- SEC issue allows certain USD-pegged stablecoins as cash equivalents.

- Market opens for institutional adoption; USDC gains attention.

- GENIUS Act supports stablecoin regulation with federal guidelines.

The U.S. SEC has updated its guidance to classify certain fully reserved, U.S. dollar-pegged stablecoins as cash equivalents, suggesting a shift towards more accommodating crypto regulations.

This marks a potential boost for institutional adoption of compliant stablecoins like USDC, reflecting evolving regulatory landscapes fostering integration within traditional financial systems.

Expanding Institutional Access: Stablecoins Gain Ground

Institutional use of qualified stablecoins becomes significantly easier under the new guidelines. This change allows regulated financial institutions to treat these digital currencies as they would cash, effectively facilitating their adoption in traditional financial systems. Legislation such as the GENIUS Act further fortifies these regulatory frameworks. According to the GENIUS Act, “The new guidance represents a significant regulatory easing for U.S. dollar-pegged stablecoins, paving the way for their broader acceptance and integration within mainstream financial systems.”

Market experts recognize the potential shift toward broadening cryptocurrency use in mainstream finance. However, official announcements from entities like Circle and Tether remain absent as of now.

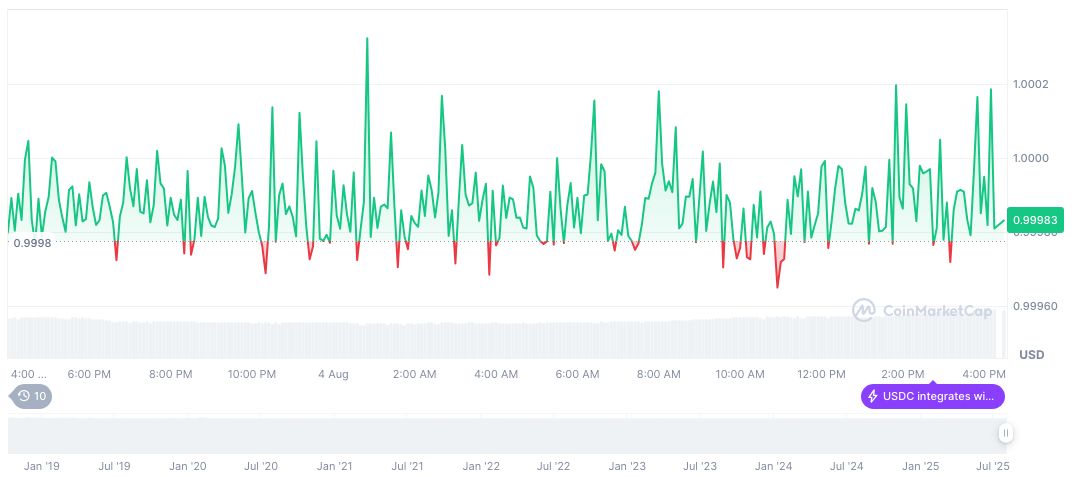

According to CoinMarketCap, USDC stands stable at $1.00 with a market cap of $64.38 billion, marking a daily trading shift of 50.81%. Price data over the past 90 days shows minimal fluctuations, highlighting its stability as a viable cash asset. This robust market presence ensures its place as a staple in digital transactions.

Historical Context, Price Data, and Expert Insights

Did you know? The recognition of stablecoins as cash equivalents draws parallels to past regulatory relaxations that triggered significant institutional backing in digital markets.

Experts anticipate greater financial accessibility and technological innovation as stablecoins gain regulatory recognition. Historical trends support the notion that such advancements can broaden the horizon for financial products, promoting seamless integration into existing financial systems.

According to CoinMarketCap, USDC stands stable at $1.00 with a market cap of $64.38 billion, marking a daily trading shift of 50.81%. Price data over the past 90 days shows minimal fluctuations, highlighting its stability as a viable cash asset. This robust market presence ensures its place as a staple in digital transactions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sec-classifies-stablecoins-cash-equivalents/