Finance reports that QMMM stock was trading at $119.40 before the freeze was implemented.

Wider SEC Scrutiny Amid Market Manipulation Fears

The suspension move from the SEC fits into a broader enforcement trend. Both the Trump and Biden administrations have targeted social media-driven touting schemes in digital assets.

More recently, Paul S. Atkins, SEC Chair, announced a Task Force to investigate pump-and-dump activities across crypto markets. This illustrates the agency’s increased attention to detail.

This task force comes amid a backdrop of questionable trading activity in the digital asset space. For example, analysts shared that MYX Finance’s price was manipulated after it surged 270% in just 24 hours.

Similarly, speculation has swirled around a top crypto exchange. Coinbase fell out of XRP’s Top 10 exchanges in terms of reserves. Critics suggested the platform may have reduced exposure to avoid liquidity risks during XRP’s all-time highs.

These events show the regulator’s concern that traded assets and speculative hype could encourage manipulative environments.